Each October, the crypto group repeats the identical slogan: “Uptober.” For Bitcoin, at the very least, it typically finds help within the charts. For XRP, nonetheless, the story is much extra difficult. Inspecting greater than a decade of value historical past, the numbers do not justify optimism.

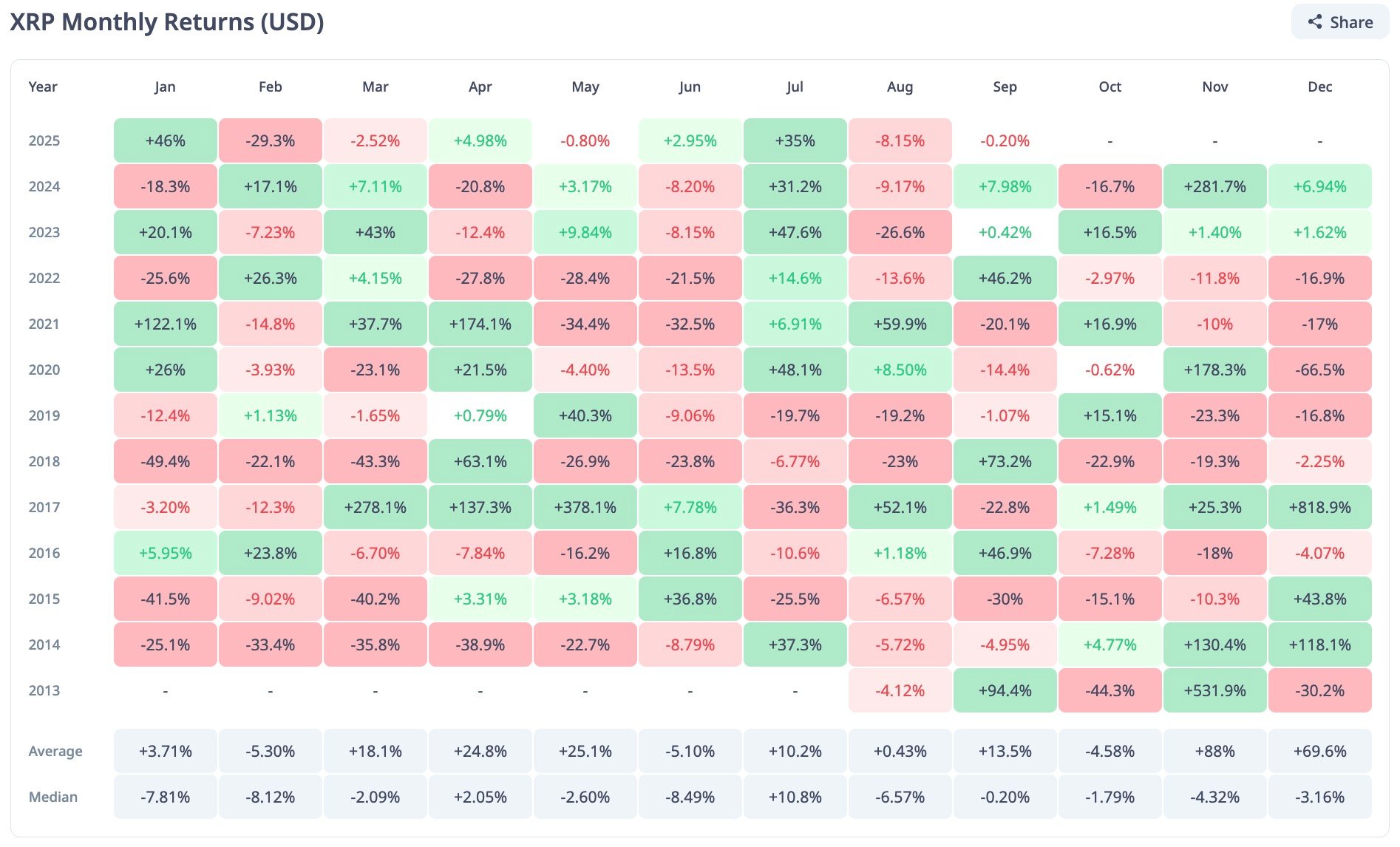

Month-to-month information reveals that October has produced a few of XRP’s most dramatic value fluctuations. In 2013, for instance, the token soared by greater than 94%. In 2014, it jumped by 130%. In 2015, there was a milder 4.7% acquire, and in 2017, there was solely a 1.49% enhance, as per CryptoRank.

However, years like 2018 and 2021 delivered double-digit losses. Essentially the most explosive October was in 2020, when XRP spiked by virtually 179% in simply 4 weeks. Nonetheless, these remoted occasions create a distorted image.

Strip away the extremes, and the median October return is a lack of 1.79%. The typical is even worse: -4.58%. This implies that historical past reveals October is extra more likely to disappoint XRP holders than reward them, regardless of the occasional blockbuster 12 months that fuels the “Uptober” fable.

Quarterly information reinforces this warning

Whereas This autumn has traditionally been the strongest interval for XRP, with a median acquire of practically 88%, the median reveals a lack of 4.32%. This once more highlights that the outcomes are closely distorted by just a few extraordinary runs slightly than constant seasonal power.

The sample is evident — “Uptober” shouldn’t be a dependable buying and selling technique for XRP. Previous years show that, whereas outsized rallies are doable, the everyday consequence is modest or unfavourable.

Buyers anticipating inexperienced candles each October are counting on folklore, not likelihood. Whereas historical past would not get rid of the potential for one other upside shock, it does emphasize the danger of treating a single month as a assure.