- Solana ETFs might be accredited inside weeks, doubtlessly flipping bearish worth motion right into a rally.

- Key ranges: $220 resistance, $178–$186 help; holding above might push SOL again towards $260+.

- Lengthy-term fashions see Solana reaching $768–$1,083 if crypto adoption accelerates in 2025.

Solana’s retreat to the $200 zone has many merchants debating whether or not it’s only a bear lure earlier than one other leg up. Analysts are pointing to U.S. regulatory modifications that might deliver Solana staking ETFs to market quicker than anticipated. ETF specialist Nate Geraci hinted that a number of filings—together with Franklin Templeton, Constancy, and Grayscale—could also be accredited “inside the subsequent two weeks.” That type of catalyst might flip short-term weak spot right into a bullish setup.

SEC Guidelines and Quick-Observe Solana ETF Filings

The SEC’s new itemizing requirements, accredited earlier this month, minimize the evaluate interval for ETF functions from almost 270 days right down to as little as 75. This opens the door for quicker approvals of digital asset ETFs past simply Bitcoin and Ethereum. Reuters famous that Solana and XRP are front-runners to learn, with launches attainable in October. In the meantime, the REX-Osprey SOL + Staking ETF (SSK), which debuted in July, pulled in $33 million in buying and selling quantity on day one—proof there’s demand for Solana merchandise.

Solana Worth Prediction After the $200 Pullback

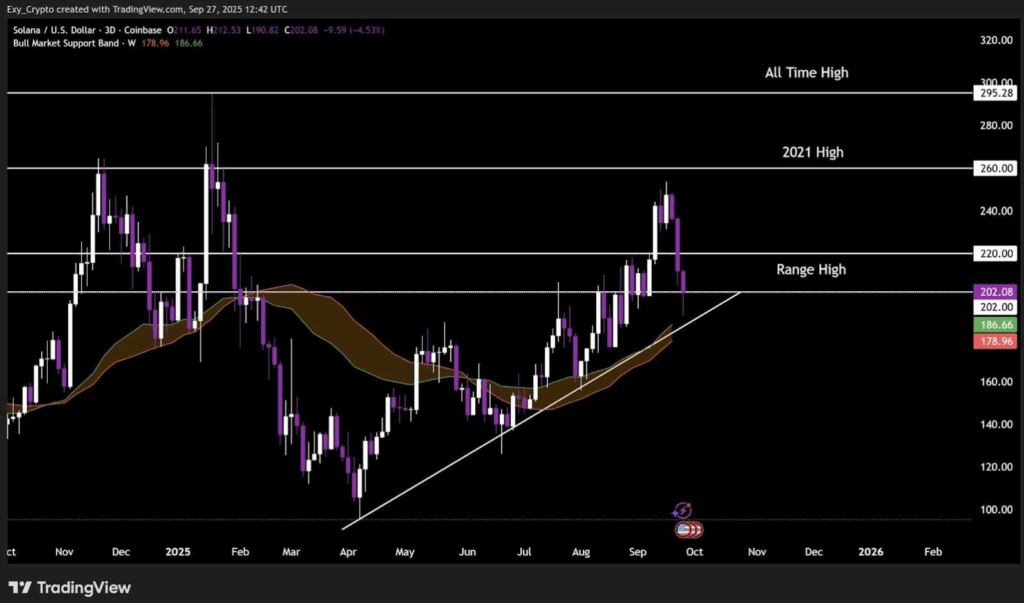

SOL traded round $202 on Saturday, down -2% day by day and -10% weekly, in accordance with Coingecko. Technical charts present a rising wedge, often a bearish sign, however ETF approval hypothesis might flip it bullish. Key ranges to observe: $220 is now resistance, whereas the Bull Market Assist Band at $178–$186 gives a security web. Traditionally, holding above that band aligns with prolonged rallies. If momentum builds, resistance sits at $260 after which the all-time excessive close to $295.

Lengthy-Time period Solana Worth Targets in 2025

Token Metrics mapped out three situations for Solana if the crypto market cap expands to $8 trillion. Their bear case places SOL at $768 (+227%), the bottom case at $926 (+295%), and the moon state of affairs at $1,083 (+362%). At right now’s $219 degree, all three symbolize large upside potential. Market knowledge from CoinGlass additionally exhibits detrimental funding charges, usually an indication of overextended bearish sentiment and attainable native bottoms.

Market Outlook: Will Solana Spark an Altcoin Season?

Geraci urged that ETF approvals might set off greater than only a Solana rally—they could gas a broader altcoin season. Nonetheless, analysts warn that investor urge for food for non-Bitcoin and Ether ETFs remains to be largely untested. For now, markets are watching October carefully, as SEC choices might reshape the panorama for altcoin investments heading into Uptober.

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.