- Ethereum rejected at $4,763, now caught within the $4.47k–$4.6k vary.

- Perpetual quantity fading reveals merchants are pulling again from leverage.

- Spot inflows of 13.9K ETH sign promoting stress, hinting at doable stagnation.

Ethereum tried to push previous $4,763 earlier this week however acquired slapped again down, slipping as little as $4,469 earlier than steadying close to $4,499. The dip, although delicate, displays fading urge for food from merchants, particularly within the leveraged markets the place exercise has cooled quick. Alternate flows additionally aren’t serving to, with over 13,000 ETH transferring onto exchanges in only a few days — an indication that some holders is likely to be trying to money out.

This mix of weaker shopping for and contemporary inflows on exchanges has left ETH form of caught, chopping sideways between $4.47k and $4.6k, with out the juice wanted for a breakout.

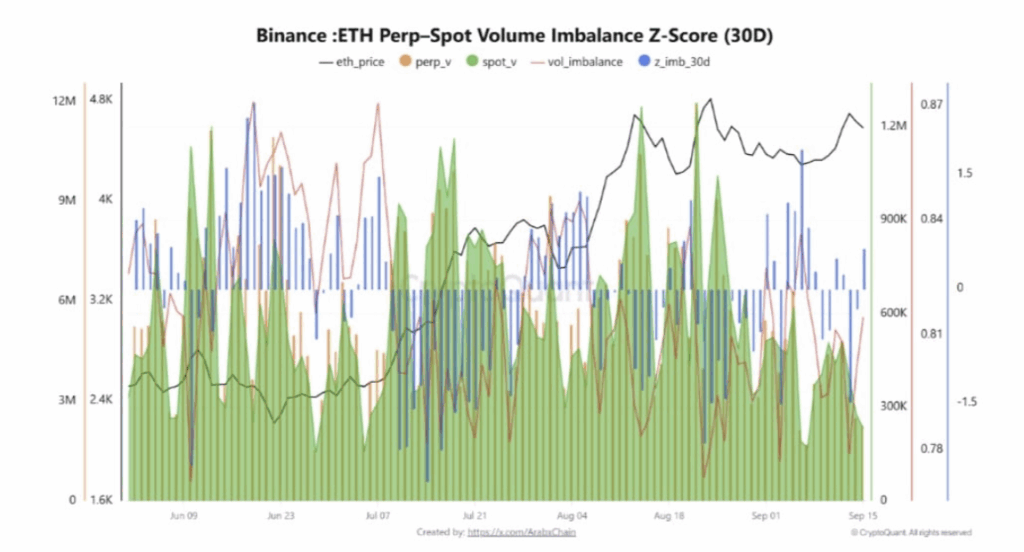

Perpetual Demand Slips, Merchants Pull Again

Perpetual contracts have been dropping steam. Knowledge from CryptoQuant reveals ETH’s Z-Rating swinging between 0.0 and -1.0 these previous two weeks. That principally means perps are now not dominating quantity, as speculators again away from leverage.

It’s not panic-selling — extra like merchants taking a step again, ready to see the place the market heads. However with much less leverage in play, Ethereum lacks that push greater it usually will get throughout robust bullish cycles.

