- TRON information 9–10M every day transactions and $25B in USDT flows, however TRX value has slipped beneath $0.34.

- Retention is weak, with cohort charges falling from 19% to simply 2%, displaying most new customers don’t stick round.

- Spot market promoting dominates, with a -35M Delta suggesting TRX might fall to $0.32 until sentiment flips bullish.

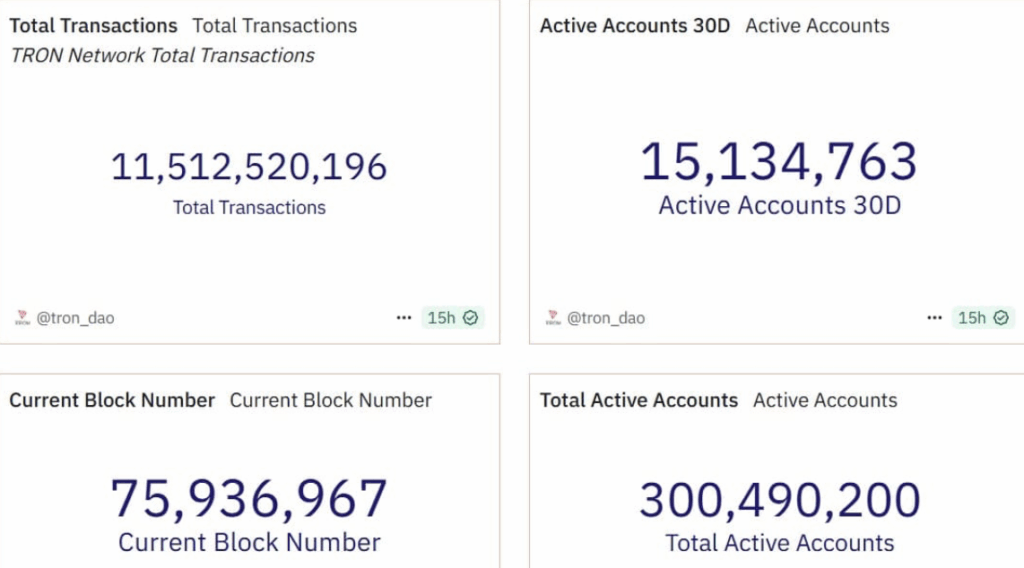

TRON has been buzzing with exercise recently. The community has been clocking between 9 to 10 million every day transactions, pushing almost $25 billion in USDT transfers each single day, and recording over 15 million energetic accounts. That sort of quantity screams adoption. And but, whenever you take a look at the token itself, TRX hasn’t precisely been driving the identical wave.

Simply 4 days in the past, TRX hit $0.35. Since then, it’s been sliding. At press time, the value sits round $0.336, down a bit of over 3% within the final 24 hours and almost 4% on the week. Clearly, there’s a disconnect between what the charts are saying and what the community is doing.

