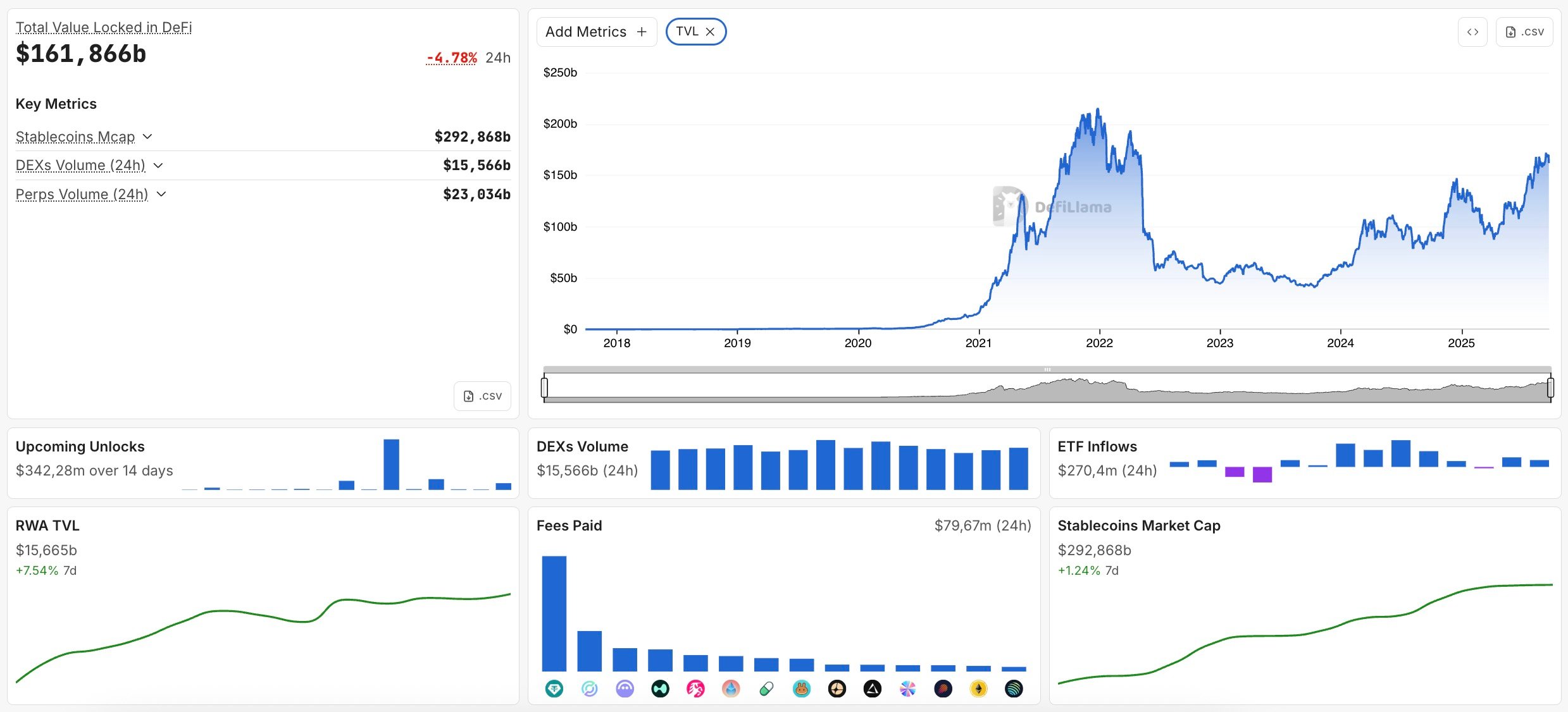

Ripple’s new roadmap makes it clear that XRP, already valued at $180 billion, is being promoted as an institutional DeFi asset at a time when the sector is demonstrating its true dimension: $161.8 billion is locked in protocols, $292.8 billion in stablecoins, $15.6 billion is traded each day on DEXes and there’s $23 billion in perpetuals quantity, based on DefiLlama.

The message is evident: XRPL is evolving past funds to embody the compliance, credit score and tokenized markets, the place billions are already altering palms each day.

Upgrades at the moment are reside, with on-chain proof of regulatory standing, freeze controls for issuers and simulation instruments for lowering errors. These options deal with regulators’ considerations, contributing to the expansion of XRPL’s stablecoin, which just lately surpassed $1 billion in a single month, and its place within the prime 10 real-world asset chains, valued at $15.6 billion in DeFi. XRP’s function as a settlement asset inside this technique continues to develop.

The larger shift will include model 3.0. A protocol-level lending system will pool liquidity and problem loans natively underneath KYC/AML requirements, creating cheaper institutional credit score and direct yield alternatives. The Multi-Function Token commonplace, due in October, will permit bonds and structured merchandise to be issued and traded immediately on XRPL.

Backside line

These will not be facet experiments however are methods of pulling regulated cash into markets the place XRP is each the collateral and the liquidity rail.

Privateness is subsequent. Zero-knowledge proofs are being developed to allow establishments to transact and collateralize positions with out revealing particulars whereas nonetheless passing audits.

In a market the place ETFs are pulling in inflows of $270 million in a single day and stablecoins are approaching $300 billion, Ripple’s plan alerts that XRP isn’t just surviving however is being positioned to take a seat on the coronary heart of the biggest flows in digital finance.