The Federal Reserve’s 25 foundation level (bp) charge reduce, its first of 2025, set the stage for weeks of market debate.

Whereas the transfer was broadly anticipated, Chair Jerome Powell’s dovish tone at yesterday’s press convention and the Fed’s sharply divided dot-plot have left traders questioning what is going to occur subsequent.

Powell Indicators a Danger Administration Pivot

Powell framed the speed reduce as a threat administration determination in his opening remarks, citing mounting cracks within the US labor market.

Revised payroll figures exhibiting 911,000 fewer jobs than beforehand reported, alongside rising long-term unemployment, level to a weaker basis than headline numbers recommend.

Sponsored

Sponsored

“The dangers to inflation are tilted to the upside, and employment dangers are tilted to the draw back,” Powell stated.

The Fed chair additionally famous that policymakers don’t really feel the necessity to transfer rapidly on charges, however should act preemptively to stop a deeper downturn.

Powell downplayed the inflationary influence of Trump’s tariffs, arguing that the pass-through has been “slower and smaller” than anticipated.

Nevertheless, he acknowledged value pressures might persist into 2026. On the similar time, he described the labor market as not “strong.”

He cited hiring slowing, immigration shifts lowering provide, and AI adoption probably weighing on entry-level jobs.

Backside line: Powell’s remarks have been much more dovish than his 2024 steering when the Fed slashed charges by 50 bps. This implies a deliberate pivot towards prioritizing employment over inflation.

Market Response With Fed Divisions on Full Show: Greenback Slides, Equities Eye Liquidity

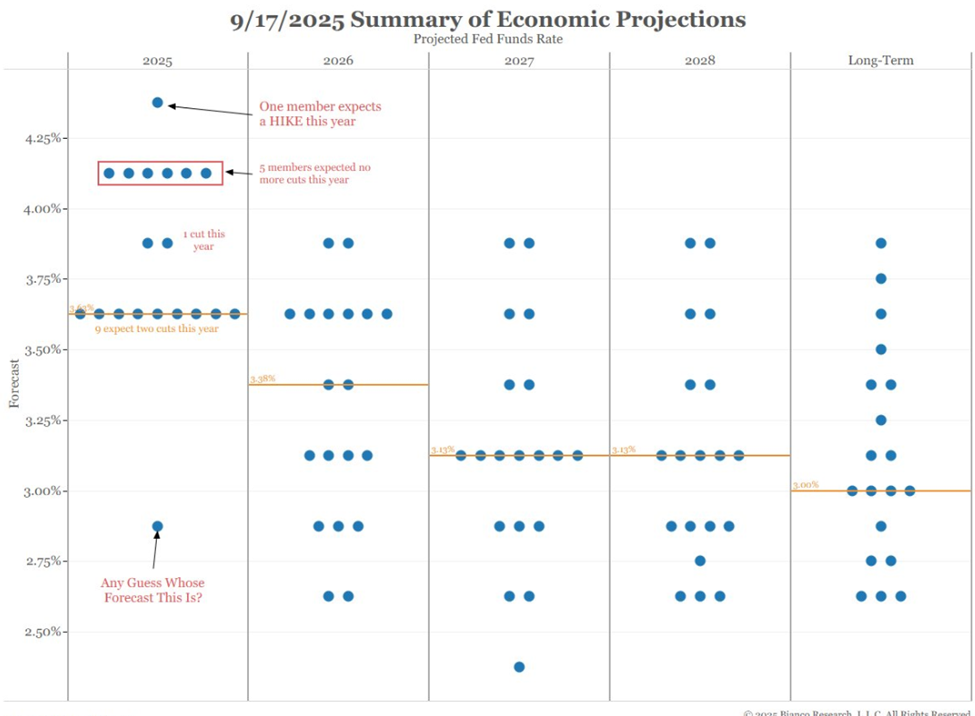

The brand new dot-plot revealed a central financial institution struggling to seek out consensus. 9 of 19 officers see two extra cuts this 12 months, whereas six count on no additional easing.

