Coinbase is as soon as once more within the highlight after unveiling a characteristic that ties its future extra carefully to decentralized finance.

The corporate’s resolution to combine high-yield USDC lending straight into its platform has sparked a wave of optimism, with analysts suggesting it may reshape how mainstream customers have interaction with DeFi. By simplifying entry to yields that have been as soon as locked behind complicated protocols, Coinbase is reducing limitations for on a regular basis buyers whereas signaling a long-term dedication to innovation in stablecoin markets. This daring step positions Coinbase as not simply an alternate, however a gateway for hundreds of thousands of consumers to entry blockchain-based revenue methods that have been beforehand confined to area of interest crypto circles, and now stand getting ready to getting into the monetary mainstream.

That very same shift towards simpler entry is shaping different corners of the market as nicely. HYLQ Technique Corp, for instance, has rebranded itself as a regulated car tied to HyperLiquid, giving fairness buyers a technique to take part in DeFi development with out touching wallets or navigating on-chain dangers. Its give attention to HYPE tokens and Canadian Securities Alternate itemizing have helped place it among the many high cryptocurrency shares now gaining consideration as investor curiosity broadens past the normal giants.

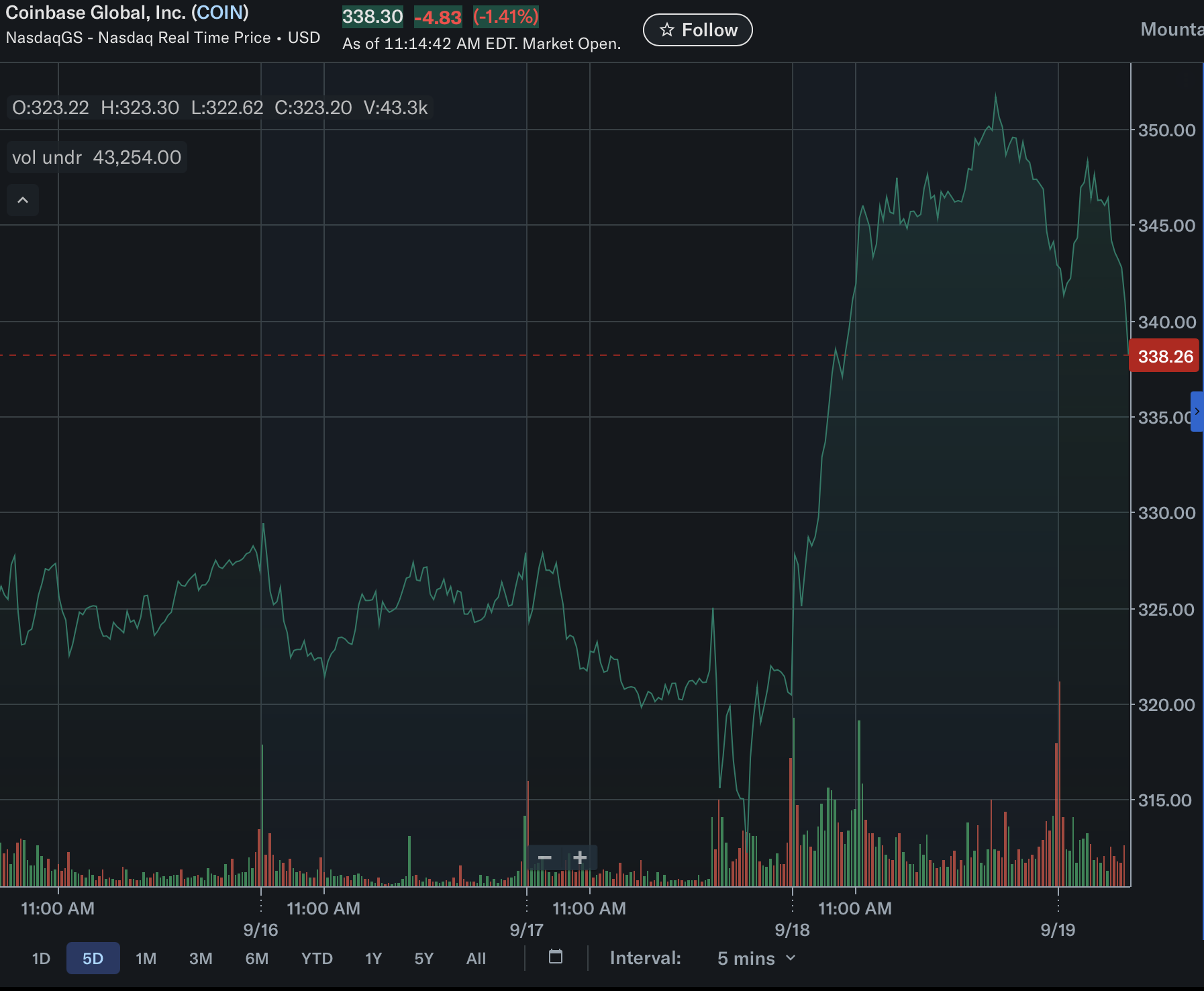

Sturdy Value Motion

Coinbase inventory surged from lows close to $322 on September 18 to intraday highs above $349 earlier than easing barely to round $338 on September 19. That transfer represented one in all COIN’s strongest single-day rallies in weeks, including greater than 7% at its peak.

Merchants at the moment are eyeing $325–$328 as key help, whereas $350 has emerged as near-term resistance. A decisive break above that stage may open the door to additional positive aspects, whereas dropping help may set off profit-taking.

Coinbase’s DeFi Lending Rollout

The catalyst for the rally got here from Coinbase’s announcement of a brand new USDC lending choice that channels deposits into Morpho, a DeFi protocol securing greater than $8 billion in property, based on DeFiLlama.

Funds might be managed by way of vaults overseen by Steakhouse Monetary and function on Base, Coinbase’s in-house Layer 2 blockchain. This system marks a shift from Coinbase’s mounted USDC Rewards (4.1%–4.5%) to market-driven DeFi yields, which might now attain double digits.

Not like the older rewards mannequin – funded straight by Coinbase’s price range – this new characteristic ties payouts to actual lending exercise in DeFi markets. Clients can begin incomes immediately and withdraw at any time, offered liquidity is on the market.

Why Buyers Are Optimistic

