- Avalanche DeFi TVL crosses $2B, doubling since spring.

- Worth assessments $36 resistance, with potential upside towards $44.

- Spot exercise and change outflows verify bullish accumulation.

Avalanche’s DeFi ecosystem has doubled in dimension since spring, pushing its whole worth locked (TVL) previous $2 billion—the best degree in two years. This surge in capital highlights rising confidence within the community as AVAX reveals indicators of constructing upward momentum throughout buying and selling markets.

Avalanche Worth Evaluation: Key Ranges at $36 and $44

AVAX lately broke by way of $26.81, establishing increased assist and reinforcing its uptrend since June. The token is now testing resistance at $36.12. A decisive shut above this degree may pave the way in which for a run towards $44, whereas failure to carry may result in short-term retracements again towards $33–$34.

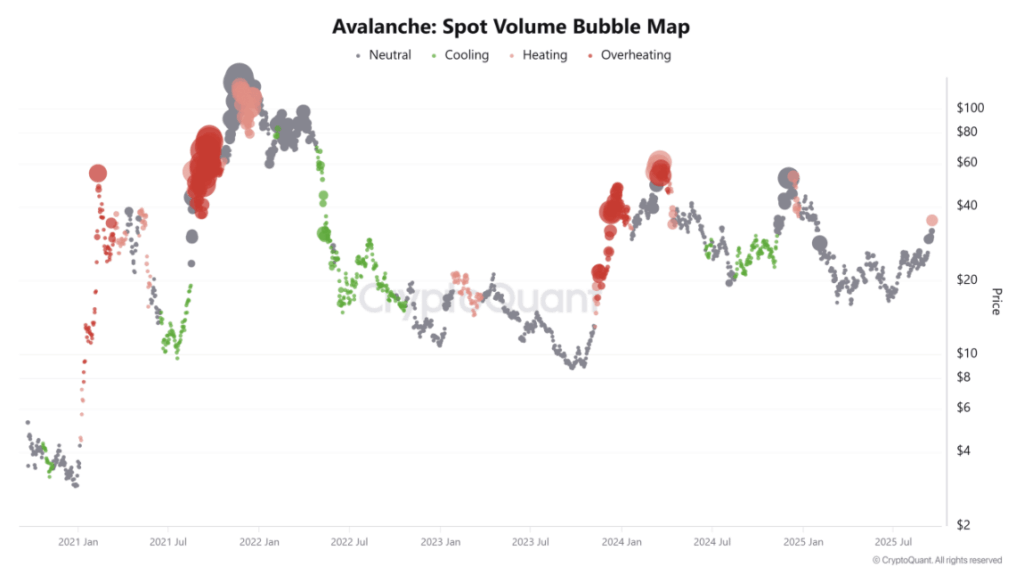

Spot Buying and selling Quantity Indicators Rising Demand for AVAX

Spot buying and selling quantity has surged, with bubble map knowledge exhibiting bigger clusters of exercise. This means stronger engagement from each retail and institutional merchants after months of consolidation. Sustained development in spot demand provides weight to the bullish breakout construction.

Trade Outflows Recommend Whale Accumulation

Trade netflow knowledge reveals practically $1 million in every day outflows, signaling accumulation as tokens go away exchanges. This reduces rapid promoting strain and aligns with the sharp rise in TVL, suggesting buyers are locking up AVAX for long-term publicity quite than holding it liquid.

Avalanche Worth Forecast: Can AVAX Break Out Towards $44?

With surging DeFi TVL, bullish technicals, rising spot exercise, and constant change outflows, Avalanche seems well-positioned for additional upside. If bulls defend $36 and momentum holds, AVAX may climb towards $44 within the close to time period, holding its breakout narrative intact.

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.