One member even initiatives a hike, whereas Trump appointee Stephen Miran dissented in favor of a 50 bps reduce.

“This assembly was a large number…One member thinks the Fed hikes this 12 months…one other thinks we get 5 cuts. This rigging of the voting to create the phantasm of a ‘consensus’ after which publishing a large dot plot like this solely additional undermines their credibility,” stated macro funding researcher Jim Bianco.

Sponsored

Sponsored

In the meantime, The Kobeissi Letter referred to as the transfer historic, highlighting the primary charge reduce in over 30 years with Core PCE inflation above 2.9%.

“It’s clear the Fed is prioritizing the labor market over inflation,” Kobeissi wrote, noting markets now count on as many as 4 extra cuts by September 2026.

The speedy market response was swift. The US greenback fell to its weakest stage since February 2022, whereas equities held close to document highs.

Futures markets priced in no less than two extra cuts by year-end, with Kalshi knowledge exhibiting the percentages of three cuts spiking above 60%.

What Did the Markets Interpret from Powell’s Speech Yesterday?

Barchart highlighted that when the Fed cuts charges inside 2% of inventory market all-time highs, the S&P 500 has traditionally risen 100% of the time over the next 12 months, averaging a 14% acquire.

Constancy’s Jurrien Timmer in contrast the second to the late-1998 LTCM disaster, when the Greenspan Fed eased into robust markets, fueling a spectacular rebound.

Sponsored

Sponsored

Crypto markets are additionally watching liquidity flows intently, with analyst Ash Crypto highlighting prospects for extra liquidity within the face of extra charge cuts. This, he says, would translate into potential pumps for crypto costs.

“Extra cuts = Extra liquidity = pump,” the analyst wrote.

The Case for Warning

Nonetheless, not everyone seems to be satisfied the reduce heralds an prolonged bull cycle. Mark Minervini argued the Fed’s transfer was a “token” reduce. Given inflation’s persistence, he says it’s unlikely to set off an aggressive easing path.

“Charge cuts are usually bullish, significantly after they happen outdoors of a recession. However the Fed is chopping preemptively quite than reacting to an outright downturn. That distinction issues: it lowers the probability of an aggressive easing path, which might diminish the market influence,” he famous.

In the meantime, economists at The Dialog careworn the balancing act: chopping too rapidly might reignite inflation, whereas shifting too slowly dangers a sharper labor downturn.

Tariff-driven value pressures complicate the image, significantly for lower-income households, who spend extra on imported necessities that are actually climbing in value.

Henrik Zeberg, a long-time cycle analyst, warned that markets might enter a euphoric blow-off part earlier than a extreme downturn.

Sponsored

Sponsored

“Liquidity now will solely construct the next peak from which the market can crash,” he wrote, likening at this time’s rally to late-Twenties conduct.

What Comes Subsequent

The divergence between robust market technicals and weakening fundamentals leaves traders in a precarious place.

Buyers consider Powell has signaled additional cuts are coming. Towards this backdrop, sentiment is bullish, no less than for now, with equities at information and crypto climbing.

As of this writing, Bitcoin was buying and selling for $117,107, whereas Ethereum exchanged palms for $4,572. Each property confirmed power following the Fed’s determination.

However, dangers abound and proceed to erode investor confidence. These embrace:

- A labor market softening into recession,

- Tariff-driven inflation stickiness, and

- Political overtones round Powell’s “threat administration” framing.

If the Fed cuts too aggressively, it dangers shedding its inflation-fighting credibility. On the similar time, rising unemployment might pressure extra drastic motion later if it strikes too cautiously.

Subsequently, the subsequent few weeks for riskier property like Bitcoin could also be outlined by liquidity-driven optimism. Nevertheless, that is with the understanding that this rally rests on fragile floor.

It’s value noting that Powell himself acknowledged that the Fed is navigating “a difficult scenario” the place each side of its mandate are flashing crimson. The historical past of such moments exhibits markets usually rally first and reckon later.