Welcome to Commerce Secrets and techniques — Bitcoin and Ether worth predictions from high analysts, together with choices knowledge, sentiment evaluation and prediction markets to find out what they’ll inform us concerning the months and years forward.

Bitcoin may end 2025 above $173K, says historical past

There’s a good probability that Bitcoin will finish the yr above $173,000, in line with economist Timothy Peterson, citing BTC’s closing worth on Sunday and historic knowledge since 2017.

“September 21 marks the date — after which — Bitcoin finishes the yr greater 70% of the time,” economist Peterson stated on X. “The median achieve is over 50%,” he added.

With Bitcoin’s worth reaching an intraday excessive of $115,879 on Sunday, a 50% improve from there would place its worth round $173,000. (Let’s ignore the value tanking on Monday for the sake of simplicity.)

Peterson defined that the sample didn’t maintain in three of eight years, together with 2018 and 2022, which had been already “well-established bear markets.”

“So the percentages are in all probability nearer to 90%,” he stated. The value nearly aligns with VanEck’s head of digital asset analysis, Matthew Sigel, who predicted Bitcoin would attain $180,000 by year-end.

Nevertheless, it falls wanting the extra optimistic forecasts from BitMEX co-founder Arthur Hayes and Unchained’s director of market analysis, Joe Burnett, who each projected $250,000.

What’s going to occur after Bitcoin peaks continues to be extensively debated inside the trade.

Journal checked in with Into The Cryptoverse founder Benjamin Cowen concerning his prediction final week that Bitcoin may finally drop as much as 70% from this cycle’s all-time excessive. He stands by it. “In all probability someplace between a 66% to 74% drop within the bear market,” Cowen tells Journal.

“However that may be a 70% drop from regardless of the all-time excessive is, not essentially from the present excessive,” he reiterates.

ETH resistance breakthrough may open door to $5K: Exec

Ether has dropped almost 8% over the previous 30 days, however Tesseract CEO James Harris stays assured that the asset’s skill to remain above $4,000 may maintain momentum and probably set off one other rally.

“The subsequent resistance sits round $4,650-$4,700; a break there may shortly open the way in which towards $5,000,” tells Journal. Ether trades round $4,207 on the time of publication.

Nevertheless, Harris says that Ether could expertise volatility within the brief time period. “Price cuts are typically liquidity-positive and supportive for danger property, however they’ll additionally sign weaker development and weigh on valuations, significantly when costs are already elevated,” he says.

“Price cuts are a double-edged sword — they enhance liquidity, however additionally they sign softer development. Add to that ETH’s sharp rally already from the sub $1,400 low, and profit-taking or pullbacks are pure dangers.”

Harris has a $6,500 year-end goal.

In the meantime, Fundstrat co-founder and BitMine chairman Tom Lee not too long ago stated that financial liquidity sensitivity, international central banks’ easing and powerful seasonality will drive the costs of Ether and Bitcoin.

“I feel they may make a monster transfer within the subsequent three months … enormous,” Lee stated.

Oct. 1 marks the beginning of This fall, which has traditionally delivered a median return of 23.85% for ETH, the second-worst-performing quarter of the yr, in line with CoinGlass. A 23.85% improve from Ether’s present worth would carry it to roughly $5,370.

XRP merchants anticipating ‘fast pump’ from ETF will likely be disenchanted: Analyst

Merchants shouldn’t count on an on the spot worth surge in XRP as a response to the current launch of the XRP exchange-traded fund (ETF) in america, in line with a crypto analyst.

“Buyers anticipating an instantaneous XRP pump may find yourself disenchanted,” Swyftx lead analyst Pav Hundal tells Journal.

On Sept. 18, the REX-Osprey XRP ETF (XRPR), which tracks XRP, launched and noticed $37.7 million in quantity, in line with knowledge from Bloomberg ETF analyst Eric Balchunas and Cboe.

Hundal says the reported volumes into XRPR are “respectable,” however merchants ought to keep cautious. “Sturdy ETF flows didn’t cease sharp sell-offs in Bitcoin and Ethereum after their spot funds had been permitted,” he says.

