- Bitmine Immersion added 234,850 ETH price $963M, increasing its whole Ethereum treasury to 2.65M ETH ($10.9B).

- BMNR inventory surged over 3% pre-market, now up almost 596% year-to-date, with every day volumes averaging $2.6B.

- Ethereum rebounded above $4,100, backed by an 80% quantity spike and rising futures open curiosity on CME and Binance.

Bitmine Immersion, the agency identified for holding the biggest Ethereum stash worldwide, simply added one other huge chunk to its treasury. Backed by Tom Lee of Fundstrat, the corporate scooped up 234,850 ETH price $963 million between September 22 and 28. That transfer pushed its whole Ethereum holdings to almost 2.65 million ETH, valued at over $10.9 billion at present costs.

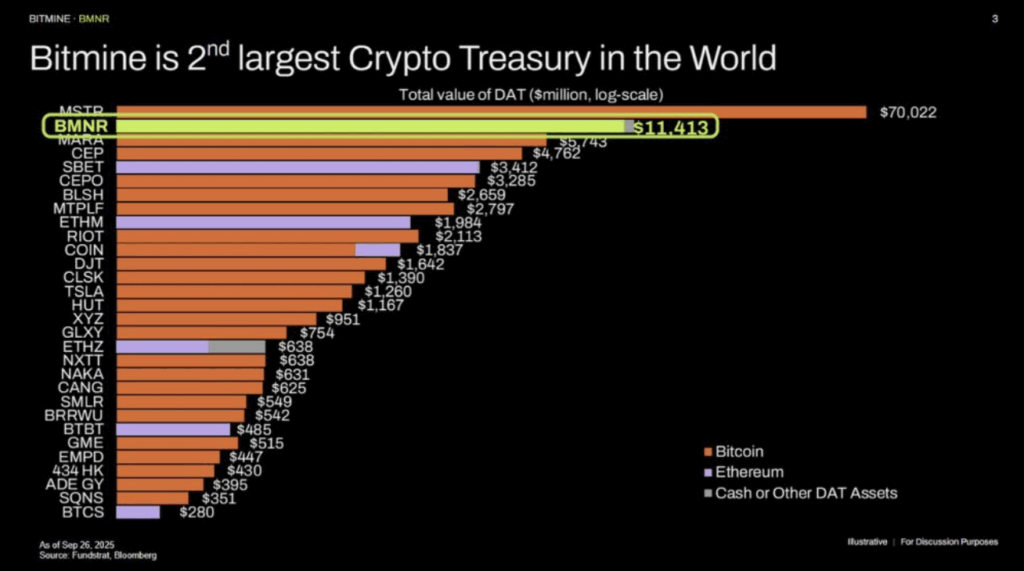

The corporate’s disclosure on September 29 additionally confirmed $436 million in money and 192 BTC on its stability sheet. This newest purchase cements Bitmine Immersion’s spot because the primary Ethereum treasury and second-largest general crypto treasury, proper behind Technique Inc. (MSTR). On high of that, Bitmine boosted its funding in Eightco Holdings to $157 million, additional diversifying its publicity.

Inventory Worth Surge After Ethereum Purchase

Information of the acquisition instantly sparked motion in Bitmine Immersion’s inventory (BMNR). Pre-market buying and selling on Monday noticed the value leap greater than 3% to $52.07. This adopted Friday’s shut at $50.50, which already marked a 1.88% every day acquire. Remarkably, BMNR inventory is up almost 596% year-to-date, making it one of many hottest tickers on Wall Road.

Merchants additionally reacted to the agency’s choice to promote 5.22 million shares at $70 per share and 10.4 million warrants with a strike value of $87.50—properly above the present market value. In response to Fundstrat, BMNR has now turn out to be one of the vital traded shares within the US, clocking in a mean every day quantity of $2.6 billion. Tom Lee, who chairs the corporate, framed the newest strikes as a part of their aggressive long-term technique.

Ethereum Worth Rebounds Above $4,100

In the meantime, Ethereum itself gave bulls one thing to cheer about. ETH value rebounded strongly from its $3,800 dip, bouncing again above $4,100. Over the previous 24 hours, ETH gained roughly 3%, transferring between an intraday low of $3,979 and a excessive of $4,145.

The rally was fueled by an 80% surge in buying and selling quantity, signaling renewed investor urge for food. Analysts pointed to Tom Lee’s earlier “backside alerts” as serving to restore confidence. On the derivatives aspect, ETH futures open curiosity jumped by over 1% to $55.43 billion. Knowledge from CoinGlass confirmed that futures OI climbed 3% in a day, with CME and Binance main positive factors at 3% and 4% respectively—suggesting institutional merchants are stepping again in.

Key Takeaway

Bitmine Immersion continues to flex as Ethereum’s high treasury holder, and its aggressive accumulation traces up with bullish sentiment in ETH’s restoration above $4,100. With BMNR inventory skyrocketing and ETH futures heating up, momentum appears to be constructing, however whether or not this interprets into sustained value development will rely on broader market circumstances.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.