A serious Ethereum holder that had been quiet for years out of the blue moved roughly 200,000 ETH Friday, price about $800 million at present costs.

Based mostly on experiences from on-chain trackers, the investor controls a complete of 736,316 ETH unfold throughout eight wallets — holdings that are actually valued practically $3 billion.

Associated Studying

The exercise caught consideration as a result of a number of of these addresses had been inactive for years, making this one of many extra notable returns by an early-era holder.

Whale Strikes Into Staking

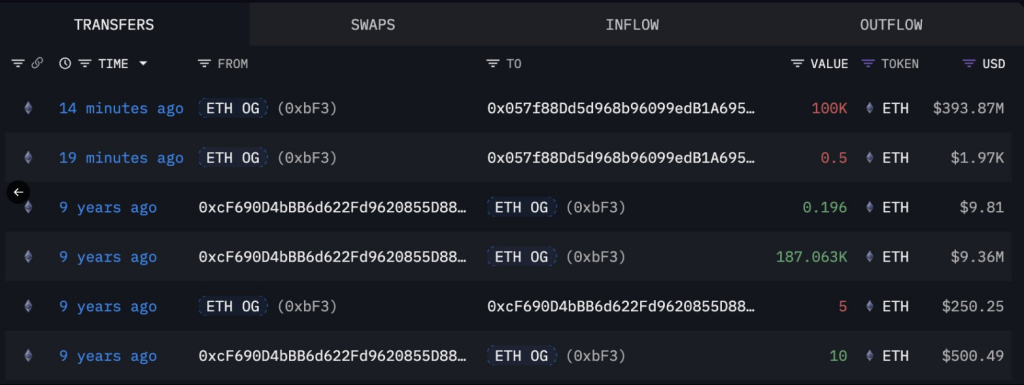

In keeping with blockchain observers, the transferred cash weren’t despatched to buying and selling venues. As a substitute, the funds had been directed into new addresses tied to staking companies, together with Ethereum’s Plasma infrastructure, the place property can earn yield whereas remaining locked.

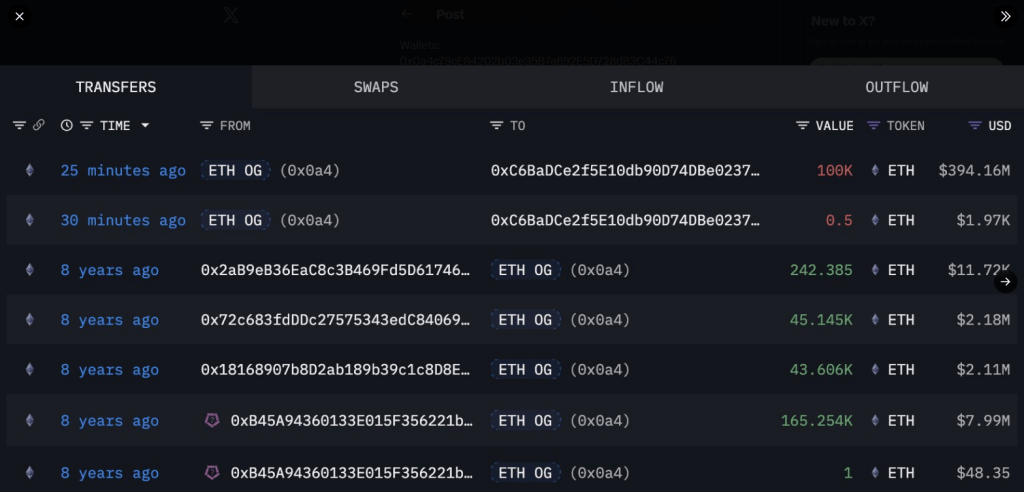

Two wallets which were dormant for over 8 years simply wakened and moved 200K $ETH($785M) to 2 new addresses.

This Ethereum OG initially sourced their $ETH primarily from #Bitfinex, at present holds a complete of 736,316 $ETH($2.89B) throughout 8 wallets.

Wallets:… pic.twitter.com/wVFzXZcL0o

— Lookonchain (@lookonchain) September 26, 2025

Emmett Gallic, an analyst who flagged the motion, described the motion as “bullish.” The selection to stake moderately than promote has been famous by market watchers as a doable sign of long-term confidence in Ethereum’s prospects.

On-Chain Information Level To Early Holders

Studies have disclosed that a lot of the ETH got here from Bitfinex and mining swimming pools energetic round 2017. A few of the wallets had final moved funds about 4 years in the past; others had been dormant for over eight years.

On the time these cash had been final energetic, their mixed price was about $30 million. That determine contrasts sharply with right this moment’s worth, which approaches $3 billion, highlighting how a lot the asset has modified palms in worth even for many who stayed put.

Worth Stress And ETF Outflows

Ethereum’s worth was underneath stress when the whale reappeared. Based mostly on market information, ETH dipped to $3,829 right this moment, a low not seen since August.

Studies present institutional automobiles have been promoting just lately: ETFs recorded roughly $547 million in outflows over 4 consecutive days earlier this week.

On Thursday, all ETFs logged internet outflows besides BlackRock, which posted neither inflows nor outflows that day. That mentioned, BlackRock had bought near $27 million price of ETH the day before today. These strikes seem to have helped push the worth decrease forward of the whale’s motion.

Associated Studying

Market Response And What It Might Imply

Analysts have identified that a big switch like this might usually stoke fears of a liquidation. On this case, the absence of alternate deposits appeared to calm some merchants.

Staking shifts cash off liquid markets and may scale back instant promote strain. Nonetheless, the broader sell-off from ETF merchandise has been sizable and will maintain appearing as a drag on worth till flows stabilize.

Featured picture from Unsplash, chart from TradingView