Ethereum (ETH), the second largest cryptocurrency, is sending combined alerts to traders. Whereas validators are gearing as much as withdraw ETH from staking, main DeFi confirms that Ethereum (ETH) mainnet nonetheless stays the constructing block of its income.

$12,000,000,000: Ethereum (ETH) exit queue hits all-time excessive

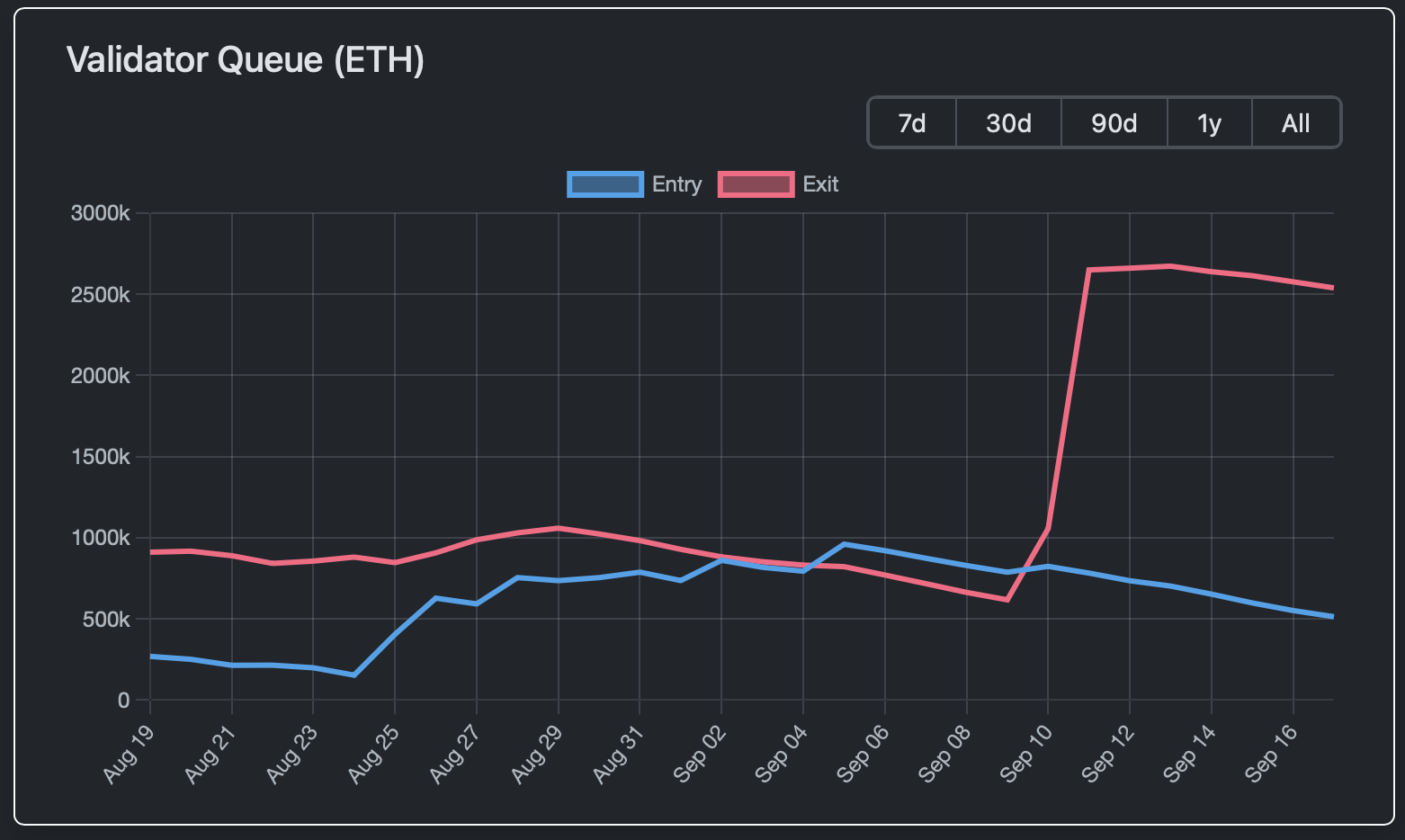

The Ethereum (ETH) validator exit queue jumped to a record-breaking excessive immediately. As of press time, over 2,600,000 Ethers (ETH) — or over $12 billion in equal — are ready in line to be unstaked by Ethereum (ETH) validators.

As such, the exit queue shall be clear in 44 days minimal, which is by far the longest wait time ever registered on the Ethereum (ETH) community.

In contrast, the ETH staking queue — the road of ETH holders focused on locking their funds for staking — dropped beneath 500,000 ETH.

This discrepancy is probably harmful for Ethereum’s (ETH) worth efficiency. ETH unstaked from validators’ contacts could be despatched to the market, which might create huge promoting strain.

On the identical time, this could be the sign of establishments focused on including ETH to their company balances. Because the euphoria round digital asset treasury corporations (DATs) is simply getting stronger, ETH could be simply altering arms.

Ethereum (ETH) blobs full: What does this imply?

In the meantime, the opposite indicator of Ethereum (ETH) community exercise can be surging. As observed by long-term Ethereum (ETH) ecosystem investor and fanatic Ryan Sean Adams, cofounder of Bankless media platform, the demand for Ethereum (ETH) blobs goes by the roof.

Ethereum (ETH) blobs — binary giant objects — are enormous chunks of knowledge utilized by L2 platforms on the highest of Ethereum (ETH). Not like calldata, which is saved on the Ethereum (ETH) mainnet completely, blobs are momentary knowledge buildings. Launched by EIP 4844, they considerably optimize L1/L2 interactions within the Ethereum Digital Machine ecosystem, making its knowledge logistics extra useful resource environment friendly.

The elevated demand for blobs is an indicator of rising transactional and sensible contracts exercise. Ethereum (ETH) has the choice to extend blob house to maintain its L2 operable and be certain that it may confirm knowledge on L1s with zero delays. Additionally, the rising demand for blob knowledge is accompanied by ETH burns dashing up.

Ethereum (ETH) mainnet nonetheless accountable for 87% of Aave income

Marc Zeller, the founding father of the Aave Chan Initiative (ACI), a number one service supplier for the Aave DAO, unveiled a serious ecosystem report. Based mostly on its knowledge, Ethereum (ETH) mainnet stays the dominant blockchain for the protocol that’s now deployed on dozens of EVM blockchains.

In keeping with his knowledge, collected within the final 12 months of Aave’s operations, transactions on the Ethereum (ETH) mainnet generated 86.6% of the protocol’s income. As such, all different blockchains Aave is working on could be characterised as “aspect quests.”

Probably the most utilized blockchains Aave operates on embrace Polygon, Avalanche, Arbitrum, Optimism and Concord. In comparison with Ethereum’s (ETH) mainnet, all of them assure decrease charges and sooner transactions, however Ethereum (ETH) adoption continues to be a lot larger amongst DeFi customers.

Within the final 12 months, increasingly Ethereum (ETH) fans are calling for L1 scaling as the subsequent precedence in Ethereum (ETH) improvement.

Ethereum (ETH) worth makes an attempt to remain above $4,500

Amid all of those combined messages despatched by the Ethereum (ETH) ecosystem, Ether, its core cryptocurrency, is trying to stabilize over the vital stage of $4,500. Within the final 24 hours, the Ethereum (ETH) worth added 0.51% on surging buying and selling quantity.

As of press time, Ethereum (ETH) is altering arms at $4,483 on main spot buying and selling platforms. Open Curiosity (OI) on futures exchanges is excessive, which confirms that curiosity in ETH stays excessive.