- Solana grabbed over 60% of tokenized inventory volumes, surpassing Ethereum with $807M out of $1.3B whole.

- Sturdy consumer exercise (2.5M each day energetic addresses) and decrease transaction prices pushed Solana forward.

- Regardless of community energy, SOL worth faces short-term bearish stress close to $192 however might rebound quickly.

Solana simply pulled off one thing huge. For years Ethereum was the highest canine in tokenized property, however now Solana has flipped it on its head. Buying and selling volumes in tokenized shares on Solana shot previous $800 million, giving it greater than 60% of the overall market share. For a blockchain that was as soon as seen as an “Ethereum various,” that’s a fairly loud assertion.

The general tokenized inventory quantity hit practically $1.3 billion, however Solana’s share was huge in comparison with everybody else. Gnosis got here in second at round $307 million, whereas Ethereum trailed behind with simply $127 million. Avalanche, Polygon, and Arbitrum? Barely even a blip in comparison with these numbers. This marks an actual shift in management, one which Ethereum in all probability didn’t count on to surrender so quickly.

Why Solana is Pulling Forward

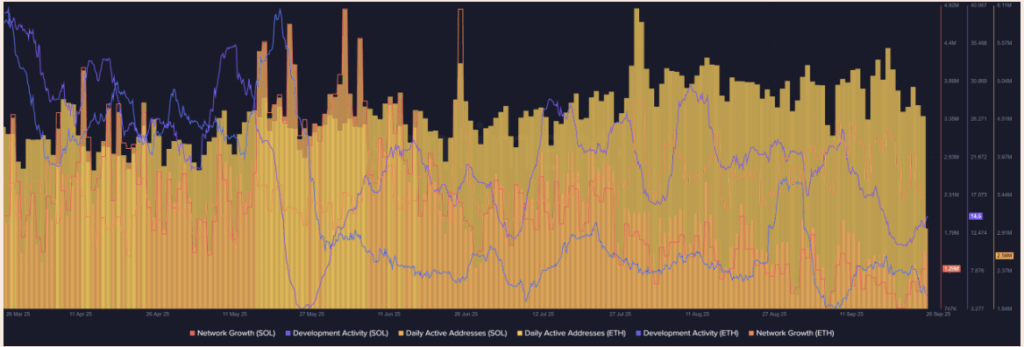

So what’s really driving this? A fast have a look at the on-chain knowledge makes it clear. By late September, Solana had over 2.5 million each day energetic addresses, whereas Ethereum managed solely about 747,000. That’s an enormous hole in consumer exercise. On high of that, Solana added roughly 1.3 million new wallets lately, far outpacing Ethereum’s slower progress.

And let’s be actual—quicker and cheaper transactions are an enormous issue. Solana is just simpler for high-volume buying and selling like tokenized shares. Whereas Ethereum continues to construct and innovate, Solana’s precise consumer engagement is what’s carrying it ahead proper now.

Brief-Time period Worth Strain on SOL

Even with these wins, Solana’s worth isn’t reflecting pure energy in the mean time. SOL slipped all the way down to round $192, falling beneath the mid-Bollinger Band and sitting near assist at $193. The RSI dropped close to 35, exhibiting oversold circumstances after merchants rushed to lock in earnings.

That doesn’t imply it’s all doom and gloom although. Oversold circumstances typically result in a rebound, and Solana’s fundamentals—particularly after dominating tokenized shares—look stronger than ever. If consumers step in round these ranges, we might see a bounce again towards larger ranges quickly.

Ultimate Take

Solana overtaking Ethereum in tokenized shares isn’t only a headline—it indicators an actual change in the place exercise is flowing. With quicker speeds, decrease prices, and an exploding consumer base, Solana has proven it could possibly lead in terms of adoption-heavy markets. Costs could be beneath short-term stress, however the larger image seems to be like Solana has a robust grip on this new narrative.

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.