Learn additionally

Options

The actual dangers to Ethena’s stablecoin mannequin (are usually not those you assume)

Options

Can Crypto be Sweden’s Savior?

Nevertheless, Hundal is optimistic that REX and Osprey’s ETF launch is only the start. “I don’t assume there’s any cause to consider any of the XRP functions received’t get by means of after REX-Osprey approval,” he explains.

“They each registered double-digit drawdowns. If historical past is any information, the brand new ETFs for altcoins like XRP may set off an identical bout of profit-taking earlier than markets stabilise,” he provides.

Some analysts are tremendous bullish on the asset heading into the tip of the yr. Crypto analyst Egrag Crypto not too long ago stated, “Based mostly on the fractal formation evaluation, it means that by mid-November, XRP could possibly be round $6 to $7.”

SOL has a good probability of surging 36% in October: Crypto researcher

Solana could attain new all-time highs by the tip of October, says Derive head of analysis Dr. Sean Dawson.

“SOL has a ~30% probability to hit $300 by the tip of October and a ten% probability to surge previous $350,” Dawson tells Journal, citing Derive’s choices knowledge.

With Solana presently buying and selling at $220, a transfer to $300 would characterize a rise of 36%, in line with CoinMarketCap. It will additionally simply high its all-time excessive of $294, which it reached in January.

Dawson factors to the current adoption of Solana from digital asset treasuries as a possible for “important upward worth motion for SOL.”

Ahead Industries (FORD), initially a medical and expertise design agency, not too long ago raised $1.65 billion in non-public funding and used the proceeds to accumulate SOL for its reserves. In the meantime, Nasdaq-listed Brera Holdings rebranded as Solmate after elevating $300 million in an oversubscribed non-public funding in public fairness to launch a Solana-focused digital asset treasury and infrastructure firm.

Bitcoiners could wish to ‘pump the brakes’ on an on the spot rally: Santiment

Bitcoin merchants shouldn’t assume the asset will shortly return to all-time excessive ranges, in line with sentiment platform Santiment.

“Retail sees a straight path towards $120K+ once more. However we could wish to pump the brakes on a continued rally, at the least immediately,” Santiment stated in a current report.

Learn additionally

Options

Crypto is altering how humanitarian companies ship assist and companies

Options

Capitalism’s Perestroika Second: Bitcoin Rises as Financial Centralization Falls

The platform stated that the worth of common energetic wallets has risen about 3.5% over the previous 30 days, whereas yearly development is round 16.1%. “Each of those sign a gentle quantity of danger in shopping for or including on to your place right now,” Santiment stated.

Santiment added that Ethereum is “seeing a barely higher alternative in leaping in for a short-term rally” as merchants over the previous 30 days are up simply 1% on common.

Nevertheless, Ether’s mid-year rally has pushed the 1-year MVRV to 37.4%, suggesting that “Bitcoin is mathematically a a lot safer guess should you plan on hodling the remainder of 2025.”

The Crypto Concern & Greed Index, which tracks total market sentiment, slipped again to “Concern” on Monday with a rating of 45, following per week of “Impartial” readings. This alerts crypto market members are uncertain of the place the market is heading subsequent.

Nevertheless, the CoinMarketCap Altcoin Season Index tells a distinct story.

The Index, which alternates between “Altcoin Season” and “Bitcoin Season” relying on how the highest 100 altcoins have carried out relative to Bitcoin over the previous 90 days, recorded a rating of 67 out of 100, indicating the market is in risk-on mode.

TradingView knowledge reveals that capital isn’t flowing closely out of Bitcoin, with Bitcoin Dominance down simply 0.05% over the previous month, presently at 58.33%.

What the derivatives markets are saying about Bitcoin and Ether

Onchain choices protocol Derive founder Nick Forster tells Journal that futures merchants are speculating on greater costs for main crypto property as the tip of the yr approaches.

Future merchants are pricing in a 42% probability of Bitcoin reaching above $120,000 by the tip of October, and a 35% probability of reaching over $135,000 by Dec. 31.

