Litecoin (LTC) has seen its market capitalization develop by 15% prior to now week, including $1 billion as its value reached a two-year excessive of $119.64.

This surge has led long-term holders (LTH) to promote their cash to safe income. Nonetheless, the LTC value rally exhibits indicators of constant momentum.

Litecoin Lengthy-Time period Holders Ebook Features

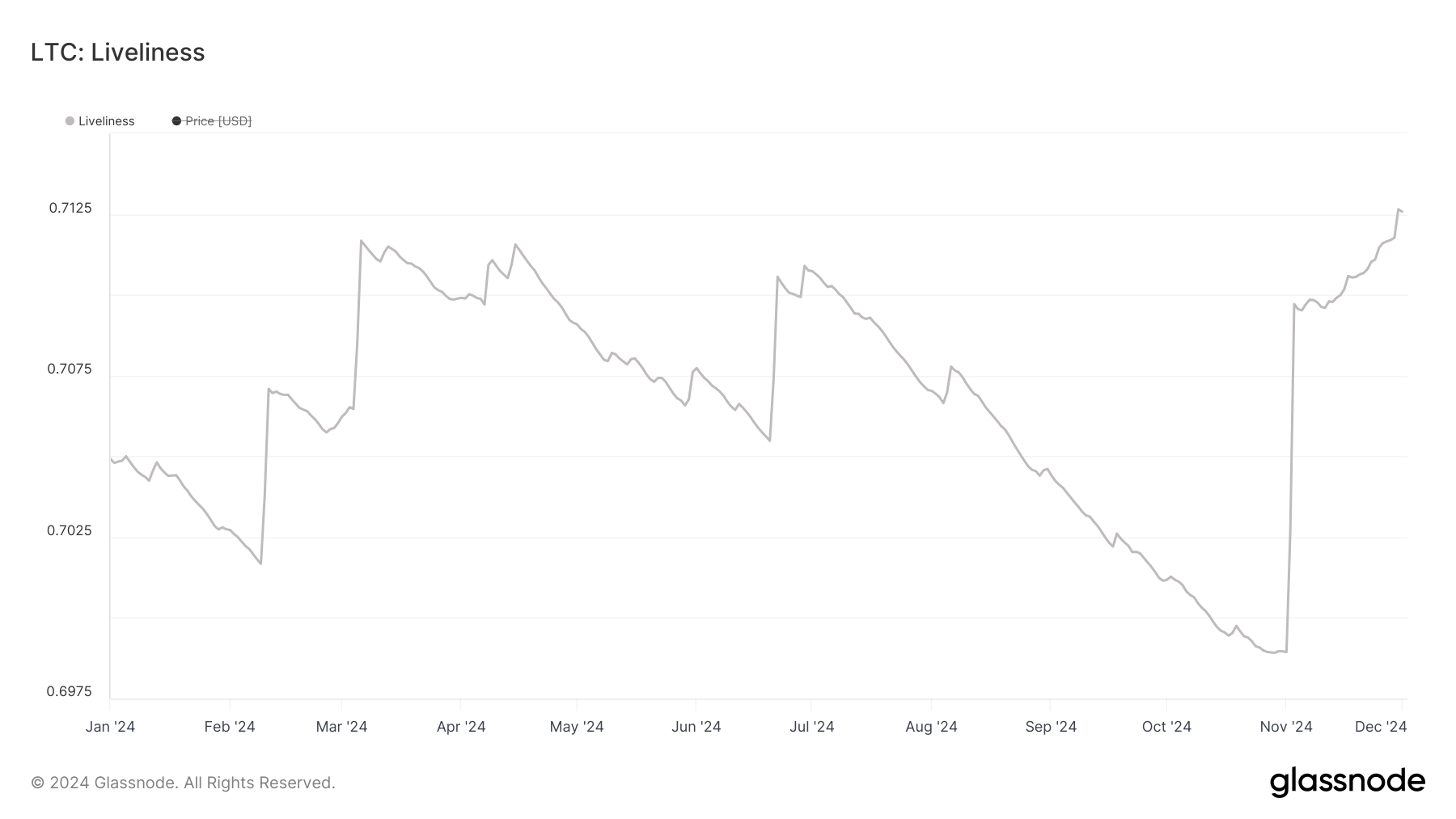

BeInCrypto’s on-chain evaluation of LTC’s Liveliness metric has revealed a surge within the variety of not too long ago moved or spent cash. Per Glassnode, this presently sits at a year-to-date excessive of 0.71. For context, as of November 1, LTC’s Liveliness had plummeted to a year-to-date low of 0.69.

An asset’s Liveliness supplies insights into the spending habits of its LTHs. It measures the proportion of cash which were not too long ago moved or spent. When it spikes, it signifies that many long-term holders are liquidating their positions.