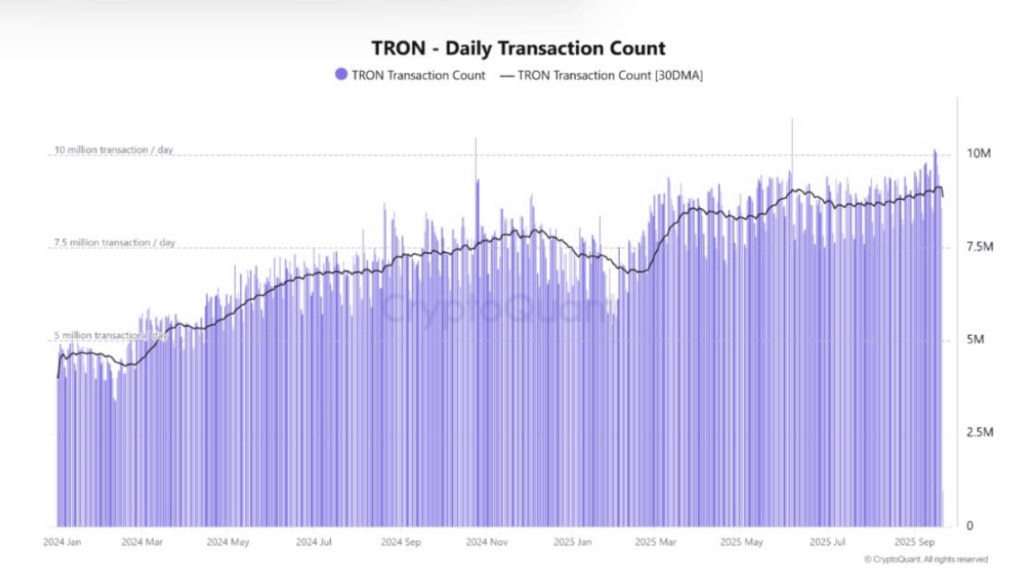

Every day Transactions Push TRON to New Highs

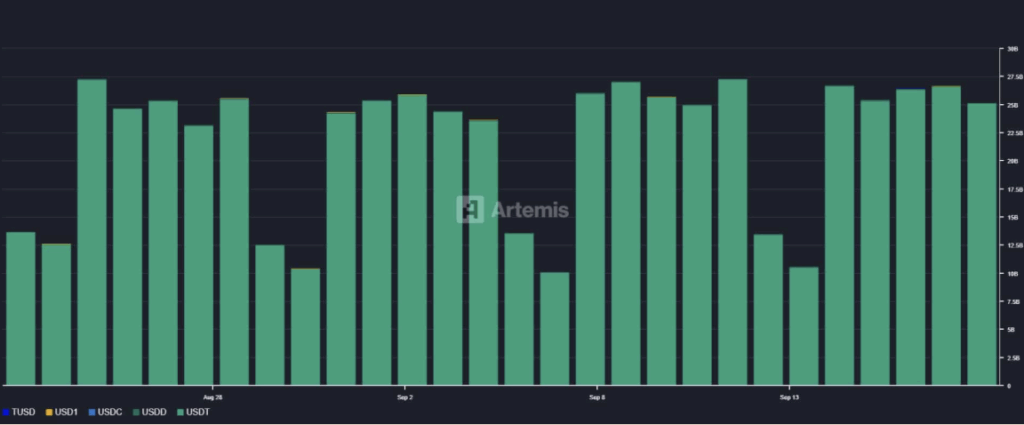

CryptoQuant information paints a transparent image—TRON is seeing a baseline of over 9 million every day transactions, up 20% in comparison with January. That’s a critical improve in exercise. Stablecoins are driving a lot of it. In line with Artemis, USDT transfers alone are holding regular at round $25 billion daily.

On high of that, energetic accounts over a 30-day window have hit 15.1 million, whereas the full variety of accounts has now blown previous 300 million. These are staggering adoption numbers. Nonetheless, not all is as rosy because it seems to be.

Retention Points Increase Questions

Regardless of this progress, consumer retention on TRON is struggling. Artemis information exhibits the community’s month-to-month cohort retention fee has plunged—from 19% earlier this yr to simply 2% now. In easy phrases: individuals strive TRON, however most don’t stick round.

Take Could 2025 for example. About 6.2 million new customers joined that month, however solely 12% of them have been nonetheless energetic three months later. That’s loads of churn, suggesting TRON is nice at pulling individuals in however not so nice at maintaining them engaged.

Bearish Stress Builds on TRX

Whereas the community is booming, TRX traders are leaning bearish. Spot Taker CVD information exhibits sellers have been in management, with a -35 million Delta logged in simply 24 hours. Coinalyze backs this up, displaying 206 million in promote quantity in comparison with 171 million in buys.

Traditionally, when sellers dominate spot markets like this, costs are inclined to dip additional. If the sample continues, TRX might slide towards $0.32. On the flip facet, if sentiment flips bullish and the heavy community utilization begins to weigh in, a rebound again to the $0.35 resistance zone isn’t out of the query.

Key Takeaway

TRON’s ecosystem is prospering on the floor—transactions, stablecoin flows, and account progress all level to actual adoption. However investor sentiment is shaky, and with out stronger retention, TRX dangers extra value stress earlier than any sustainable rally.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.