When analysts, publishing at Yahoo Finance turned their consideration to Technique Inc. (MSTR), they discovered an intriguing setup growing on the charts.

Among the many 6,000 publicly traded securities listed throughout main U.S. exchanges, solely a handful present technical patterns that stand out as real reversal alternatives. For Technique Inc., lengthy thought-about a proxy for Bitcoin publicity, latest worth motion has begun flashing such a sign.

Screening for Indicators

Market watchers typically use Barchart’s instruments to filter out noise, particularly its Three-Day Losers screener. Not like a 52-week low checklist, which may lure traders in extended declines, this filter tends to seize essentially sturdy firms experiencing short-term pullbacks. MSTR lately appeared on this checklist after dropping 1.18% because the begin of the week, a modest transfer contemplating its volatility.

The report highlighted that Technique’s inventory stays up over 149% up to now 12 months, that means even small dips may signify home windows of alternative for bullish speculators. Merely put, an organization so tied to the trajectory of Bitcoin typically responds sharply when merchants misprice its momentum.

A Quantitative Case for Reversal

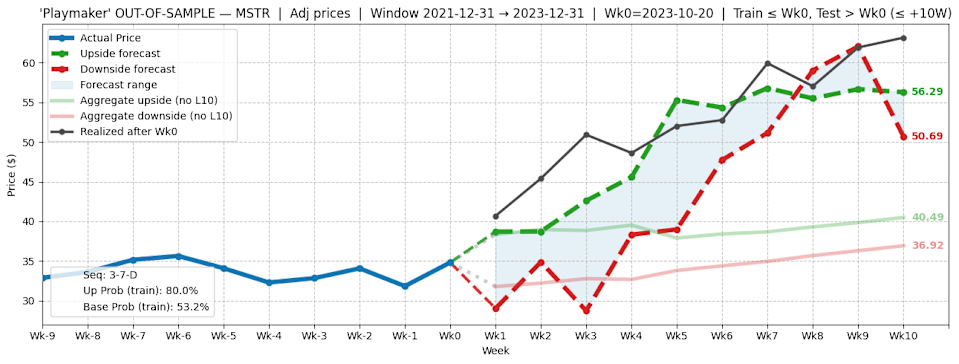

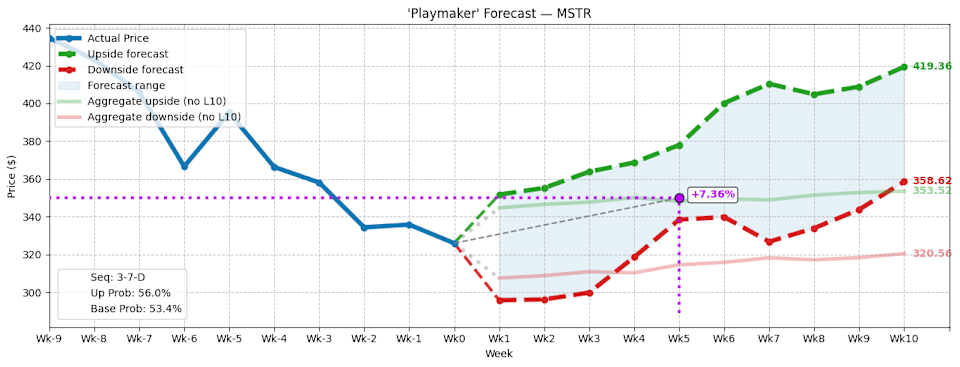

Reasonably than relying purely on fundamentals, the evaluation emphasised quantitative indicators. Technique Inc. is presently buying and selling inside a distribution-heavy setting. Over the previous 10 weeks, MSTR has posted solely three weekly features in opposition to seven weekly losses, a “3-7-D” sequence.

Traditionally, this sample has flashed simply 25 instances since January 2019. Within the first week after the sign, upside chance was measured at round 56%. Extra importantly, the weeks that adopted sometimes noticed worth drift greater than the market’s baseline. Median expectations recommend MSTR may transfer between $358.62 and $419.36, in comparison with a baseline drift of $320.56 to $353.52.

For bullish merchants, this means that the present technical setup could also be undervalued by choices markets, which have a tendency to cost within the extra conservative baseline vary.

Testing the Sign in Totally different Environments

One query raised by the report was whether or not this bullish sequence may solely work throughout euphoric crypto cycles. To check this, analysts ran out-of-sample knowledge between January 2022 and December 2023, a time when crypto markets confronted headwinds relatively than breakouts. Even then, the identical 3-7-D sequence tended to resolve in a powerful upside drift, reinforcing the statistical weight behind the sign.

For merchants skeptical of short-term narratives, this backtest offered confidence that the reversal setup is extra than simply noise amplified by Bitcoin’s rallies.

Buying and selling the Setup

The article pointed to 1 significantly engaging commerce: a 345/350 bull name unfold expiring October 17. This includes shopping for the $345 name and promoting the $350 name for a internet debit of $205. The potential most achieve is $295 if the inventory clears $350, representing a 144% return at expiration. The breakeven sits at $347.05, a degree analysts consider is affordable given the historic conduct of this sequence.

For extra aggressive merchants, there could possibly be justification to increase the strike to $380, although the conservative unfold nonetheless presents a uncommon risk-reward ratio. The chance lies in capturing outsized upside whereas maintaining threat capped, a dynamic that many fairness merchants discover compelling within the extremely risky crypto-equity house.

Outlook: Balancing Volatility and Imaginative and prescient

The evaluation framed Technique Inc. as extra than simply one other fairness identify. For some, it stays a lightning rod within the debate about whether or not to take a position straight in Bitcoin or by company autos like MSTR. Critics level to dilution, leveraged debt, and volatility, whereas supporters emphasize the distinctive equity-market pathway it offers for establishments unable to carry Bitcoin straight.

This ongoing debate locations Technique in a class of its personal: each a speculative wager on Bitcoin’s worth and a proxy for the evolution of institutional crypto adoption. So long as this stress persists, MSTR will proceed to draw merchants in search of uneven alternatives.

HYLOQ’s Distinctive Play on Hyperliquid

Whereas Technique Inc. stirs controversy, the creator famous that different equity-linked crypto performs are starting to emerge. One standout is HYLQ Technique Corp, which has positioned itself because the “MicroStrategy of altcoins.” Holding practically 29,000 HYPE tokens, HYLQ presents direct publicity to Hyperliquid, a decentralized alternate identified for zero-gas charges, sub-second settlement, and over $2 trillion in lifetime transaction quantity.

What differentiates HYLQ is its itemizing on the Canadian Securities Trade, a transfer that brings audited reporting and oversight, one thing many crypto-related equities lack. With Hyperliquid’s Layer-1 blockchain able to processing 200,000 transactions per second, analysts see HYLQ as a severe candidate in decentralized buying and selling.

Traders in search of a regulated entry level into DeFi can purchase and examine HYLQ worth straight by Interactive Brokers, making entry each easy and clear. This pathway permits conventional merchants to faucet into Hyperliquid’s progress whereas staying inside a well-known fairness framework.

For conventional traders cautious of unregulated altcoin markets, HYLQ offers a uncommon, regulated gateway into DeFi’s fast growth. Simply as Technique presents a pathway into Bitcoin publicity by fairness markets, HYLQ positions itself because the structured bridge into the subsequent era of decentralized finance.