Be a part of Our Telegram channel to remain updated on breaking information protection

The crypto business is warning the Financial institution of England towards imposing limits on stablecoin holdings, after a Monetary Occasions report stated it plans to cap them for people and companies.

In response to a Sept. 15 story, the Monetary Occasions (FT) stated the BoE is contemplating imposing caps of £10,000 to £20,000 ($13,600 to $27,200) on people, whereas limiting companies to round £10 million ($13.6 million).

Stablecoins are already broadly used for funds within the UK, with adoption of those tokens anticipated to develop.

Executives say the proposed guidelines may stifle adoption, complicate enforcement, and depart the UK trailing behind the US and EU in digital finance.

Financial institution Of England Says It Desires To Stop Huge Outflows

In response to the BoE’s government director for monetary market infrastructure, Sasha Mills, the deliberate restrictions on systemic stablecoin possession is a part of an effort to stop any sudden deposit withdrawals. It could additionally restrict the scaling of other cost programs.

The plan to restrict stablecoin possession comes because the central financial institution and the Monetary Conduct Authority work on creating a regulatory framework for digital tokens pegged to fiat currencies.

BoE officers have insisted that the boundaries could possibly be transitional whereas the market adjusts to digital cash.

Central Financial institution’s Deliberate Stablecoin Guidelines Are A “Dangerous” Concept

Crypto teams and executives within the area are urging the BoE to not impose the restrictions. Amongst them is Coinbase’s vice chairman of worldwide coverage Tom Duff Gordon, who advised the FT that “imposing caps on stablecoins is dangerous for UK savers, dangerous for the Metropolis and dangerous for the sterling.”

The Financial institution of England placing an possession cap on stablecoins is one other instance of the governing elite doing actually the stupidest factor it may do.

Making an attempt to outlaw the long run by no means works.

We should embrace it.

— Zia Yusuf (@ZiaYusufUK) September 15, 2025

Riccardo Tordera-Ricchi of The Funds Affiliation additionally advised the FT that the boundaries would “make no sense,” as a result of there aren’t at present any caps on money or financial institution accounts within the UK.

Some have additionally stated that imposing the deliberate guidelines could be almost unimaginable. Simon Jennings of the UK cryptoasset enterprise council stated enforcement would require digital IDs and different programs to realistically monitor stablecoin possession.

The BoE’s plans may additionally deepen tensions between the central financial institution and the Treasury, which has proven help for digital innovation within the monetary sector.

In July, Chancellor Rachel Reeves stated she wished to push ahead developments in blockchain know-how throughout the conventional finance sector, together with efforts round tokenized securities and stablecoins.

Crypto business teams and executives have additionally warned that the foundations would go away the UK with stricter oversight than the US or the European Union (EU).

US And EU Embrace Stablecoins

The US and EU have signaled an embrace of stablecoins, and have each established their very own frameworks for the digital belongings.

Again in September 2020, the EU proposed its Markets in Crypto-Belongings (MiCA) regulation as a part of its “Digital Finance Bundle.” The regulation is designed to supply authorized readability and a regulatory framework for crypto belongings and any associated providers throughout the EU.

The MiCA framework entered into pressure in June 2023, however stablecoin-related guidelines solely began being utilized in June 2024. Broader guidelines for crypto service suppliers have been utilized later from December 2024.

This 12 months, the US Senate additionally authorised the Guiding and Establishing Nationwide Innovation for US Stablecoins (GENIUS) Act, which was signed into regulation in July by US President Donald Trump. It goals to create a regulatory framework for the issuance and use of stablecoins throughout the US.

Each the MiCA framework and the GENIUS Act don’t impose limits on the quantity of stablecoins residents can maintain. As an alternative, they deal with issuance, reserve administration, and compliance with anti-money laundering (AML) and anti-terrorism insurance policies.

Stablecoin Market Anticipated To Balloon To $1.2 Trillion

The stablecoin market has grown steadily since each the MiCA framework and the GENIUS Act have gone into pressure, with the latter serving as an even bigger catalyst.

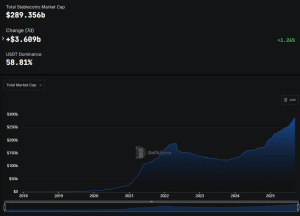

In response to DefiLlama knowledge, the stablecoin market cap stands at round $289.356 billion. That is after it grew by greater than $3.609 billion in simply the previous seven days.

Stablecoin market cap (Supply: DefiLlama)

That progress is anticipated to proceed, with Coinbase predicting earlier this 12 months that the stablecoin market may soar to above $1.2 trillion by 2028.

Equally, Goldman Sachs has predicted {that a} “stablecoin summer time” may see the market attain a capitalization of $2 trillion by the tip of 2028.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be a part of Our Telegram channel to remain updated on breaking information protection