On-chain analytics agency Glassnode has revealed the place a Bitcoin stage traditionally seen as a key battleground between bulls and bears presently lies.

Bitcoin Brief-Time period Holder Value Foundation Is Located At $111,400 Proper Now

In a brand new submit on X, Glassnode has talked in regards to the Bitcoin Realized Value of the short-term holders. The “Realized Value” is an on-chain indicator that measures, in brief, the common price foundation or acquisition stage of the common investor on the BTC community.

When the spot value of the cryptocurrency is buying and selling above this metric, it means the holders as an entire are sitting on some internet unrealized revenue. Then again, being beneath the indicator implies the general market is underwater.

Within the context of the present matter, the Realized Value of a particular a part of the blockchain is of curiosity: the short-term holders (STHs). This cohort contains the buyers who bought their cash inside the previous 155 days.

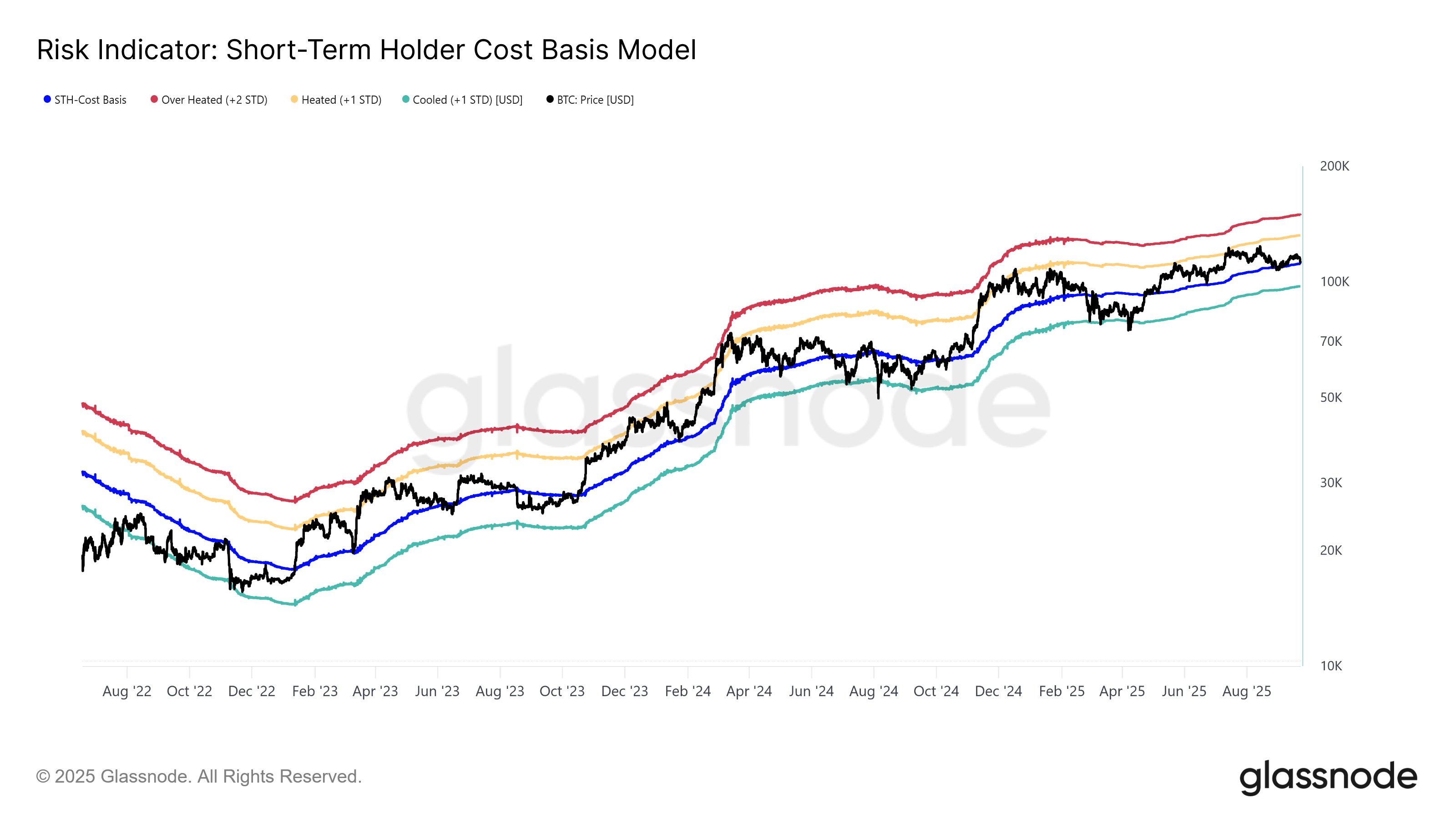

Now, right here is the chart shared by the analytics agency that reveals the development within the Bitcoin STH Realized Value over the previous couple of years:

As displayed within the above graph, the Bitcoin STH Realized Value is presently sitting at $111,400, which signifies that the cryptocurrency’s spot value is buying and selling fairly close to it.

As such, if the asset’s newest bearish momentum continues, a retest of the extent might occur. Traditionally, BTC has had some notable interactions with the metric, with it rotating roles as each help and resistance.

The reason behind this development lies in the truth that STHs embrace essentially the most reactive buyers available in the market. If the temper within the sector is bullish, these merchants take part in shopping for on retests of their price foundation, believing the decline to be only a “dip.” Equally, they promote at their break-even mark when the sentiment is bearish, fearing that they are going to drop into losses once more.

When one among these patterns doesn’t maintain for the indicator, it may be an indication that the market construction is shifting. In different phrases, which facet of the road BTC is buying and selling might have an effect on its trajectory. “The short-term holder price foundation is commonly handled as the important thing battle line between bulls & bears,” notes Glassnode.

Given the relevance that the STH Realized Value has had previously, a retest for Bitcoin, if one occurs, might be price watching. “Sustained buying and selling beneath this stage might sign a shift towards a mid- to long-term bearish market construction,” explains the analytics agency.

BTC Value

Bitcoin has been unable to make any restoration since Monday’s plunge as its value continues to be floating across the $112,800 mark.