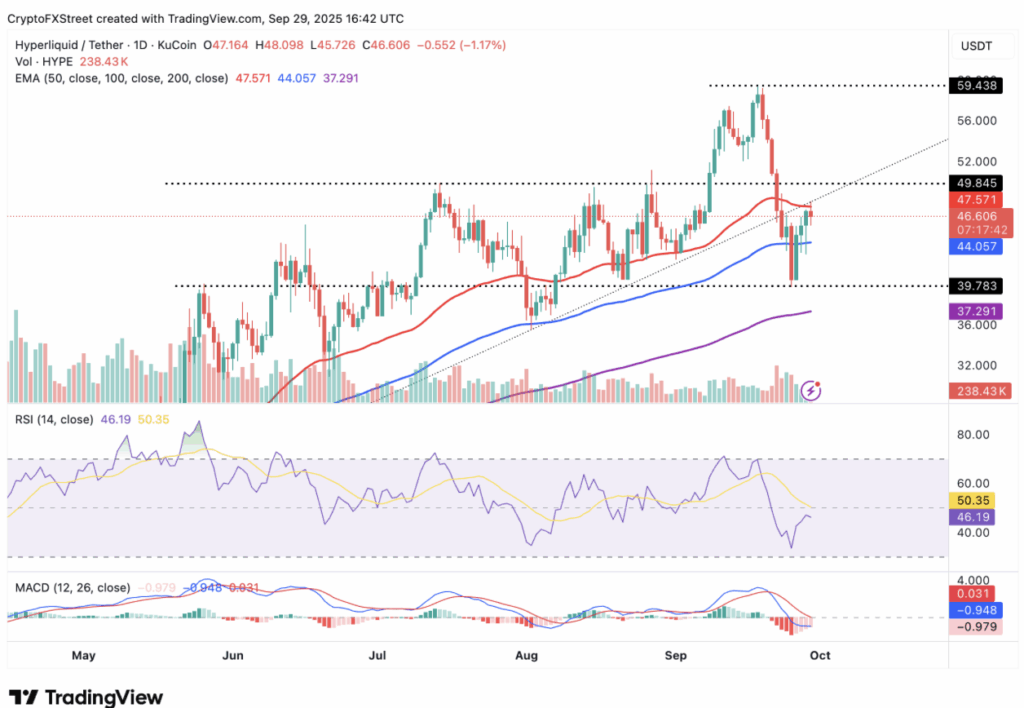

- HYPE worth trades above $46 after a 33% drop from September highs, with assist close to $39.78 holding agency.

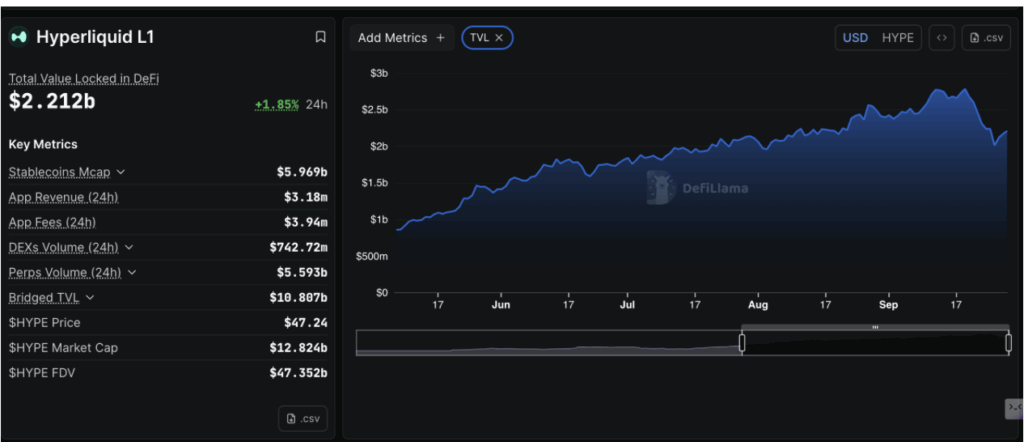

- Robust DeFi metrics: $2.21B TVL, $3.94M day by day charges, and $84B cumulative quantity again its market place.

- Key ranges: $47.57 resistance and $50 breakout goal; draw back dangers if $44 and $37 helps fail.

Hyperliquid (HYPE) has been driving out some wild swings these days. After hitting its all-time excessive close to $59.43 on September 18, the token slid almost 33% to check assist at $39.78 final Thursday. By Monday, HYPE was buying and selling again above $46, however the volatility has left merchants on edge—questioning if momentum can carry it greater or if one other leg down is brewing.

DeFi Metrics Present Underlying Energy

Regardless of the sharp correction, Hyperliquid’s fundamentals look removed from weak. Its DeFi Whole Worth Locked (TVL) sits at $2.21 billion, up nearly 2% in 24 hours. That’s nonetheless under the file $2.78 billion reached in mid-September, however effectively above final week’s dip to $2.01 billion. The rebound in TVL suggests capital is sticking round, even with broader crypto market turbulence.

Protocol information additionally paints a bullish backdrop. Day by day charges common $3.94 million, with revenues at $3.18 million—numbers that hold Hyperliquid on the prime of the decentralized perpetuals sport. Add in a staggering $84 billion in cumulative buying and selling quantity and the backing of its USDH stablecoin, and it’s clear the DEX isn’t shedding relevance any time quickly.

Futures Open Curiosity Indicators Market Confidence

Hyperliquid futures’ Open Curiosity (OI) has stabilized close to $2.3 billion, displaying that merchants are staying engaged. OI displays the notional worth of all futures contracts, and regular ranges recommend the market isn’t panicking. As a substitute, it’s leaning towards gradual stability, a setup that would enable worth to grind greater. So long as speculative curiosity holds, bulls could discover the situations ripe for an additional breakout.

Technical Outlook: Key Ranges to Watch

Technically, HYPE is caught between its 100-day Exponential Shifting Common (EMA) at $44.05 and resistance on the 50-day EMA close to $47.57. Breaking above $47.57 might arrange a push to retest the psychological $50 barrier, and from there, the ascending trendline could gas additional upside momentum. A confirmed purchase sign from the MACD would solely strengthen the bullish case.

On the flip aspect, shedding the 50-day EMA might carry extra promoting strain. A drop under the 100-day EMA at $44 would possibly open the door to deeper losses, with the 200-day EMA down at $37.29 appearing as the subsequent main assist. For now, merchants are watching carefully—Hyperliquid’s dominance within the perpetuals market and its regular buyback program might hold the bullish flame alive, however the charts depart little room for error.

Disclaimer: BlockNews offers unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.