- Hedera now processes over 10,000 TPS, making large-scale tokenization technically and economically viable.

- Governance, auditability, and compliance instruments in Hedera’s Token Service (HTS) are designed to win institutional belief.

- ETF progress and new governing council members strengthen Hedera’s place as a reputable platform for enterprise adoption.

Hedera’s been making noise recently. The community is now pushing by way of greater than 10,000 transactions each single second. On paper, that’s large, however it’s not nearly bragging rights or a velocity document. What issues here’s what builders and establishments can truly do with that sort of throughput—particularly relating to tokenization.

Ben Sheppard, an entrepreneur who’s been knee-deep in AI and Web3 tasks, defined that velocity alone isn’t sufficient. Governance, auditability, and the flexibility for establishments to plug into present processes… that’s the place the true battle lies. Hedera is making an attempt to hit all these notes, and that’s why persons are paying consideration.

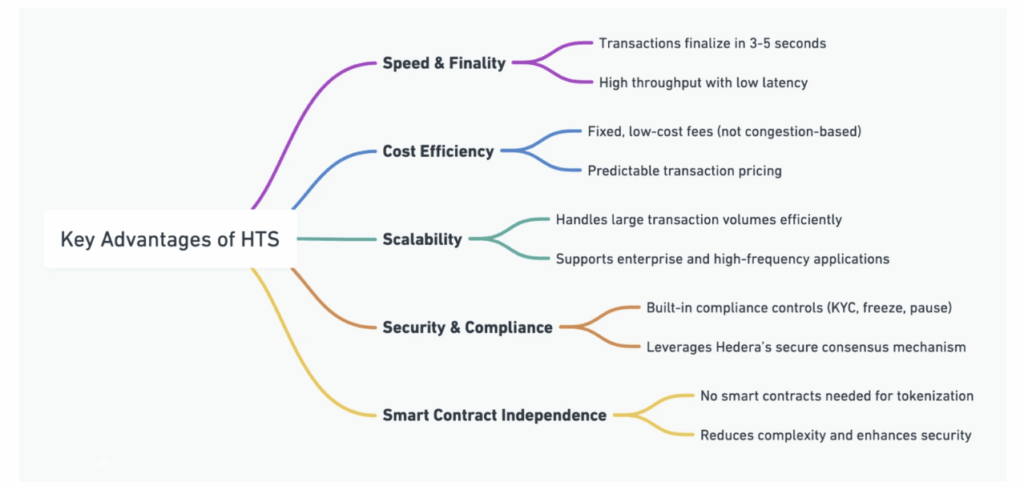

Hedera Token Service Defined

The Hedera Token Service (HTS) offers customers the flexibility to mint, transfer, and handle tokens proper on the community with out writing customized sensible contracts. That’s a giant deal as a result of it reduces prices, threat, and complexity. It helps each fungible tokens (like stablecoins) and NFTs, all with finality in simply 3–5 seconds. Charges? Virtually pocket change—usually a fraction of a cent.

Key takeaways from HTS:

- Tokens with out the overhead of Solidity or exterior contracts

- Predictable transaction prices beneath $0.01

- Scalability past 10,000 TPS, even beneath heavy load

- Compliance instruments baked in, like KYC, freezes, customized charges, and provide controls

For enterprises, meaning fewer complications and a system that appears much more like conventional finance infrastructure—simply quicker and cheaper.

Why Throughput Truly Modifications the Economics

Excessive throughput doesn’t simply sound cool, it modifications the maths. Sheppard identified that tokenizing massive asset portfolios on Ethereum was all the time bottlenecked by charges and velocity. Non-public chains helped, however they’re costly and clunky. Hedera’s mannequin lowers these boundaries. Out of the blue, tokenizing actual property portfolios or bond markets begins wanting much less like a whitepaper dream and extra like a working product.

Nonetheless, velocity by itself isn’t sufficient to win over Wall Road. Establishments need to know the principles, the guardrails, and who’s steering the ship. That’s the place governance and regulatory readability step in.

Belief, Governance, and the ETF Impact

Sheppard put it bluntly: “Tokenizing billion-dollar property isn’t nearly TPS—it’s about belief.” Establishments need governance fashions that make sense, audit trails regulators can settle for, and assurance that networks can slot into present techniques. Hedera’s council mannequin, which now contains teams like Arrow Electronics and Blockchain for Vitality, is designed to do exactly that.

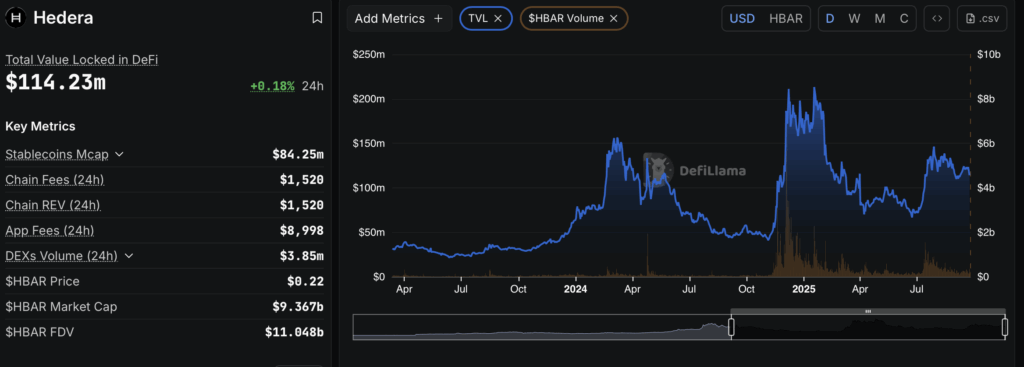

That belief narrative bought one other increase with the DTCC including Constancy and Canary Capital’s HBAR ETFs to its eligibility register. Add in hypothesis over a U.S. spot HBAR ETF, and all of the sudden Hedera seems much more like a severe institutional play than a fringe blockchain.

Regulation and Political Stability

Governments don’t like dropping management—plain and easy. Sheppard argued that whereas SMEs and startups could experiment with public blockchains, regulators want frameworks that hold their levers of oversight intact. Meaning disclosure requirements, AML protections, regulated custodians, and constant cross-border guidelines.

He went so far as saying regulators may solely totally embrace public blockchains as soon as they arrive wrapped in worldwide or multilateral backing—one thing like a UN stamp of approval. Till then, hybrid and permissioned setups could act as stepping stones.

Trying Forward: Setting the Requirements

The subsequent few years received’t be about one platform “successful.” As a substitute, Sheppard expects a convergence—networks, regulators, and establishments coming collectively to ascertain shared requirements. What sticks long-term are frameworks regulators can dwell with and establishments can belief.

Hedera, with its velocity, governance mannequin, and rising council, may assist form these requirements. However the larger story is whether or not tokenization evolves from small pilots into world, regulated monetary merchandise that may be traded simply as simply as shares or bonds right this moment.

Conclusion

Hedera has proven it might probably ship the uncooked efficiency—10,000 TPS and past. However the larger image is about marrying that scale with governance and regulatory confidence. Tokenization received’t scale simply because it’s quick. It’ll scale when enterprises, regulators, and establishments all see it as reliable. That’s the true race Hedera is operating.

Disclaimer: BlockNews offers unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.