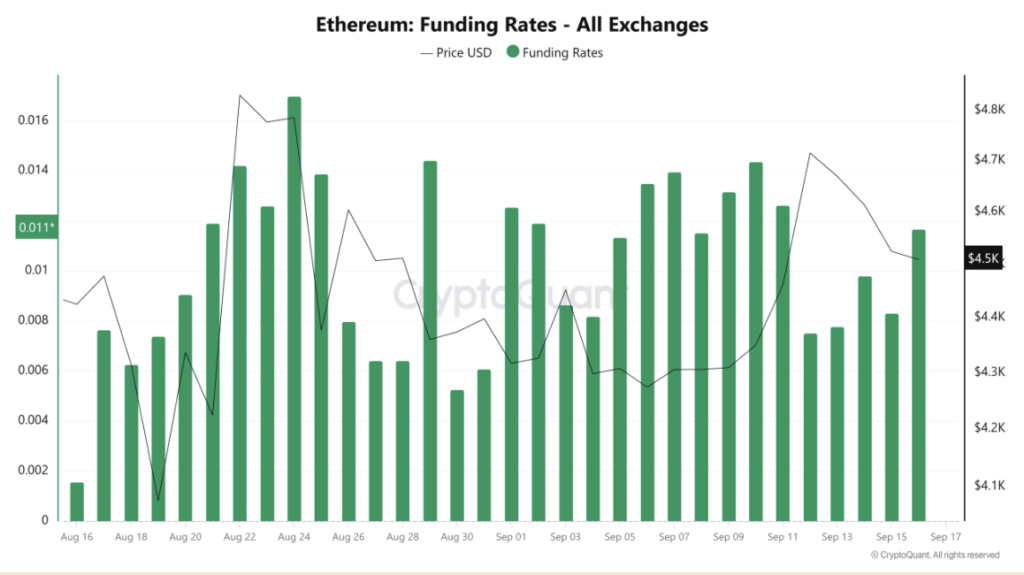

Optimistic Funding Charges Maintain Bulls Alive

Even with fading perp exercise, ETH’s Funding Charges stay in optimistic territory, sitting at 0.011 — the very best in 5 days. That means merchants nonetheless lean bullish, a minimum of sentiment-wise.

The catch? With fewer gamers opening contemporary lengthy positions, the market could possibly be susceptible to a protracted squeeze. With out sufficient conviction behind these optimistic charges, even a small wave of promoting might flip momentum rapidly.

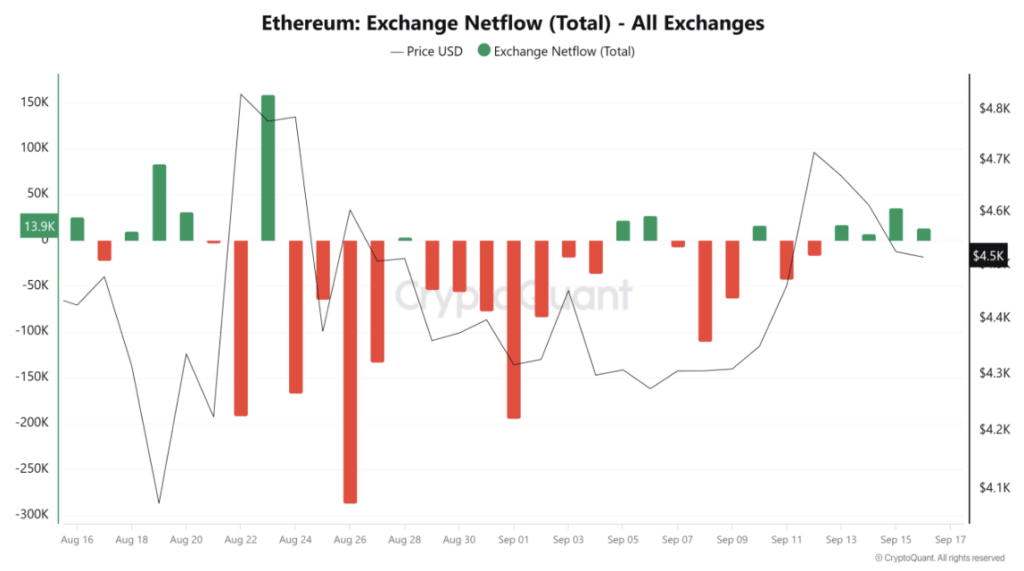

Spot Market Exhibits Heavy Promoting Strain

The spot market isn’t choosing up the slack both. Buying and selling quantity has stayed underneath the 1M mark for days, approach under the degrees seen throughout ETH’s stronger rallies earlier this summer season.

Alternate Netflows again that up — inflows of 13.9K ETH level to aggressive promoting, not accumulation. Consumers are quiet, sellers are dominant, and that imbalance has saved ETH trapped in its slender vary.

What’s Subsequent for Ethereum Worth?

Proper now, Ethereum’s outlook seems extra like stagnation than a contemporary breakout. With leverage shrinking, spot demand muted, and change inflows rising, ETH is more likely to keep capped between $4,470 and $4,600 for now.

Until new demand kicks in — both from leverage merchants returning or stronger spot shopping for — ETH’s push towards $5,000 could have to attend.

Disclaimer: BlockNews gives unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.