XRP named Thailand’s high asset for 9 straight months

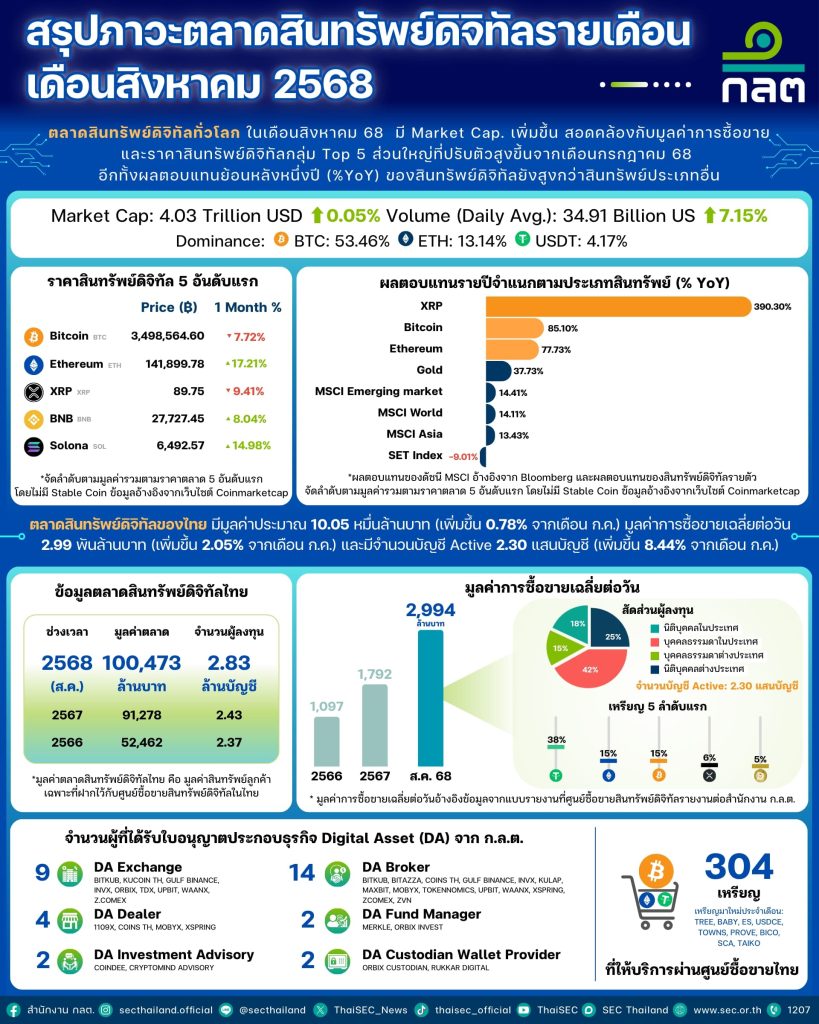

XRP delivered the strongest returns amongst all main asset lessons in Thailand, hovering 390% year-on-year in August, in line with the Thai Securities and Alternate Fee’s newest digital asset market report.

The XRP token has now topped the SEC’s efficiency rankings for 9 consecutive months, outpacing gold, equities and different benchmarks listed within the regulator’s database. Solana was the final asset aside from XRP to high Thailand’s chart. Bitcoin and Ethereum rounded out the highest three performers in August.

Thailand’s cryptocurrency market continues to develop. Month-to-month buying and selling quantity rose 2.05% to 299.4 billion baht (about US$8.2 billion), whereas the variety of energetic accounts elevated 8.44% to 230,000. Retail buyers made up the most important share of buying and selling at 42%, adopted by institutional buyers (21%), juristic individuals (18%) and international buyers (16%).

Regardless of rising adoption, crypto stays barred as a method of fee in Thailand, with exceptions equivalent to a pilot program for vacationer transactions. On social media, some customers famous that crypto may present another for over 3 million locals lately minimize off from financial institution entry in a nationwide crackdown on “mule accounts” — once-legitimate financial institution accounts rented or bought to illicit actors.

Locals should ramp up on their crypto pockets literacy if they need different strategies to carry their belongings. The crackdown additionally consists of cryptocurrency exchanges.

AnchorX’s Chinese language yuan-pegged stablecoin

A Kazakhstan-based stablecoin issuer has launched a digital token pegged to the offshore Chinese language yuan.

