Bitcoin has reached $116,000, a transfer that closed the CME hole from three weeks in the past and reignited dialogue about its subsequent targets.

Analysts now see the market coming into a pivotal stage, with consideration shifting not simply to Bitcoin but in addition to Ethereum and altcoins.

Bitcoin: CME Hole Closure and Subsequent Ranges

Daan Crypto Trades confirmed that the $117K CME hole has been crammed, marking an vital technical milestone. The one vital unfilled hole on the chart now lies round $92K, although the analyst cautioned merchants to not obsess over distant ranges. As a substitute, he emphasised watching short-term momentum, which continues to favor bulls as Bitcoin consolidates above $115K.

Ethereum: Rotation vs. Bitcoin Energy

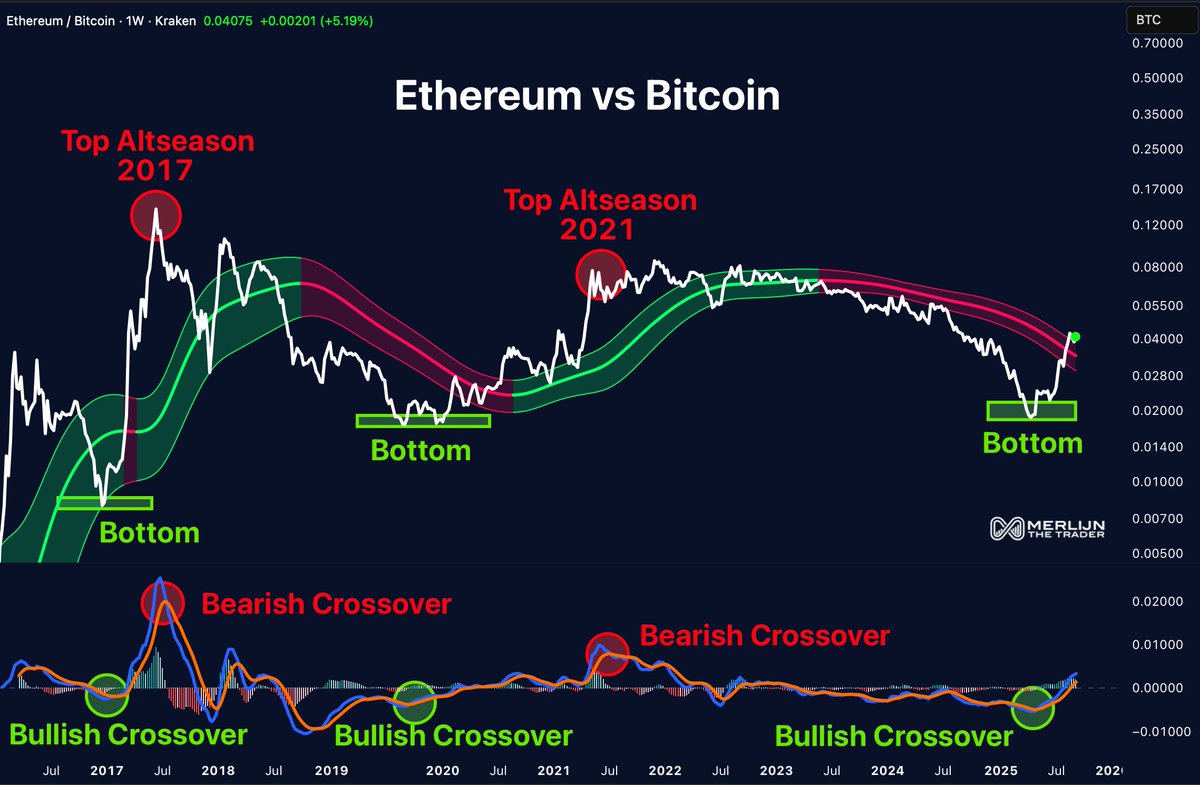

In the meantime, Ethereum is exhibiting renewed power in opposition to Bitcoin. Merlijn The Dealer identified that the ETH/BTC chart mirrors previous altseason bottoms, with a bullish crossover signaling the opportunity of Ethereum climbing towards $5,400. Earlier cycles in 2017 and 2021 noticed ETH surge after related crossovers, making this setup one to look at.

Altcoin Rotation in Focus

Traditionally, durations of Bitcoin consolidation have preceded altcoin rallies. With Ethereum exhibiting bullish construction and XRP hinting at a breakout, merchants are questioning whether or not Bitcoin’s dominance might quickly cool, opening the door for an additional rotation into majors and top-performing Layer-1s.

For now, the crypto market faces a key inflection level: if Bitcoin can maintain above $116K and Ethereum sustains momentum, the stage could also be set for a broader altseason echo of previous cycles.