Be part of Our Telegram channel to remain updated on breaking information protection

Fundstrat CIO Tom Lee says crypto market leaders Bitcoin (BTC) and Ethereum (ETH) are poised to print “monster” positive factors if the Federal Reserve publicizes a extensively anticipated rate of interest lower this week.

“I feel they may make a monster transfer within the subsequent three months,” Lee stated, who can also be chairman of ETH treasury agency Bitmine Immersion Applied sciences, in an interview with CNBC.

Lee’s prediction is predicated on the idea that cryptos like BTC and ETH are delicate to financial coverage and finest positioned to learn from a price lower, which usually results in an elevated urge for food for risk-on belongings equivalent to cryptos.

Lee in contrast the present scenario to September 1998 and 2024, when the Fed lower charges after an “prolonged pause.”

“The Fed can really reinject confidence by saying we’re again into an easing cycle,” he stated, including {that a} price lower will likely be a “actual enchancment in liquidity.”

Ethereum A ”Development Protocol,” Lee Says

Lee stated that whereas each Bitcoin and Ethereum are delicate to liquidity out there, the altcoin additionally stands to learn from the current transfer by AI builders and Wall Road to transition on-chain in what he known as a “stablecoin-ChatGPT second for crypto.”

“So, Ethereum I feel trades virtually like 1971 Wall Road which was when the greenback went off of the gold customary” and there was “numerous innovation,” Lee added.

“Ethereum is actually a development protocol,” he stated. “The convergence of each Wall Road transferring onto the blockchain and AI and agentic-AI making a token financial system is making a supercycle for Ethereum.”

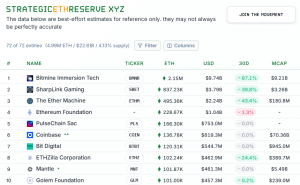

That’s additionally why BitMine has been so aggressive in accumulating Ethereum’s native ETH token, he added. The corporate is at present the biggest company Ethereum holder globally, with round 2.15 million ETH valued at roughly $9.21 billion, information from StrategicETHReserve exhibits.

High ten ETH treasury companies (Supply: StrategicETHReserve)

BitMine has employed the identical debt-financing playbook utilized by Michael Saylor’s Technique to buy Bitcoin, and at present holds 1.78% of ETH’s complete provide.

Analysts had been just lately flagging issues across the firm’s tumbling share value, however it’s surged 17% prior to now week and is now down solely 3% prior to now month, in response to Google Finance.

Merchants Anticipate Fed Curiosity Fee Lower As Trump Pushes For Extra

Lee’s predictions come as merchants develop more and more assured that the Fed will announce the primary rate of interest lower for the yr this week.

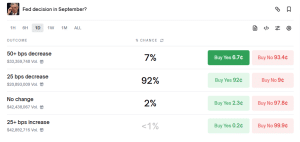

The Fed begins a two-day coverage assembly in the present day, with the choice scheduled for Sept. 17. Markets anticipate a 25 foundation level lower, which might decrease rates of interest to between 4% and 4.25%.

Merchants on the decentralized predictions platform Polymarket place the chances of a 25 bps lower announcement this week at 92%. There are even some that see a 7% probability {that a} larger, 50bps lower, will likely be introduced.

Rate of interest lower odds (Supply: Polymarket)

These odds are echoed by the CME FedWatch instrument, which exhibits that analysts see a 96.1% probability that charges will likely be lower within the subsequent Fed assembly. These analysts additionally see a 3.9% probability that the Fed will slash charges by 50 bps.

That’s as US President Donald Trump continues to stress Fed Chair Jerome Powell for giant rate of interest cuts.

In August, Trump argued that rates of interest ought to be lower by 3 proportion factors. He added that rate of interest reductions of this magnitude would save the US “one trillion {dollars} a yr.”

🇺🇸 TRUMP SAID INFLATION IS VERY LOW AND FED SHOULD CUT RATES BY 3 POINTS. pic.twitter.com/FljnHJphSf

— Ash Crypto (@Ashcryptoreal) July 15, 2025

The crypto market has traded flat over the previous 24 hours forward of the Fed determination, however maintains a capitalization of greater than $4 trillion, in response to information from CoinMarketCap.

BTC has managed a minor 24-hour acquire whereas ETH has slid by a fraction of a %. Each are within the inexperienced on the longer-term weekly time-frame.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be part of Our Telegram channel to remain updated on breaking information protection