- Ethereum’s NVT ratio has dropped to historic lows, hinting at undervaluation but additionally elevating questions of sustainability.

- Open Curiosity and liquidation information reveal rising speculative urge for food and heavy strain on shorts.

- With Binance clusters shifting upward, Ethereum’s momentum leans bullish, eyeing the $5,000 mark.

Ethereum’s 30-day NVT ratio has plunged to unseen depths, signaling the community is buzzing with exercise in comparison with its market cap. Traditionally, such deep bottoms in NVT usually trace at robust rebounds since undervaluation tends to attract in new shopping for strain. However there’s a catch—typically these dips in NVT solely replicate momentary transaction spikes that fade simply as quick. Proper now, Ethereum sits at a crossroads, with buyers asking if the present inflows imply actual adoption or simply speculative churn.

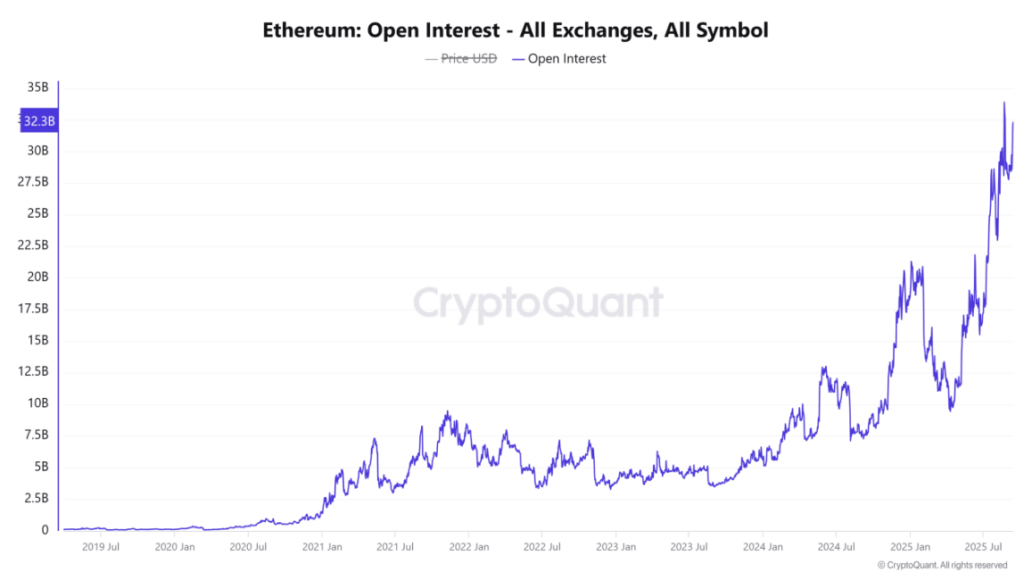

Open Curiosity Surge Reveals Rising Speculative Urge for food

Ethereum’s Open Curiosity has jumped to $32.27 billion, a 4.11% spike in simply 24 hours. This surge reveals merchants are stacking up positions on either side of the market, with longs and shorts gearing up for the following transfer. Traditionally, rising OI in bullish cycles has amplified volatility, as leverage merchants wrestle for management. If this momentum sticks, it may sign religion in Ethereum’s breakout—however the flip aspect is danger. Heavier OI makes the market extra fragile, the place sudden liquidations, particularly close to resistance zones like $4,700, may set off sharp swings.

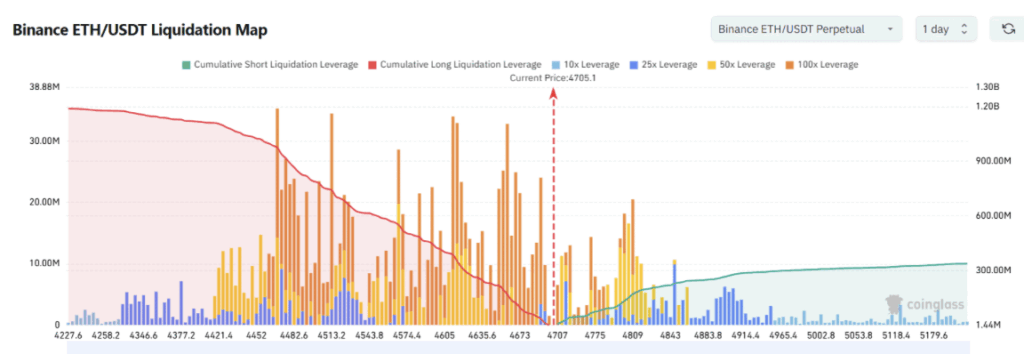

Brief Squeezes Hit Bears as Liquidations Mount

The derivatives market reveals a heavy tilt towards shorts, with over $14 million in brief positions liquidated in comparison with solely $3 million from longs. Bears are taking the brunt of the ache, whereas bulls appear to carry the higher hand. This imbalance usually sparks brief squeezes that reach rallies, notably when leverage doesn’t reset at calmer ranges. Nonetheless, momentum is fragile—one wave of profit-taking may flip sentiment on its head, proving simply how unstable Ethereum’s present liquidation panorama stays.

Binance Knowledge Shifts Battle Towards Greater Value Clusters

Recent Binance liquidation information reveals $4,700 was the important thing strain level, however Ethereum has already damaged by means of. Consideration now strikes increased, towards clusters round $4,900 to $5,000. With heavy leverage stacked simply above the breakout zone, volatility is prone to intensify as worth pushes into new ranges. If ETH consolidates and holds its floor, cascading liquidations may gasoline a quick surge increased. However, slipping again below $4,700 dangers a pointy retest—however with shorts already battered, the percentages lean in favor of the bulls holding dominance.

Ethereum’s Path Towards $5,000 Seems to be More and more Robust

Ethereum’s breakout above $4,700 confirms bullish energy, powered by undervaluation on NVT, swelling Open Curiosity, and relentless brief liquidations. With Binance leverage clusters shifting upward, situations favor a continued run towards $5,000. This uncommon alignment between on-chain alerts and derivatives information paints a transparent image: Ethereum is stepping right into a recent enlargement part, with momentum firmly on the aspect of consumers.

Disclaimer: BlockNews gives unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.