The legendary finance analyst Tom Lee has shared his prediction on Bitcoin value in 2025.

In a current dialogue with Anthony Scaramucci, he highlighted the best-case state of affairs for the BTC value within the subsequent 12 months.

“Over the following 12 months, I imagine one thing within the vary of $250,000 is feasible — even perhaps extremely possible, primarily based on the present value cycle,” he mentioned.

The potential for the U.S. to legitimize Bitcoin as a strategic reserve asset dramatically enhances its long-term value outlook, mentioned Lee.

Ought to the federal government comply with by means of with buying 1,000,000 Bitcoins, it will place itself as the biggest Bitcoin holder globally. This transfer would considerably bolster Bitcoin’s legitimacy, underscoring its worth as a mainstream monetary asset and solidifying its standing inside the international economic system.

Tom Lee additionally highlighted the position of MicroStrategy in bolstering the Bitcoin adoption.

“Moreover, it’s virtually like taking a web page from MicroStrategy’s playbook. MicroStrategy has demonstrated that utilizing Bitcoin as a steadiness sheet asset can create great worth for its shareholders,” Lee mentioned.

As reported by U.Right now, Lee has repeatedly predicted that the value might surge to as excessive as $150,000 this 12 months.

Throughout a current look on CNBC’s “Squawk Field,” Fundstrat’s Tom Lee has predicted that the value of Bitcoin (BTC) might find yourself surging above the $100,000 degree this 12 months.

Bitcoin to hit $100,000 quickly

As bulls strap in for $100,000 Bitcoin and a doable correction afterwards, the cryptocurrency value has been in sideways mode for the previous week.

Legendary dealer Peter Brandt has just lately urged merchants to not panic amid a short-term correction.

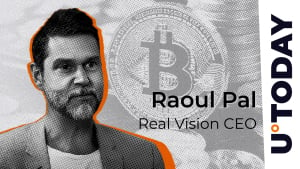

In the meantime, a famend investor Raoul Pal has made a strikingly bullish assertion about Bitcoin (BTC), probably reshaping investor views.

In a current put up on X, Pal revisited his idea of the “banana zone,” a time period he makes use of to explain a broad value vary through which Bitcoin demonstrates robust potential for long-term development.

In line with Pal, this part indicators a interval when Bitcoin is primed for substantial appreciation, reinforcing its attraction as a strategic funding.