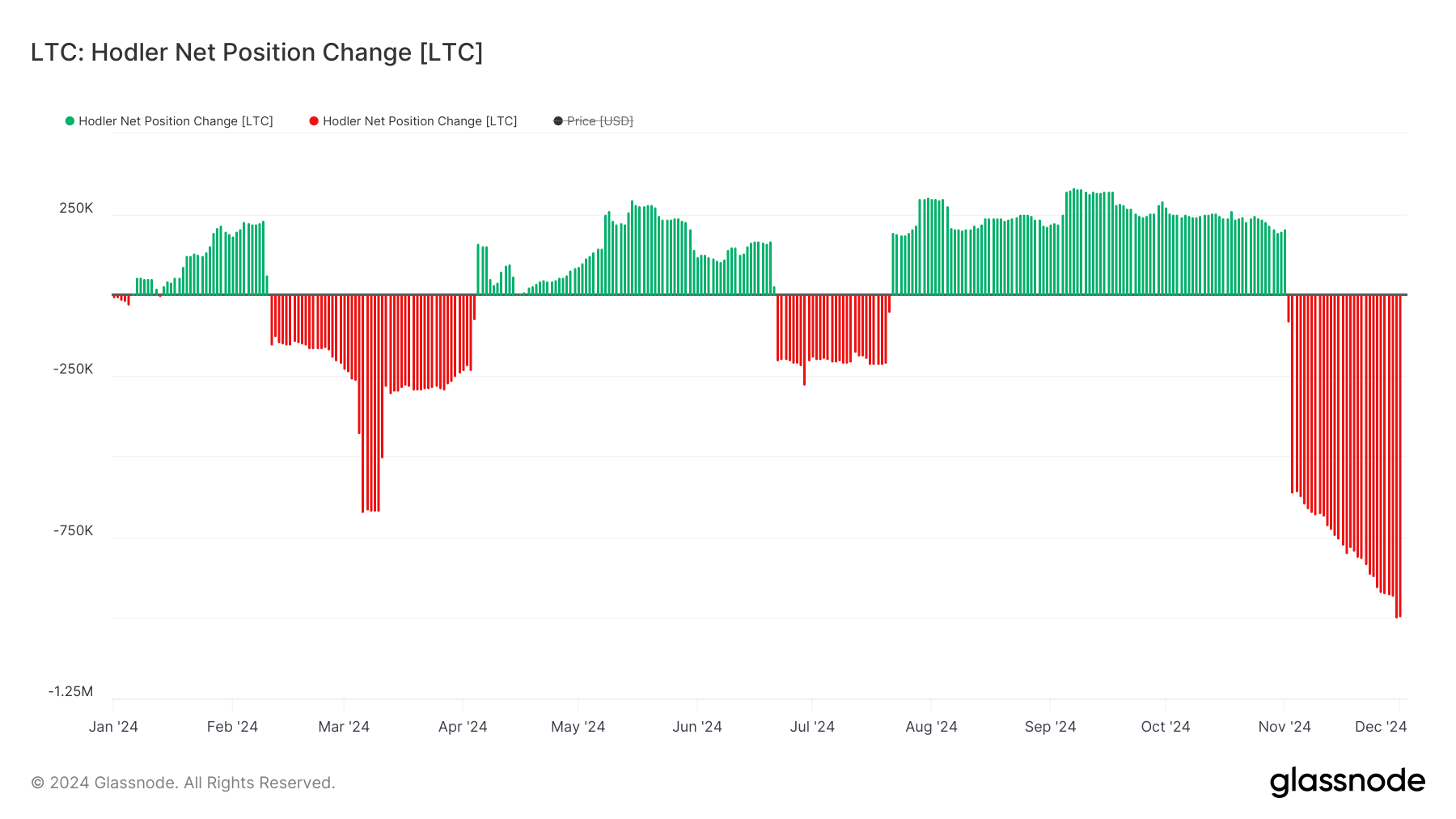

Notably, the adverse readings from LTC’s Hodler Internet Place Change affirm this distribution pattern amongst its LTHs. This metric, which additionally tracks the habits of LTHs, has returned solely adverse values since November 2. Actually, on December 1, it closed at a year-to-date low of -993,199.

When the Hodler Internet Place Change is adverse, long-term holders (HODLers) are promoting extra of their holdings than they’re accumulating, indicating profit-taking.

LTC Value Prediction: The Bulls Stay in Management

Regardless of the promoting exercise by the coin’s LTHs, the bullish bias towards the LTC stays important. At press time, LTC trades above its Ichimoku Cloud, confirming the optimistic momentum out there.

This indicator tracks the momentum of an asset’s market traits and identifies potential assist/resistance ranges. When an asset’s value rests above the Ichimoku Cloud, it signifies a bullish pattern, indicating that the asset is in an upward momentum with the potential for additional positive factors.

If this holds true, the LTC value rally could proceed towards $143.41, a degree it final traded at in January 2022. Conversely, LTC’s value could drop to $107.58 if this bullish momentum wanes.

Disclaimer

In step with the Belief Venture pointers, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. At all times conduct your individual analysis and seek the advice of with an expert earlier than making any monetary choices. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.