Forster factors out that there’s a “giant cluster of calls” across the $145,000 to $170,000 worth stage for Bitcoin by the tip of October, signaling a wholesome quantity of merchants positioning for “main upside.”

As for Ether, future merchants are pricing in a 30% probability that Ether reaches above $5,000 by the tip of October, and a 15% probability Ether hits above $7,000 by the tip of December.

Forster warns merchants to “count on volatility to rise and the battle for DeFi liquidity to escalate.”

What prediction markets say about Bitcoin and Ether

Prediction markets have grown more and more bullish over the previous 30 days, with This fall — Bitcoin’s traditionally strongest quarter — now simply days away.

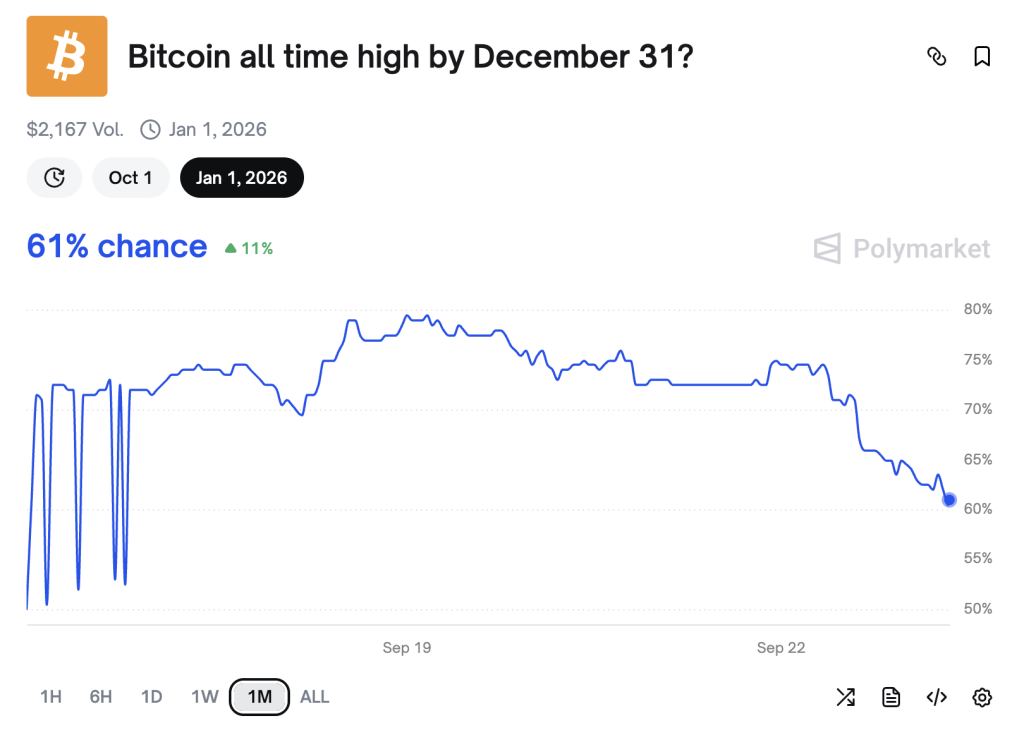

With the tip of the month only a week, the percentages of Bitcoin breaking its August all-time highs of $124,100 by the tip of September are simply 3%, in line with crypto prediction platform polymarket.

However by Dec. 31, the possibility jumps to 61%, up 11% over the previous 30 days.

In the meantime, the percentages of different main cryptocurrencies reaching highs earlier than the tip of the yr have additionally surged over the previous month.

Solana has a 53% probability of surpassing its earlier peak of $293 by the tip of 2025, up 11% from its odds final month as its worth spiked 8.5% over the identical interval.

Ethereum has 61% odds of breaking its $4,878 all-time excessive by the tip of this yr, up 5% from its odds final month, regardless of its worth declining 12% over the identical interval.

Subscribe

Probably the most participating reads in blockchain. Delivered as soon as a

week.

Ciaran Lyons

Ciaran Lyons is an Australian crypto journalist. He is additionally a standup comic and has been a radio and TV presenter on Triple J, SBS and The Undertaking.