Analysts imagine Coinbase’s enlargement into onchain lending may speed up adoption of DeFi amongst retail customers who’ve prevented the sector because of complexity or safety issues. By integrating yield methods straight into its app, Coinbase is successfully bridging mainstream finance and blockchain credit score markets.

The timing can also be favorable. DeFi lending volumes are up 72% year-to-date, reflecting surging demand for blockchain-based yield alternatives. By transferring early, Coinbase positions itself to seize a slice of this rising market and additional strengthen USDC’s position as a yield-bearing stablecoin.

Wanting Forward

With enthusiasm constructing round simpler entry to blockchain yields, optimistic buyers are additionally exploring different methods to seize DeFi’s development by way of fairness markets. HYLQ Technique Corp (CSE: HYLQ) has emerged as one of many extra intriguing names, positioning itself as “The Public HYPE Treasury.” Reasonably than specializing in stablecoins, HYLQ ties shareholder worth on to HyperLiquid’s HYPE token, now ranked among the many high 15 cryptocurrencies by market cap.

The corporate just lately introduced the acquisition of an extra 5,000 HYPE tokens at a median value of $52.47, bringing its whole holdings to 38,961.53 HYPE value over $2 million at present ranges.

Executives signaled their intent to maintain accumulating within the weeks forward, underscoring confidence in HyperLiquid’s momentum. The platform itself has processed greater than $2.5 trillion in lifetime derivatives quantity, constantly dealing with billions in every day trades whereas introducing improvements to cut back systemic danger.

By pairing this DeFi-scale development with the regulatory safeguards of a Canadian Securities Alternate itemizing, HYLQ gives buyers with a technique to entry probably the most promising high cryptocurrency shares whereas navigating by way of the extra secure framework of public fairness markets.

Outlook

The previous day’s value rally displays Wall Road’s perception that Coinbase is just not solely surviving regulatory headwinds but additionally innovating to form the following part of digital finance. If the inventory can break by way of the $350 resistance zone, momentum merchants might even see scope for additional upside as confidence grows in Coinbase’s DeFi pivot. Long run, the success of its USDC lending characteristic may decide whether or not Coinbase cements its position because the main bridge between conventional markets and decentralized finance.

On the similar time, the seek for new alternatives is increasing investor consideration past Coinbase alone. HYLQ Technique Corp, with its rising treasury of HyperLiquid’s HYPE tokens and controlled Canadian Securities Alternate itemizing, is rising as a complementary play.