Coinbase World, Inc. (NASDAQ: COIN) continues to be one among Wall Avenue’s most divisive names, with analysts unable to decide on a unified outlook.

In accordance with MarketBeat information, the inventory carries a consensus “Maintain” score from 25 analysis companies. Inside that blend, two analysts suggest promoting, ten urge holding, and 13 name the inventory a purchase. The typical 12-month worth goal stands at $352.72, underscoring the big selection of expectations surrounding the crypto alternate.

On the identical time, institutional exercise reveals that giant companies proceed including to their positions in COIN, signaling confidence in its long-term position inside the digital asset financial system. This renewed curiosity has additionally sparked a broader development: extra traders are researching different crypto-related equities that may present publicity past Coinbase. Amongst these names, HYLQ Technique Corp has been drawing rising consideration, positioning itself as a regulated gateway into HyperLiquid’s increasing DeFi ecosystem. Many retail and institutional merchants alike are starting to purchase and examine HYLQ worth as they discover new methods to take part in blockchain development. With its distinctive itemizing construction and centered technique, HYLQ is step by step establishing itself among the many most carefully watched rising crypto shares available on the market.

Analyst Views Diverge

The divergence is mirrored in current analysis notes. Keefe, Bruyette & Woods trimmed its goal from $355 to $335, assigning a “market carry out” score in early August. William Blair, in distinction, initiated protection in June with an “outperform” score. Sanford C. Bernstein went even additional, lifting its goal to $510 whereas additionally tagging Coinbase as “outperform.” Needham & Firm raised its view from $270 to $400 with a “purchase” advice, whereas Jefferies raised its goal from $260 to $405 however opted for a “maintain.”

Such conflicting indicators spotlight the uncertainty surrounding Coinbase’s path. Whereas some companies see the alternate as well-positioned to learn from crypto’s structural development, others level to rising competitors, regulatory headwinds, and unstable buying and selling volumes as causes for warning.

Insider Gross sales and Company Exercise

The inventory has additionally drawn consideration because of insider transactions. On August 22, insider Lawrence J. Brock bought practically 6,000 shares at a median worth of $311.37, a transfer that diminished his place by over 90%. On the identical day, Chief Accounting Officer Jennifer N. Jones bought 1,756 shares at roughly $300.50 every. In whole, insiders bought greater than 1.17 million shares value $438.7 million over the previous 90 days. Regardless of these gross sales, insiders nonetheless maintain about 23.4% of Coinbase’s excellent inventory, reflecting a significant alignment of pursuits with exterior shareholders.

Institutional Positioning

Massive traders stay deeply concerned with Coinbase. Hedge funds and asset managers collectively personal practically 69% of shares excellent, in keeping with current filings. Smaller companies akin to Mascagni Wealth Administration and Copia Wealth initiated new positions earlier this yr, whereas Evelyn Companions practically doubled its stake within the second quarter. On the bigger finish, Vanguard boosted its holdings by nearly 5% within the first quarter, lifting its place to greater than 19.2 million shares value $3.32 billion. ARK Make investments, one among Coinbase’s most vocal backers, elevated its place barely to over 3 million shares valued at greater than $528 million. Groupama Asset Administration additionally made headlines by doubling its publicity, amassing 3 million shares value greater than half a billion {dollars}.

This regular accumulation by establishments contrasts with insider promoting, including one other layer to the controversy about Coinbase’s near-term prospects.

