- Aster hit a report $2.14 earlier than easing again to $1.95–$2.00 help.

- Buying and selling quantity surpassed $11B, whereas TVL soared to $1.6B, exhibiting speedy adoption.

- Key ranges to look at: $1.90 help and $2.14 resistance for the following breakout.

Aster (ASTER) made headlines after taking pictures as much as a recent all-time excessive of $2.14, solely to ease again slightly below the $2.00 mark on Tuesday. The token, which fuels the Aster decentralized change (DEX) for perpetuals on Binance, has shortly turn out to be one of many most-watched names in DeFi. Backed by YZi Labs—previously generally known as Binance Labs—the venture is flexing critical muscle for such a younger platform.

Explosive Development in Buying and selling and TVL

In simply days of going stay, Aster’s perp DEX quantity rocketed previous $11 billion, highlighting its quickly rising adoption. The platform’s web site experiences a staggering $544 billion in cumulative buying and selling quantity already, with greater than 524,000 customers plugging in. Open Curiosity has climbed to roughly $255 million, whereas staking and DeFi exercise hold fueling momentum.

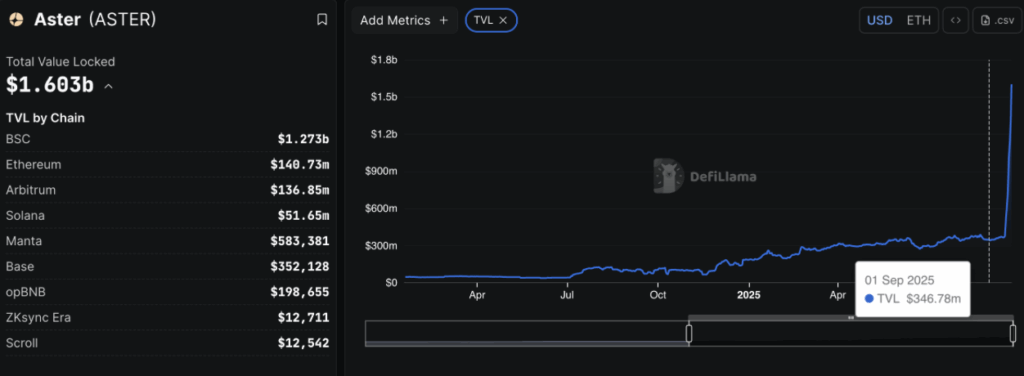

Based on DefiLlama, Aster’s Whole Worth Locked (TVL) has hit $1.6 billion—up massively from simply $347 million on September 1. That’s almost a 5x leap in lower than a month, exhibiting that customers aren’t simply buying and selling, they’re locking funds in and sticking round.

Technical Image: Bulls Nonetheless in Management?

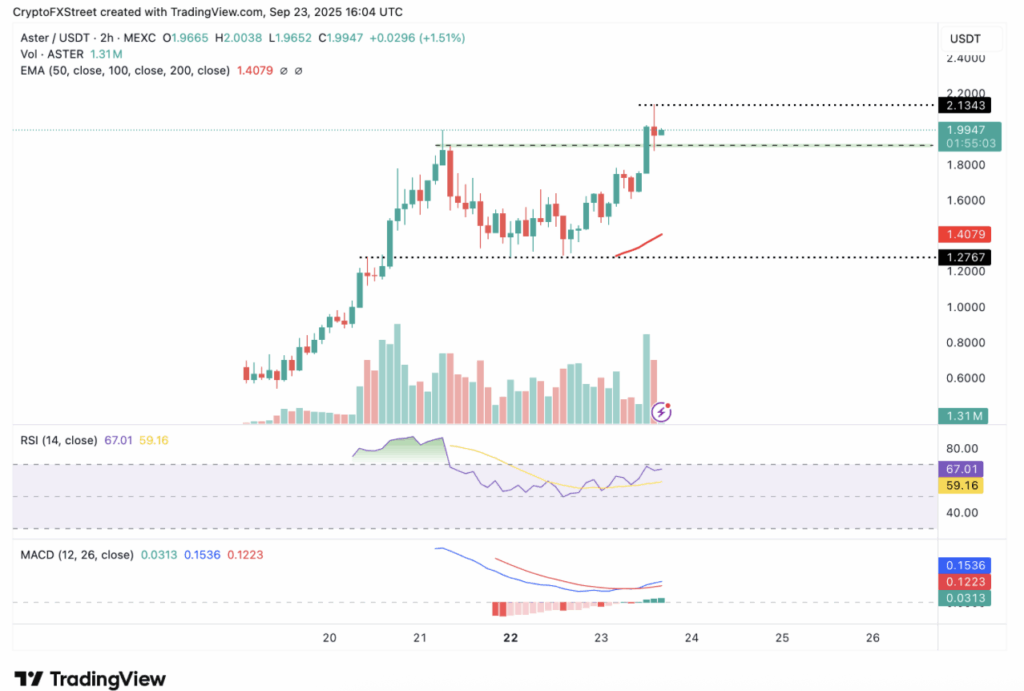

Proper now, Aster is hovering close to $1.95–$2.00. The $1.90 zone has emerged as short-term help, serving to consumers defend in opposition to dips. On the charts, momentum continues to be tilted in favor of the bulls. The MACD, whereas flashing a short-term promote sign earlier, hasn’t dampened general confidence. If merchants pile in on these pullbacks, a recent transfer over $2.00 appears to be like possible.

The RSI sits round 68—closing in on the overheated 70+ degree. That implies power but in addition a warning flag, since overly stretched situations usually deliver a spherical of profit-taking. Merchants are watching two principal zones: the report $2.14 excessive on the upside, and the $1.90 help on the draw back. Whichever breaks first may dictate Aster’s subsequent short-term pattern.

The Backside Line

Aster’s fundamentals look sturdy, with surging buying and selling quantity, report TVL, and rising consumer development backing the hype. Worth motion may wobble within the close to time period if RSI overheats or sellers push beneath $1.90, however the greater image suggests bulls are nonetheless steering the ship. A decisive break above $2.14 would set the stage for one more leg increased, whereas failure to carry help dangers a sharper pullback earlier than the following run.

Disclaimer: BlockNews gives unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.