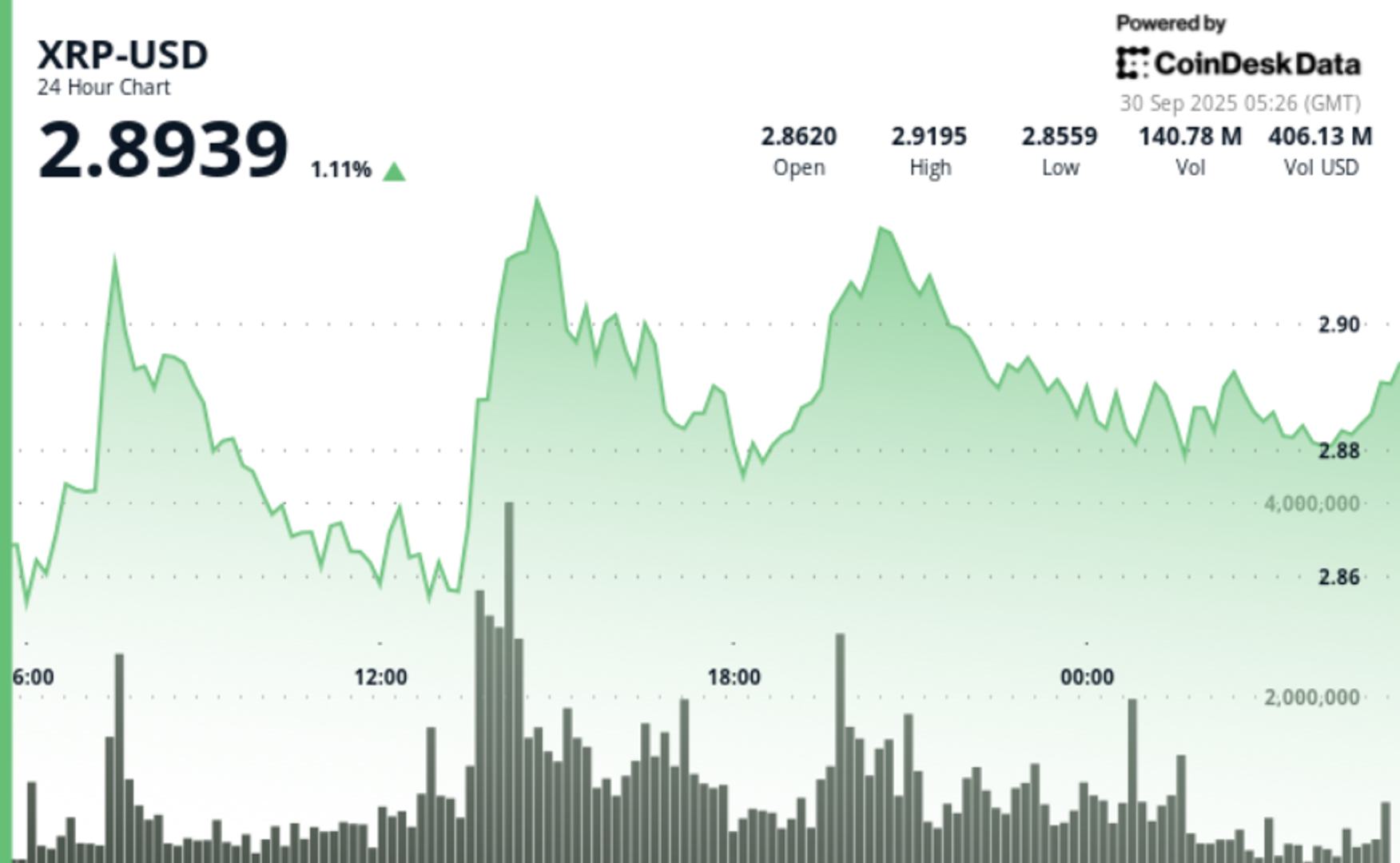

XRP gained 2.1% throughout the 24-hour buying and selling session from September 28 at 21:00 to September 29 at 20:00, climbing from $2.84 to $2.90 whereas transferring inside a $0.10 vary that represented 3.47% of the opening worth.

Information Background

• Massive institutional addresses holding between 10–100 million XRP tokens gathered over 120 million cash throughout the final 72 hours.

• Seven XRP spot ETF purposes stay pending earlier than the U.S. Securities and Change Fee. Grayscale’s submission is scheduled for October 18, with others queued by November 14, making a concentrated window of regulatory catalysts that would reshape near-term flows.

• Market sentiment has been buoyed by anticipation of elevated company portfolio publicity. Analysts body ETF approvals as a structural driver that would speed up XRP’s adoption inside institutional allocation methods.

Value Motion Abstract

• XRP traded inside a $0.10 hall, fluctuating between a low of $2.84 and a excessive of $2.93, reflecting 3.5% volatility throughout the interval. Value capped out close to $2.93 the place promoting strain intensified, significantly throughout the September 29 14:00 session.

• Essentially the most vital upward strikes got here at 02:00 and 07:00 GMT on September 29, the place quantity spiked to over 97 million items. These surges considerably outpaced the every day common of 57.4 million, confirming institutional participation throughout rally phases.

• The ultimate hour of buying and selling prolonged the advance, as worth moved from $2.88 to $2.90 for a 0.7% late achieve. The breach of the $2.90 psychological barrier was confirmed by a 4.8 million unit quantity burst, taking the session to its highs earlier than settling round $2.9045.

Technical Evaluation

• Resistance is clustered between $2.92 and $2.93, the place worth repeatedly stalled on greater quantity. This zone marks the following hurdle for continuation, with breakout affirmation doubtless requiring a detailed above $2.93 on increasing participation.

• Assist has consolidated between $2.85 and $2.86, the place consumers constantly defended bids throughout retracements. A number of profitable retests of this band all through the session spotlight its significance as an accumulation zone.

• The $2.90 psychological stage has shifted right into a near-term pivot. Value reclaimed it within the late session, and merchants will monitor whether or not this could maintain as assist heading into the weekend.

• Volatility over the 24-hour window reached 3.47%, in line with elevated institutional repositioning round key regulatory catalysts.

What Merchants Are Watching

• Whether or not XRP can maintain closes above $2.90 and flip this into assist, which might validate continuation makes an attempt towards $3.00 and past.

• The SEC’s October–November ETF assessment window, with Grayscale’s October 18 date seen as the primary main structural catalyst for institutional inflows.

• Whale pockets exercise, with 120 million tokens gathered over three days suggesting additional upside if this tempo continues.

• Broader macro situations, with Treasury yield volatility and Fed coverage indicators influencing danger urge for food throughout each equities and digital belongings.