Briefly

- Hyperliquid surges 9.26% to $44.11 as the one high 10 crypto in inexperienced whereas the remainder of the market tanks 1.8%.

- BNB drops 0.14% to $947.55, because the worst performer in high 10 after the Aster-driven spike fades.

- The Crypto Concern and Greed Index marks probably the most bearish studying since April. Here is what the charts say merchants can count on.

The crypto market is nursing a nasty hangover after a significant panic episode earlier this week, with the full market cap of crypto sliding 1.8% to $3.75 trillion because the notorious Crimson September curse threatens to assert one other sufferer.

But on this sea of purple, there’s at the least one token staying afloat: Hyperliquid’s HYPE is up a defiant 9.26% and standing as the one cryptocurrency within the high 11 exhibiting inexperienced on the day.

In the meantime, conventional markets are enjoying a distinct tune totally—the S&P 500 edged up 0.22% to six,619 factors whereas gold climbed 0.33% to $3,762 per ounce, exhibiting buyers nonetheless have urge for food for some threat property, simply not crypto threat—at the least not proper now. What’s extra, President Donald Trump introduced a bundle of tariffs set to take impact October 1, which has the potential to ship threat property scrambling for canopy.

The Crypto Concern and Greed Index has plunged to twenty-eight, firmly in “concern” territory and probably the most pessimistic studying since April, when Trump’s earlier tariff bulletins despatched markets right into a tailspin.

Even nonetheless, there’s an enchanting subplot unfolding within the perpetual futures DEX wars that is turning typical knowledge on its head.

Hyperliquid value: The HYPE is again?

Whereas its rival Aster has been stealing headlines with a jaw-dropping surge since its launch final week, Hyperliquid is quietly mounting its personal comeback.

Hyperliquid is each its layer-1 blockchain community and a decentralized trade that focuses on perpetual futures—derivatives contracts that by no means expire and permit crypto merchants to each hedge threat and primarily wager on the long run value of digital property, comparable to Bitcoin.

The trade is powered by a token of the identical identify, which trades as HYPE, and each the trade and the token have skilled a rush of curiosity over the past a number of months. For context, regardless of the latest ups and downs, HYPE is up greater than 20% within the final three months and up near 600% within the final yr, at the moment commanding a formidable $12.2 billion market cap.

The Hyperliquid token surged right now from a low of $40.376 to its present value of $44.114, representing a 9.26% acquire in a market the place the whole lot else is bleeding.

Trying on the technical breakdown, HYPE is displaying the type of conduct that merchants would interpret as doubtlessly the tip of a significant correction. The worth of the coin, in any case, is down near 10% within the final 30 days.

The Relative Power Index, or RSI, is one such technical indicator that merchants depend on. RSI measures value momentum on a scale from 0 to 100, the place readings above 70 sign overbought situations and beneath 30 suggesting oversold.

Hyperliquid sits at 41—technically bearish territory, however this is what merchants want to grasp: After a token corrects from $56 to $40, an RSI at 41 really alerts wholesome consolidation moderately than weak spot. This is sort of a reload zone the place good cash accumulates earlier than the subsequent leg up. Merchants sometimes see RSI readings between 30-45 after main corrections—discover the chart continues to be on an upwards trajectory—as shopping for alternatives moderately than promote alerts.

The Common Directional Index, or ADX, for HYPE is at 29, which reveals strengthening development momentum. ADX measures how robust a value development is no matter route—readings above 25 verify a longtime development, and at 29, we’re seeing HYPE get away of its consolidation part. The foremost dip cooled the ADX quite a bit, however nonetheless wasn’t sufficient to wipe out the upward development in place.

Exponential transferring averages, or EMAs, give merchants a way of value resistances and helps by taking the typical value of an asset over the quick, medium, and long run. Hyperliquid continues to be a younger coin, with out the buying and selling historical past of an asset like Bitcoin, however the EMA image seems bullish.

In the meanwhile, HYPE’s 50-day EMA is sitting above its 200-day EMA, that means the typical value over the quick time period continues to be larger than the typical value over the long run. This configuration sometimes alerts that short-term momentum is overpowering long-term pessimism, suggesting the trail of least resistance is larger.

However as a warning signal, the hole between each EMAs is closing, which might doubtlessly result in a dying cross formation (when the EMA50 strikes beneath the EMA200). On this situation, some merchants could decide to arrange purchase orders close to the EMA200 for these considering the token could proceed its bearish correction earlier than bouncing.

