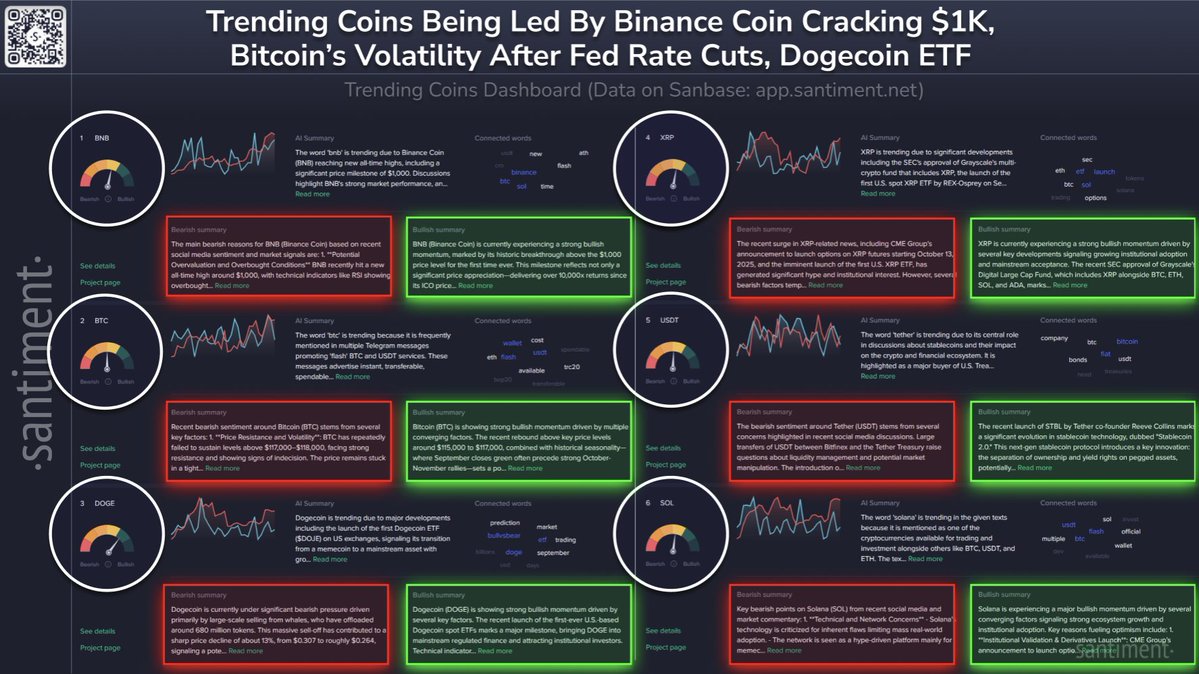

Crypto discussions throughout social media are shifting quickly, with a number of main tokens commanding investor consideration, in accordance with the most recent Santiment information.

Binance Coin (BNB) has surged into the highlight after breaking by the $1,000 milestone. Analysts spotlight the token’s rising position in transaction charges, pockets integration, and Binance’s increasing ecosystem. With sturdy liquidity and annual token burning, BNB is more and more seen as each a utility asset and a speculative driver.

Bitcoin (BTC) stays a relentless presence in market chatter, fueled by rising use instances throughout wallets, prompt transfers, and buying and selling platforms. Whereas worth motion has been extra secure, BTC continues to anchor sentiment round digital property, particularly as ETFs and treasury consumers play a rising position in liquidity.

Meme coin Dogecoin (DOGE) is having fun with renewed momentum following the launch of the primary Dogecoin ETF within the U.S. This shift has elevated DOGE from a community-driven token to at least one gaining institutional consideration. Market watchers cite its inflationary provide mannequin and increasing use in tipping and transactions as key drivers of its endurance.

XRP has additionally jumped in visibility because of a string of regulatory and institutional milestones. The SEC’s approval of Grayscale’s multi-crypto product, together with REX-Osprey’s deliberate U.S. spot XRP ETF and CME’s launch of XRP futures in October, underscores the token’s march towards mainstream acceptance.

Elsewhere, Solana (SOL) and Tether (USDT) are trending for various causes. SOL stays central to crypto gaming and cost platforms, whereas USDT continues to spark debate over its position in U.S. Treasury markets and the steadiness of its reserves.

Collectively, these developments illustrate how investor focus in 2025 is formed not simply by worth motion, however by structural milestones—from ETF launches and regulatory approvals to the combination of stablecoins and tokenized property into international finance.