Be a part of Our Telegram channel to remain updated on breaking information protection

The Bitcoin value edged up a fraction of a proportion within the final 24 hours to commerce at $117,217 as of 5:00 a.m. EST on a 42.97% improve in each day buying and selling quantity to $66.51 billion.

The rise in value comes proper after the US Federal Reserve minimize rates of interest by 25 foundation factors on Sept. 17, 2025. Fed Chair Jerome Powell defined this choice by pointing to a slowing labor market, although inflation stays excessive.

J-Powell and the Fed minimize charges by 25 bps.

What does that imply for Bitcoin?

“It is positively bullish for Bitcoin” – @Andre_Dragosch from @Bitwise_Europe stated on #CHAINREACTION.

3 most important causes:

💹 Lower in actual yield

💵 Inflation 🔼 = BTC upside

💰 Cash provide progress = 🚀 pic.twitter.com/lKZmSSggUT— Gareth Jenkinson (@gazza_jenks) September 18, 2025

That reveals a change in US financial coverage aiming to assist the economic system develop. Powell talked about sluggish job progress and weird modifications in labor provide as causes to ease the strict financial coverage.

📝 Powell’s message yesterday was easy: the Fed minimize as a result of the labor market cracked.

🟡 Unemployment is rising and job creation is now under the breakeven price

🟡 Inflation is again up and nonetheless “considerably elevated”

🟡 Progress has slowed, exercise is moderating

🟡 Tariffs are… pic.twitter.com/qECoEhawij— Er. Vipin (@Er_Vpin) September 18, 2025

The minimize helps debtors with excessive prices and makes many traders hopeful. This optimism unfold throughout completely different investments, together with Bitcoin and different cryptocurrencies.

The Fed’s price minimize goals to steadiness job progress and hold costs secure, which has been robust with combined financial indicators.

Decrease charges often imply extra liquidity within the markets, which inspires folks to spend money on riskier belongings like Bitcoin.

Bitcoin On-Chain Evaluation Reveals Rising Demand

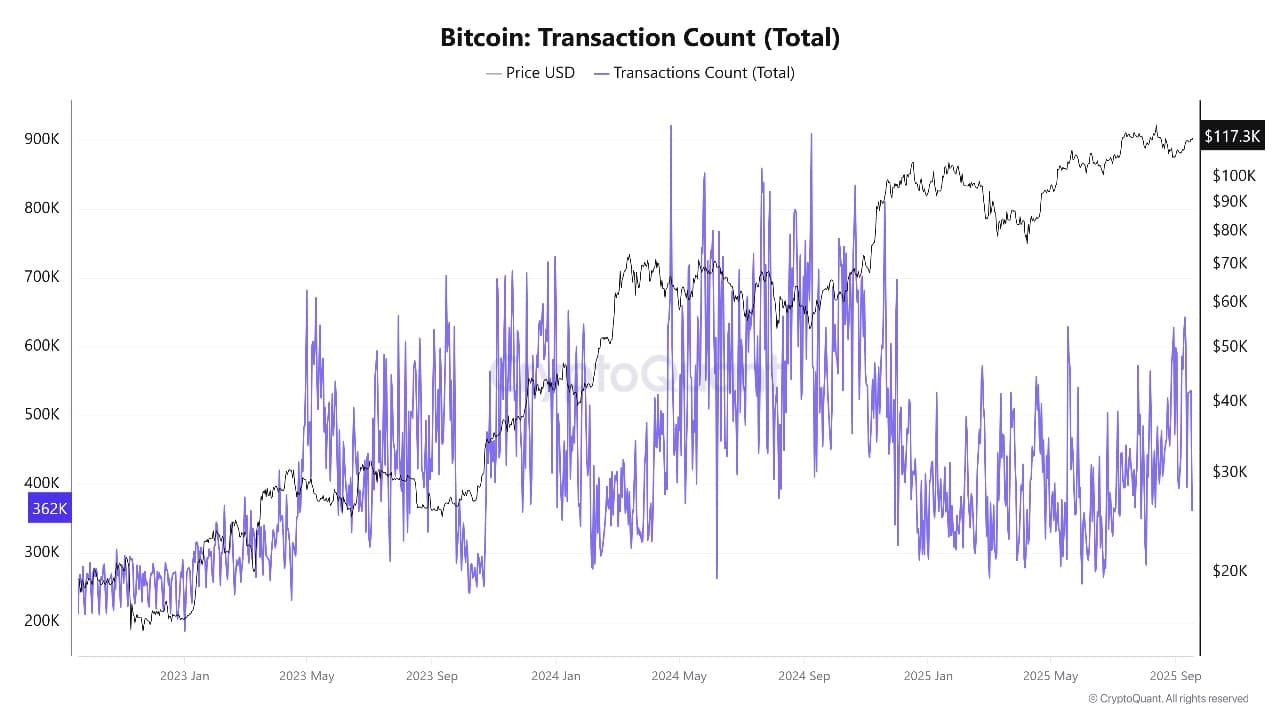

Taking a look at Bitcoin’s on-chain knowledge, there are indicators of sturdy demand supporting the current value rise. Extra Bitcoin transactions are occurring, and extra pockets addresses are lively. This implies extra individuals are utilizing Bitcoin.

Additionally, there’s a noticeable pattern of Bitcoin shifting off exchanges, which implies holders are protecting their cash fairly than promoting. This reduces the provision obtainable on the market and helps the worth go up.

Taking cash off exchanges is often very bullish as a result of it limits promoting stress and reveals that holders count on the worth to rise additional.

The regular improve in transactions additionally factors to a wholesome community, giving additional confidence to merchants throughout occasions of financial uncertainty.

Bitcoin Transaction Rely Supply: Crypto Quant

Bitcoin Worth Technical Evaluation Helps Additional Upside

Bitcoin’s weekly chart reveals that its value stays sturdy above $117,000, with a achieve of about 1.69%. The value discovered help close to the $110,000 and $105,000 ranges, which have stopped it from falling throughout current dips.

BTCUSD Evaluation Supply: Tradingview

The chart options Bitcoin buying and selling properly above its 50-week shifting common round $98,000, a key degree that reveals the long-term uptrend is alive. The subsequent resistance or goal degree is at $124,500, which may very well be reached as the worth rides the present upward channel.

Technical indicators help the constructive view: the Relative Power Index (RSI) is about 60.7, suggesting the worth is gaining energy however not but too excessive. The Transferring Common Convergence Divergence (MACD) has constructive bars, confirming the bullish pattern.

In the meantime, the Common Directional Index (ADX) close to 24.7 reveals a reasonably sturdy pattern pushing the worth upward. If Bitcoin stays above the $110,000 help, it might quickly transfer previous $124,500 and possibly even attain new document highs within the coming weeks.

In abstract, Bitcoin is gaining from the Fed’s price minimize, which will increase cash movement out there and makes traders extra keen to take dangers. On-chain indicators present holders really feel assured and aren’t promoting, decreasing market provide. Technical evaluation additionally signifies Bitcoin is trending up with sturdy momentum.

The value shifting previous $117,000 is a giant step, with strong help ranges able to hold it regular. When combining these elements, Fed coverage, blockchain knowledge, and technical developments, the outlook is beneficial for Bitcoin to proceed rising and check larger value ranges quickly.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be a part of Our Telegram channel to remain updated on breaking information protection