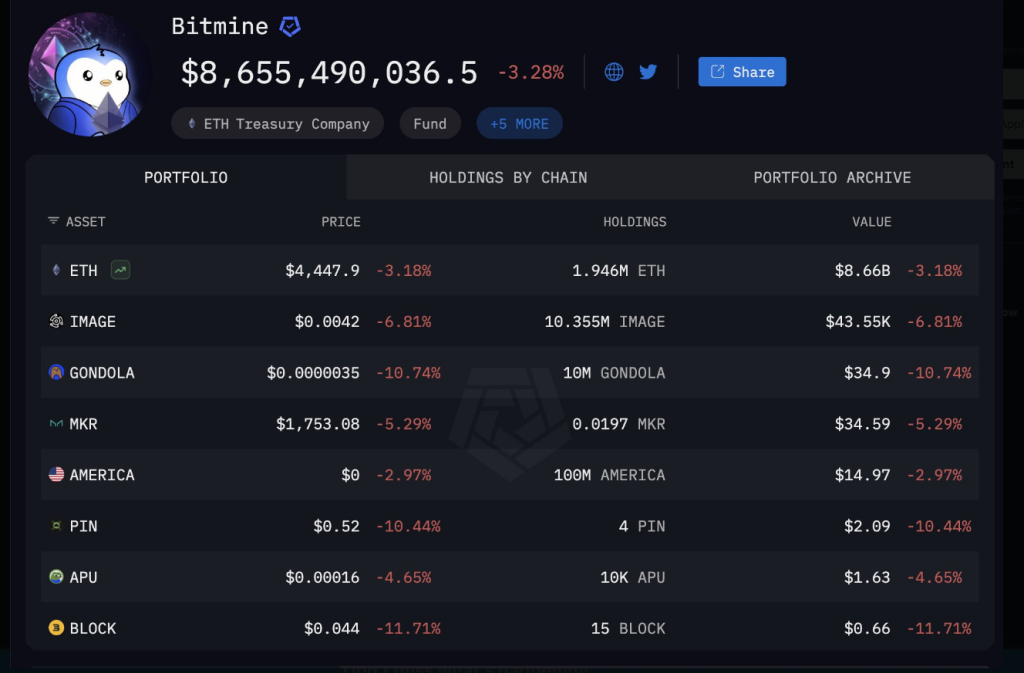

BitMine Immersion Applied sciences has added practically $70 million value of Ethereum to its holdings, pushing the corporate’s ETH stash to a worth close to $8.66 billion.

Associated Studying

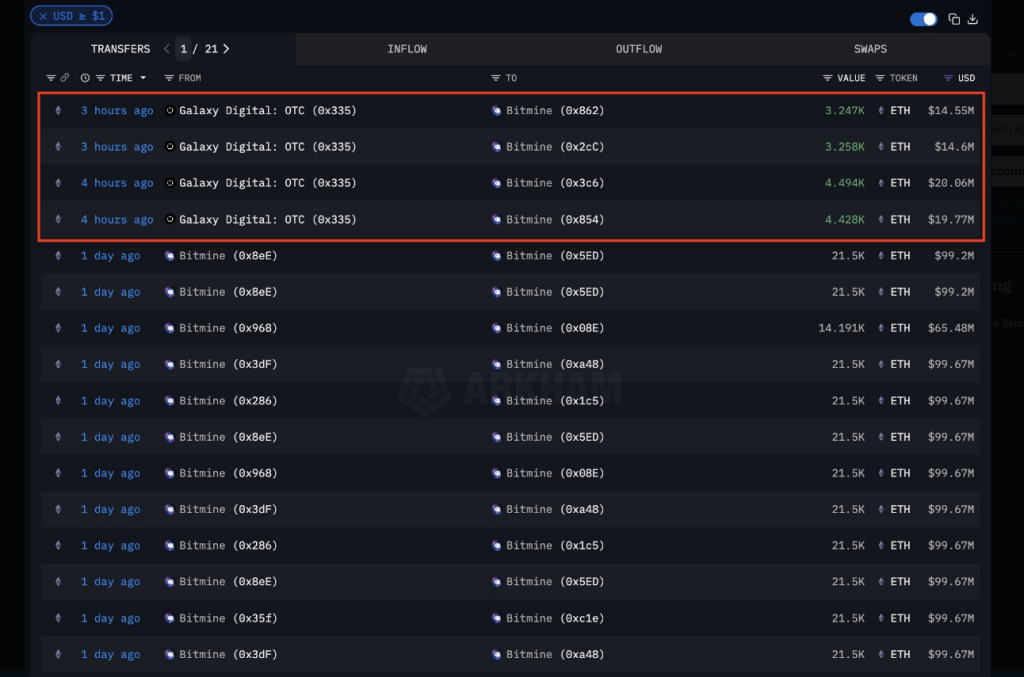

Based mostly on reviews, the purchases had been made by means of Galaxy Digital’s over-the-counter desk and arrived in a number of chunks fairly than a single block.

Buy Damaged Into 4 Tranches

The current buys had been break up into 4 settlements: 3,247 ETH ($14.50 million), 3,258 ETH ($14.6 million), 4,494 ETH ($20 million), and 4,428 ETH ($19.75 million).

That totals about 15,427 ETH, which sums to roughly $69 million on the costs reported. In accordance with public trackers cited within the protection, these had been seemingly coordinated OTC trades designed to keep away from shifting the spot market.

TOM LEE IS BUYING EVEN MORE $ETH

Tom Lee’s Bitmine simply purchased one other $69M of ETH from Galaxy Digital. They now maintain $8.66 BILLION of ETH.$BMNR is bullish on $ETH. pic.twitter.com/t9BWh9btPR

— Arkham (@arkham) September 19, 2025

How A lot Of Ethereum Does BitMine Maintain

Experiences have disclosed that BitMine now holds about 1.95 million ETH. That holding is valued at about $8.66 billion utilizing the identical pricing used within the protection.

Analysts monitoring company treasuries say that company and institutional ETH reserves collectively quantity to a couple % of circulating provide, and BitMine is listed among the many largest single holders.

The figures can look massive compared with complete ETH provide, however the share is determined by which provide measure is used — circulating, staked, or in any other case locked.

Market Mechanics Behind The Transfer

Shopping for massive quantities on OTC desks is frequent for public corporations and massive gamers. It reduces slippage and retains huge orders off public order books.

The ETH right here moved with out apparent worth spikes. Some transfers had been seen on chain; the personal phrases of OTC trades often stay confidential.

Based mostly on reviews citing blockchain trackers like Arkham, the on-chain flows matched the scale and timing described.

Threat, Accounting And Technique

Holding huge quantities of a risky token carries actual dangers. A pointy fall in ETH would hit BitMine’s steadiness sheet. On the similar time, regular accumulation indicators a transparent strategic wager on future appreciation.

Market observers examine this method to different companies that maintain crypto as a part of their company treasury, and regulators and accountants will watch how such holdings are reported in quarterly filings.

Associated Studying

Company Accumulation Goes Massive

Some particulars stay unclear. Experiences cite Arkham and Strategic Ether Reserve as the first sources, however OTC trades don’t reveal full pricing particulars and the precise phrases are sometimes personal.

As a result of these settlements occur off-exchange, public information present transfers however not each pricing particulars. Massive holders’ exercise tends to draw additional consideration when ETH strikes sharply up or down.

Based mostly on these numbers, the transfer is yet one more signal of enormous company accumulation of ETH.

Featured picture from Unsplash, chart from TradingView