AnchorX stated in February that it obtained an in-principle approval from Kazakhstan’s monetary authority to challenge its offshore yuan-pegged stablecoin AxCNH on Conflux, a public blockchain that has obtained coverage help in China. AxCNH will goal settlement and funds for abroad Chinese language companies and companions of the Belt and Highway Initiative, Beijing’s formidable international commerce technique.

China’s commerce with BRI accomplice nations reached 22.1 trillion yuan (about $3.1 trillion) in 2024, with over half of its imports coming from BRI accomplice nations.

The launch of a yuan-pegged stablecoin doesn’t essentially sign a shift in China’s crypto stance or counsel that Beijing is making ready to greenlight stablecoins, regardless of current rumors. The difficulty has lengthy been contentious amongst international crypto customers, as buyers on the earth’s second-largest economic system stay barred from core actions equivalent to buying and selling and mining.

China’s forex, the renminbi, operates in two distinct markets. The onshore yuan (CNY) circulates inside the mainland below strict capital controls and can’t freely move throughout borders. Its counterpart, the offshore yuan (CNH), is used internationally for commerce and funds.

Following the introduction of Hong Kong’s stablecoin rules, main Chinese language companies reportedly lobbied the central financial institution for permission to challenge yuan-pegged stablecoins within the metropolis, which serves as the most important marketplace for CNH. Nevertheless, more moderen reviews point out that some Chinese language corporations could also be pulling again from Hong Kong’s stablecoin race.

Learn additionally

Options

Earlier than NFTs: Surging curiosity in pre-CryptoPunk collectibles

Options

Pectra onerous fork defined — Will it get Ethereum again on observe?

Shanghai court docket sells Filecoin in Hong Kong

A Shanghai district court docket has carried out the town’s first sale of cryptocurrency seized in a felony enforcement case, below steering from the Shanghai Increased Individuals’s Court docket.

The Baoshan District Individuals’s Court docket disposed of greater than 90,000 Filecoin, following procedures that mirror a framework unveiled by Beijing police in June for dealing with seized digital belongings.

Underneath the system, courts entrust tokens to a licensed establishment, which delegates buying and selling to a certified agent. Transactions are executed on a Hong Kong–licensed cryptocurrency trade at at least the 20-day common value. Proceeds are then transferred to the court docket’s account, the place they will both be confiscated into the state treasury or returned to the victims.

The Shanghai Excessive Court docket stated the transfer marked their first profitable disposal of digital belongings, closing a niche the place earlier instances lacked a authorized path for liquidation.

Learn additionally

Options

Cryptocurrency buying and selling dependancy: What to look out for and the way it’s handled

Options

TradFi is constructing Ethereum L2s to tokenize trillions in RWAs: Inside story

Crypto trade to flee annual grilling from South Korean lawmakers

Stablecoins are set to dominate cryptocurrency-related discussions in South Korea’s upcoming annual parliamentary audit.

In earlier years, crypto audits typically featured lawmakers grilling monetary regulators and trade executives over market failures and manipulation. Final 12 months, the Monetary Providers Fee was accused of favoring the monopolies of main exchanges.

However all through 2025, the native trade has not seen the high-profile scandals or main instances of market manipulation that sometimes set off such confrontations. Consequently, main trade executives are unlikely to be summoned this 12 months. As an alternative, consideration is shifting to stablecoins, a coverage precedence for President Lee Jae-myung, whose administration took workplace in June on a crypto-friendly stance.

In keeping with native media citing unnamed sources, legislators are anticipated to request knowledge from exchanges on inflows and outflows of US dollar-pegged stablecoins.

The Nationwide Meeting’s audit is scheduled to start round Oct. 13, instantly after Chuseok, a vacation typically described as Korea’s Thanksgiving. Lawmakers on the Nationwide Coverage Committee, which oversees monetary and crypto-related points, have already begun drafting witness lists.

Subscribe

Essentially the most partaking reads in blockchain. Delivered as soon as a

week.

Yohan Yun

Yohan Yun is a multimedia journalist protecting blockchain since 2017. He has contributed to crypto media outlet Forkast as an editor and has lined Asian tech tales as an assistant reporter for Bloomberg BNA and Forbes. He spends his free time cooking, and experimenting with new recipes.