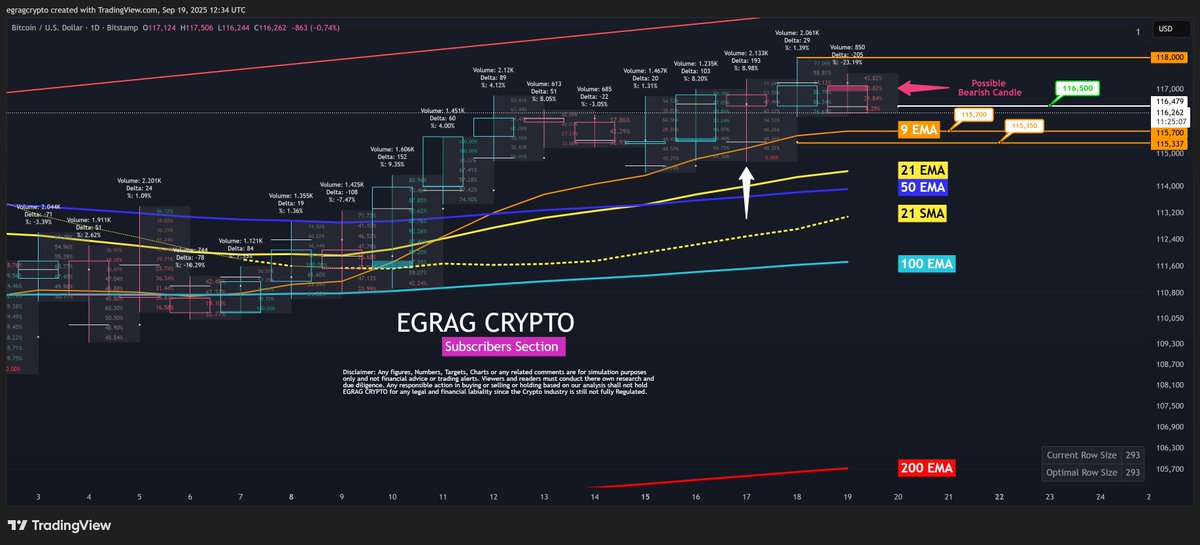

Bitcoin is at the moment displaying blended indicators, with a bearish every day candle forming whereas merchants carefully monitor help ranges for indicators of energy.

Analyst Egrag Crypto highlighted that the 9-day EMA is taking part in a important function, suggesting a possible bounce could also be underway.

Bears Maintain Management, However Help Ranges Matter

At current, Bitcoin’s Quantity Delta signifies that bears stay in command of short-term value motion. Nonetheless, Egrag factors out that if the worth dips into the $115,700 – $115,350 zone, bulls might step in with renewed shopping for curiosity. A profitable rebound from this vary may set off momentum towards the $118,000 mark, reinforcing the broader bullish outlook.

200 EMA: The Greater Image Reset

Lengthy-term merchants are additionally watching the 200-day EMA, a stage Bitcoin often retests throughout consolidation phases. Egrag notes that whereas a possible drop of $12,000 could seem steep, such resets typically precede bigger rallies. Traditionally, these pullbacks have cleared the best way for Bitcoin to arrange its “subsequent large pump.”

Weekend Watch and Monday Shut

Market watchers will maintain a detailed eye on Bitcoin’s efficiency over the weekend. Based on Egrag, the every day shut on Monday might show decisive in confirming whether or not bulls can reclaim management or whether or not additional draw back is probably going earlier than the following leg increased.

Outlook

For now, the roadmap seems clear: a bounce from the mid-$115K zone might ship Bitcoin towards $118K rapidly, whereas a deeper check of the 200 EMA might delay however not derail the bullish setup. As Egrag concluded, “time will inform.”