Monetary Snapshot

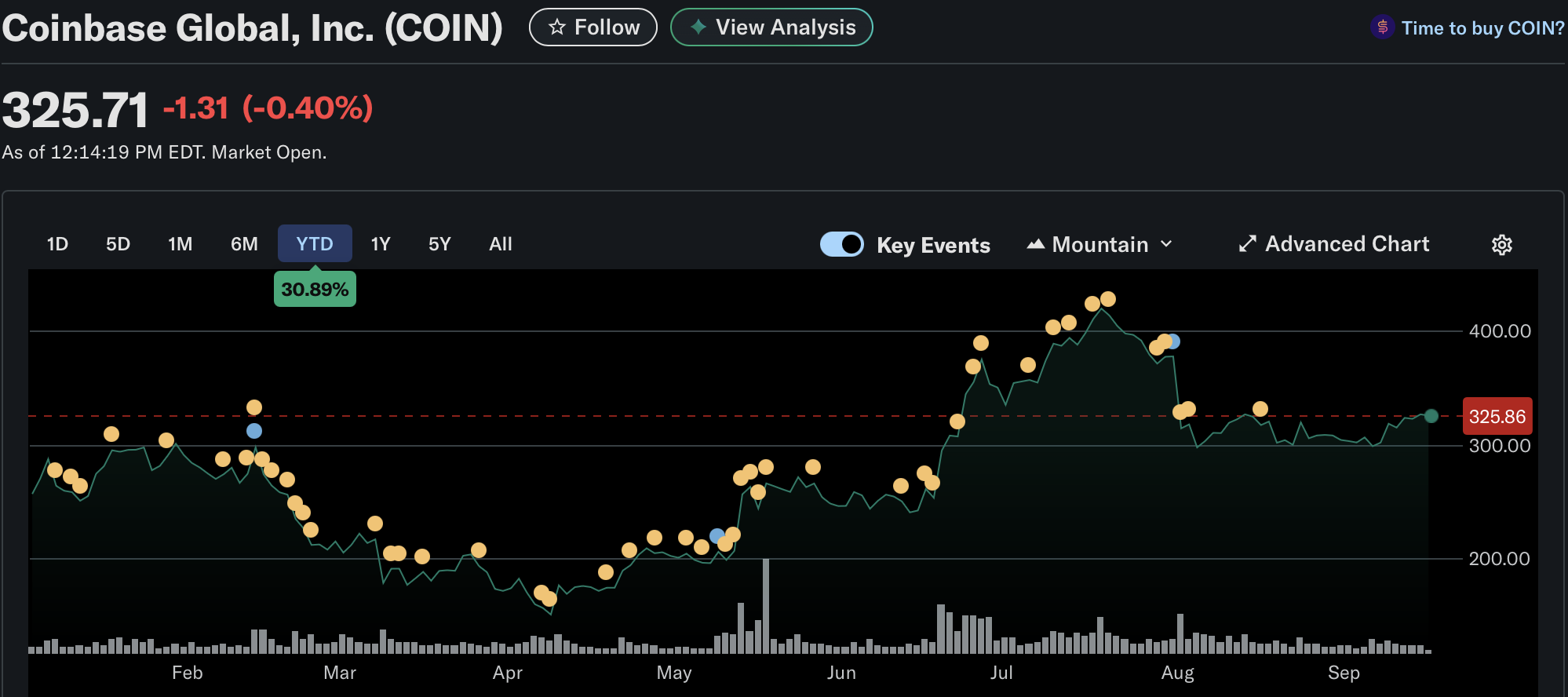

From a monetary standpoint, Coinbase stays firmly tied to the ups and downs of the crypto financial system. Shares opened at $327 on Tuesday, giving the corporate a market capitalization of $84 billion. Its price-to-earnings ratio sits close to 32, reflecting the expansion expectations priced into the inventory. The 12-month buying and selling vary is broad, with a low of $142 and a excessive of $444, emphasizing its volatility.

The corporate’s most up-to-date earnings report in late July fell wanting Wall Avenue’s forecasts. Coinbase delivered earnings per share of $0.12, lacking consensus estimates of $0.91. Income got here in at $1.50 billion versus expectations of $1.68 billion, though that also represented a 3.3% year-over-year improve. Internet margin stood at 40.9% with return on fairness of 16%, strong figures by conventional requirements however beneath what some traders had hoped. Analysts now count on full-year earnings per share to common round 7.22, suggesting cautious optimism.

Coinbase’s Function within the Crypto Economic system

Past the quarterly numbers, Coinbase’s strategic significance stays simple. The alternate gives an important on-ramp for each retail and institutional purchasers, providing liquidity, custody options, and an increasing suite of monetary instruments for the digital asset ecosystem. Its worldwide presence has grown steadily, although it faces stiff competitors from decentralized platforms and world exchanges with lighter regulatory burdens.

For now, Coinbase continues to learn from the broader rise of crypto adoption, whilst the corporate adjusts to a panorama formed by Bitcoin’s pullbacks and Ethereum’s ongoing rallies. Market contributors more and more deal with the inventory as a barometer for sentiment within the sector: when crypto is sizzling, Coinbase tends to surge; when volumes decline, its inventory cools simply as shortly.

But Coinbase is not the one fairness traders are watching on this house. A more recent entrant, HYLQ Technique Corp, has begun to draw important consideration by providing publicity to a really totally different nook of the digital asset financial system. The agency reinvented itself as “The Public HYPE Treasury” after dropping its earlier ventures in gaming and fintech. Immediately, its focus is singular: construct a treasury of HyperLiquid’s HYPE tokens, an asset tied to one of many fastest-growing decentralized exchanges on the earth.

What makes HYLQ stand out shouldn’t be solely its deal with HyperLiquid but in addition the way in which it has structured investor entry. By securing a Canadian Securities Change (CSE) itemizing, the corporate has differentiated itself from the shadowy world of over-the-counter penny shares that dominate a lot of the crypto-equity house. This placement places HYLQ within the firm of established names like MicroStrategy, Coinbase, and Marathon Digital, companies which have used regulated exchanges to construct belief with each establishments and retail traders.

The itemizing carries sensible advantages as nicely. CSE guidelines mandate quarterly reporting, audited financials, and regulatory compliance, lowering the dangers usually related to early-stage crypto performs. Buyers don’t have to fret about opaque disclosures or the specter of administration vanishing with treasury property, a state of affairs not extraordinary within the sector.

Equally essential, HYLQ’s shares may be traded via acquainted brokers akin to Interactive Brokers, Questrade, and TD Direct, all at cheap fee ranges. That ease of entry issues in a unstable market the place liquidity and pace usually dictate outcomes. In essence, HYLQ combines the speculative upside of an rising DeFi play with the structural safeguards of a publicly listed fairness.

The Highway Forward

Coinbase continues to sit down on the middle of the dialog about crypto adoption on Wall Avenue. Analysts stay cut up, with some pointing to its model recognition, liquidity, and regulatory standing as clear benefits, whereas others spotlight slowing retail exercise, rising competitors, and the volatility of its income streams. Institutional possession stays excessive, with giants like Vanguard and ARK Make investments sustaining important positions, reinforcing the concept that Coinbase has cemented itself because the main U.S. alternate. Its monetary outcomes present each the promise and the challenges of working in such a cyclical trade, margins stay robust, however earnings usually swing with the market’s temper.

For many traders, Coinbase has change into a dependable proxy for general sentiment in digital property: when Bitcoin rallies, COIN often follows; when volumes dry up, the inventory cools simply as quick. But as consideration grows round crypto-related equities, some are additionally starting to discover newer entrants like HYLQ Technique Corp, which is positioning itself within the fairness markets as a special sort of bridge into DeFi ecosystems.