Be part of Our Telegram channel to remain updated on breaking information protection

Swift is growing a blockchain-based ledger to allow real-time, 24/7 cross-border funds, with Ethereum ecosystem developer Consensys constructing the preliminary prototype.

The answer is a part of an effort to allow cross-border funds at “unprecedented scale,” the Society for Worldwide Interbank Monetary Telecommunication, or Swift, mentioned in press launch.

”We’re paving the way in which for monetary establishments to take the funds expertise to the subsequent stage with Swift’s confirmed and trusted platform on the centre of the trade’s digital transformation,” mentioned CEO Javier Pérez-Tasso.

The system could have ”parallel tracks of innovation to improve the expertise over current ‘fiat’ rails, in addition to to prepared the trade for digital finance,” he mentioned.

The corporate expects the ledger, a safe, real-time log of transactions between monetary establishments, will file, sequence and validate transactions and implement guidelines via good contracts, the agency mentioned.

Consensys And Main Banks Collaborate With Swift

Consensys has been tasked with growing the conceptual prototype of the blockchain-powered settlement layer. The corporate is well-known for growing the favored Web3 pockets MetaMask, in addition to a number of different merchandise throughout the Ethereum ecosystem.

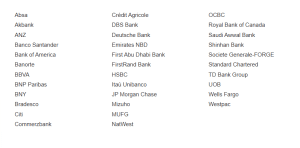

Together with Consensys, Monetary establishments from 16 nations are additionally offering Swift (which stands for Society for Worldwide Interbank Monetary Telecommunication) with suggestions on the design of the system, in response to the press launch.

They embody Financial institution of America, BNY, Deutsche Financial institution, JP Morgan Chase, Normal Chartered, and Wells Fargo.

Group of banks engaged on Swift resolution design (Supply: Businesswire)

Swift Has Monopolized TradFi, Seems To Increase Attain To Blockchain Area

Swift doesn’t truly transfer cash, however acts extra as a messaging layer between banks throughout the globe. That is meant to cut back errors and fraud threat.

With over 11,500 establishments from over 200 nations plugged into its interbank messaging system, exclusion the Swift system can successfully reduce a rustic or financial institution from the worldwide monetary system.

A report from the US Federal Reserve Financial institution of New York highlighted SWIF’s energy, and mentioned “sanctions that restrict entry to this community have develop into notably expensive for sanctioned entities.”

With its blockchain resolution, Swift now seeks to increase its affect to the distributed ledger ecosystem.

As a landmark second for the worldwide monetary system and blockchain trade alike, Swift introduced at Sibos 2025 it’s launching a brand new blockchain-based ledger: https://t.co/lHUHsjoxJE

We congratulate our accomplice Swift and the broader Swift neighborhood on adopting blockchains and… pic.twitter.com/GSqGSYrwGk

— Chainlink (@chainlink) September 29, 2025

The newest announcement of a blockchain-powered resolution follows a report from final week that Swift had began testing on-chain funds and messaging utilizing Ethereum’s layer-2 community Linea.

The report additionally mentioned that Swift was contemplating launching its personal stablecoin, however didn’t specify which community the product can be deployed on.

Swift has additionally not talked about which blockchain the brand new settlement layer can be constructed on. Nonetheless, the involvement of Consensys suggests it could be Ethereum.

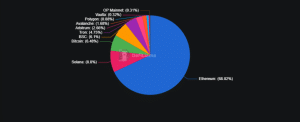

Ethereum is at the moment the main blockchain community by way of Whole Worth Locked (TVL) out there. Knowledge from DefiLlama reveals that $87.47 billion is locked on the Ethereum blockchain, which equates to round 68.02% of the worth throughout the completely different networks out there.

TVL throughout blockchains (Supply: DefiLlama)

Ethereum additionally has a 53.55% share of the stablecoin market, which has a capitalization of $294.856 billion.

Not Swift’s First Blockchain Transfer

Swift’s blockchain collaboration with Consensys is just not the corporate’s first transfer into distributed ledger know-how.

In March final 12 months, the corporate acknowledged the worth of tokenization and the blockchain mannequin. Nonetheless, Swift argued that these shared ledgers usually are not “well-suited to carrying and storing excessive volumes of information” due to the way in which knowledge is synchronized throughout nodes. For this reason it believes that it may possibly present a messaging layer for a blockchain-based monetary system.

Later that very same 12 months, in November, Swift additionally supplied its world monetary messaging community to combine tokenized fund processes with current fiat fee techniques. The initiative was carried out with the assistance of UBS Asset Administration and the blockchain oracle community Chainlink.

In late 2024, Swift additionally introduced that banks in North America, Europe, and Asia would begin digital asset trials on its community.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be part of Our Telegram channel to remain updated on breaking information protection