On Myriad, a prediction market developed by Decrypt‘s guardian firm Dastan, sentiment on HYPE hasn’t but reached the bullishness exhibited within the charts. In the meanwhile, Myriad merchants do not count on the worth of HYPE to rise to $69 any time quickly, putting these odds at simply 30% when measured in opposition to the percentages of it dropping beneath the $40 mark.

Key Ranges:

- Speedy help: $36.00 (EMA200)

- Sturdy help: $28.00 (seen on the chart as earlier resistance)

- Speedy resistance: $48.00 (EMA50)

- Sturdy resistance: $$56.00 (earlier excessive zone)

BNB value: Paying the worth for Aster’s success

The story of BNB right now is a basic “promote the information” situation, because the Binance-issued token drops 4.23% to $947.55 within the final 24 hours, making it the worst performer among the many high 10 cryptocurrencies by market cap.

As mentioned earlier this week on Decrypt, BNB had been on hearth recently, and was on Tuesday the one coin within the high 10 by market cap within the inexperienced. A lot of the worth motion could possibly be attributed to a rise in exercise on the BNB community because of the explosive progress of Aster, a Hyperliquid competitor on the BNB Chain.

However, as we’ve seen so many instances in markets: what goes up, should ultimately come down. And for the time being, the, er, hype round Aster has slowed. And BNB now seems to be taking a success in consequence.

BNB’s RSI is at 51, which sits proper at impartial and sometimes signifies a market in equilibrium ready for the subsequent catalyst. For merchants, this dead-center studying usually precedes sharp strikes in both route because the market breaks out of indecision.

The ADX at 36 confirms a robust established development, however the Squeeze Momentum Indicator reveals a bearish impulse in underway.

When ADX is excessive however momentum is bearish, it sometimes means sellers are in management and dip patrons needs to be cautious. This mix usually ends in continued stress till ADX drops beneath 25, signaling development exhaustion.

Trying on the value motion on the chart, BNB opened the day round $946, reached a excessive close to $959, however has since retreated to $947.55. At present’s doji (a candlestick with no physique, principally exhibiting that the opening and shutting costs are nearly the identical)reveals vital volatility and promoting stress at spherical quantity resistance. The 50-day EMA sits nicely above the 200-day EMA, sustaining a bullish longer-term construction, however the rapid value motion beneath each the opening value and the psychological $960 stage suggests near-term weak spot.

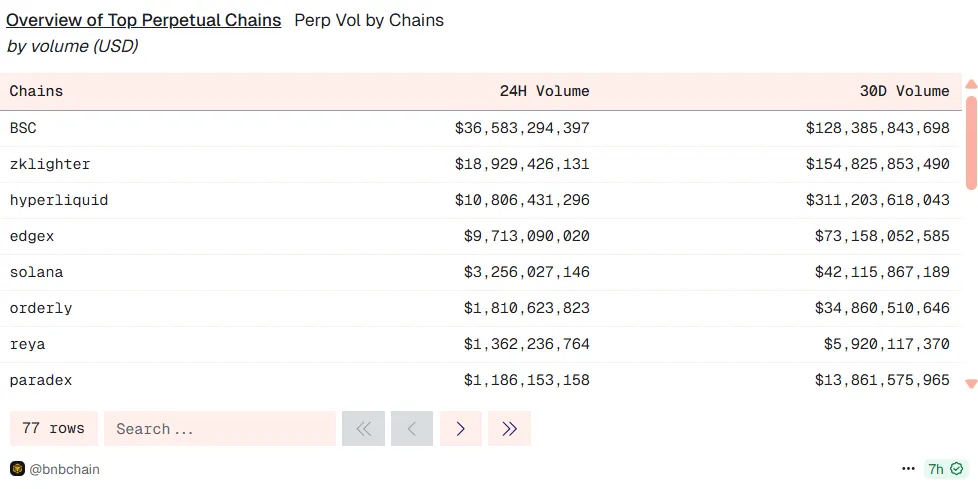

The catalyst for BNB’s preliminary surge was clear: BNB Chain’s 24-hour perpetual quantity stands at $36 billion, overtaking Hyperliquid’s $10.8 billion, pushed primarily by the meteoric rise of Aster. Nonetheless, right now’s correction suggests merchants are taking earnings on the Aster-driven rally.

Key Ranges:

- Speedy help: $920 (seen help on chart)

- Sturdy help: $880-$900 (EMA50l)

- Speedy resistance: $1,000-$1,080 (psychological spherical quantity and all-time excessive)

Disclaimer

The views and opinions expressed by the writer are for informational functions solely and don’t represent monetary, funding, or different recommendation.

Each day Debrief Publication

Begin every single day with the highest information tales proper now, plus unique options, a podcast, movies and extra.