- Cardano trades close to $0.798, with resistance stacked at $0.83–$0.85 and assist at $0.78.

- ETF approval odds sit at 91% by late October, boosting sentiment however not guaranteeing a breakout.

- By-product knowledge reveals bullish bias, however weak choices exercise leaves ADA uncovered to volatility shocks.

Cardano (ADA) is making an attempt to claw its method again after final week’s dip, buying and selling close to $0.798 at press time. Consumers have stepped in across the $0.78 zone, defending assist, however the market remains to be struggling below key shifting averages. The massive query now—can ADA reclaim the $0.83–$0.85 band, the place resistance stacks up with each the 50-day EMA and Fibonacci ranges?

ADA Value Going through Thick Resistance

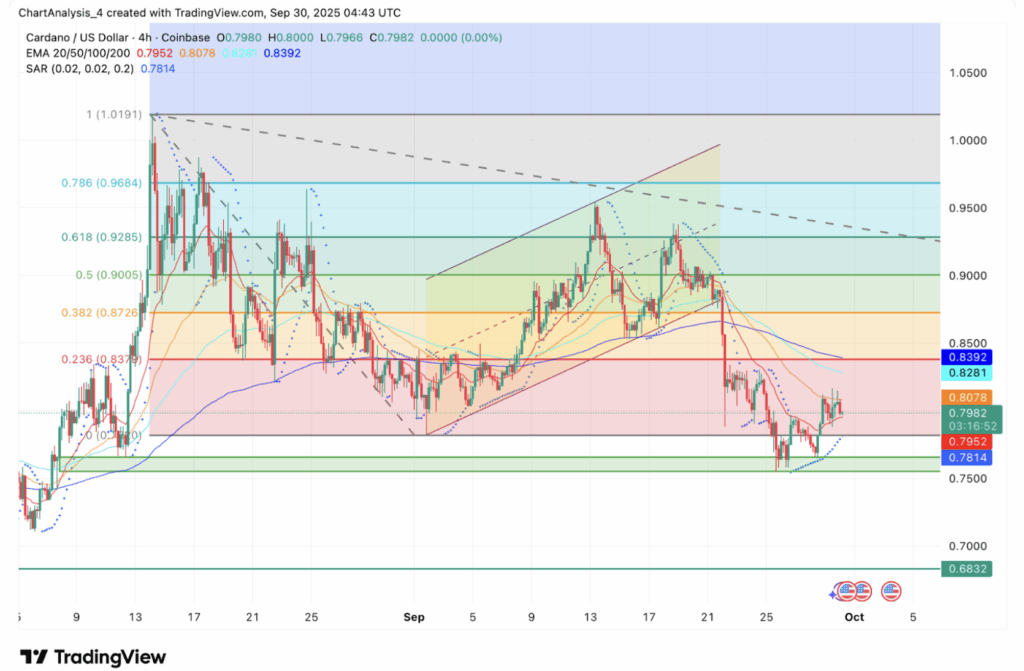

On the 4-hour chart, ADA is caught in a good consolidation between $0.78 and $0.83 after falling again from September highs above $0.95. Value motion is pinned under the 20-day EMA ($0.80), whereas stronger resistance sits overhead with the 50-day and 100-day EMAs at $0.82–$0.83. Add the 200-day EMA at $0.84, and also you’ve obtained a cluster that’s powerful to crack.

If bulls handle to push by means of, upside targets sit at $0.87 (Fib 0.382) and $0.90 (Fib 0.5). On the draw back, rapid assist is at $0.78, with deeper cushions close to $0.75 and $0.71. Momentum alerts stay blended—the RSI is bouncing again from oversold however hasn’t confirmed bullish divergence, whereas Parabolic SAR dots nonetheless hover above worth, preserving the short-term pattern tilted bearish.

ETF Buzz Provides Gas to the Narrative

Hypothesis round a Cardano spot ETF is heating up. Prediction markets now give a 91% likelihood of approval by October 26, sparking debate about whether or not ADA might see inflows like Bitcoin and Ethereum did earlier this 12 months. Analysts argue even modest institutional allocations might present liquidity assist, although timing could not sync with short-term technical setups.

The ETF hype has clearly improved sentiment, however merchants stay cautious—watching whether or not narrative momentum can overcome the resistance cluster on charts.

On-Chain Flows Present Blended Alerts

Derivatives knowledge reveals rising exercise. Open curiosity sits at $1.41B, barely larger on the day, whereas buying and selling quantity surged 26% to $2.03B. On Binance, the lengthy/quick ratio is closely bullish at 3.14, displaying leveraged merchants are leaning on the upside.

That stated, choices exercise is method down—92% decrease than current weeks—suggesting an absence of hedging in opposition to volatility. Liquidation knowledge reveals round $732k wiped in 24 hours, with longs taking a lot of the ache. The image? Restoration appears fragile, and with out hedging, sharp strikes might nonetheless sting.

Why Fundamentals Nonetheless Matter

Trying previous near-term noise, Cardano continues to construct its long-term case. The community has run for over eight years with out downtime or hacks, one thing few blockchains can declare. That stability makes ADA enticing to establishments who may view it as much less speculative in comparison with riskier altcoins. With ETF hypothesis within the combine, that monitor document might turn into a serious promoting level.

Technical Outlook: ADA Ranges to Watch

- Upside targets: $0.83–$0.85 (EMA cluster), $0.87 (Fib 0.382), $0.90 (Fib 0.5).

- Help zones: $0.78, $0.75, and deeper at $0.71.

- Development assist: $0.68 stays the important thing long-term protection line.

A each day shut above $0.83 would flip construction bullish and open a path to $0.90. Failure, nevertheless, might drag ADA again towards $0.75 or worse.

Will Cardano Go Up in October?

For now, ADA stays caught in a variety. Technicals flash warning, however open curiosity, bullish leverage ratios, and the ETF catalyst give patrons a preventing likelihood. If momentum holds, ADA might check $0.90–$0.93 into October. But when $0.78 cracks, sellers will doubtless drag it right down to $0.75 and even decrease.

Cardano sits in that awkward center floor—optimism constructing, resistance thick, and merchants watching carefully for a decisive transfer.

Disclaimer: BlockNews supplies impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.