Be part of Our Telegram channel to remain updated on breaking information protection

The Ethereum value jumped 2.4% within the final 24 hours to commerce at $4,186 as of 4:05 a.m. EST on buying and selling quantity that surged 41% to $36.2 billion.

This comes as BitMine chairman Tom Lee says ETH is priced at ‘a reduction to the longer term’ with future adoption of the blockchain by Wall Avenue and AI firms set to push the token larger.

“We proceed to consider Ethereum is likely one of the largest macro trades over the subsequent 10-15 years,” Lee stated. “Wall Avenue and AI shifting onto the blockchain ought to result in a higher transformation of in the present day’s monetary system. And nearly all of that is happening on Ethereum.”

Lee’s phrases come as BitMine introduced on Monday that its holdings stand at 2.65 million Ether price $11.6 billion.

🔥 BitMine now holds 2.65M ETH ($11B) — by far the world’s largest ETH treasury.

Chairman Tom Lee: “ETH is buying and selling at a reduction to the longer term” 🚀 as Wall Avenue + AI adoption speed up.

Bit Digital additionally eyes a $100M increase to stack extra ETH. pic.twitter.com/D7WQ5GFvhT

— Jessica Gonzales (@lil_disruptor) September 30, 2025

ETH treasury companies are actually sitting on an Ethereum hoard price $15.8 billion, based on Coingecko knowledge. This represents slightly below 10% of the whole Ethereum provide.

With the buildup gaining traction, can the value of ETH proceed hovering?

Ethereum Worth Restoration Try: Can The Bulls Reclaim Management?

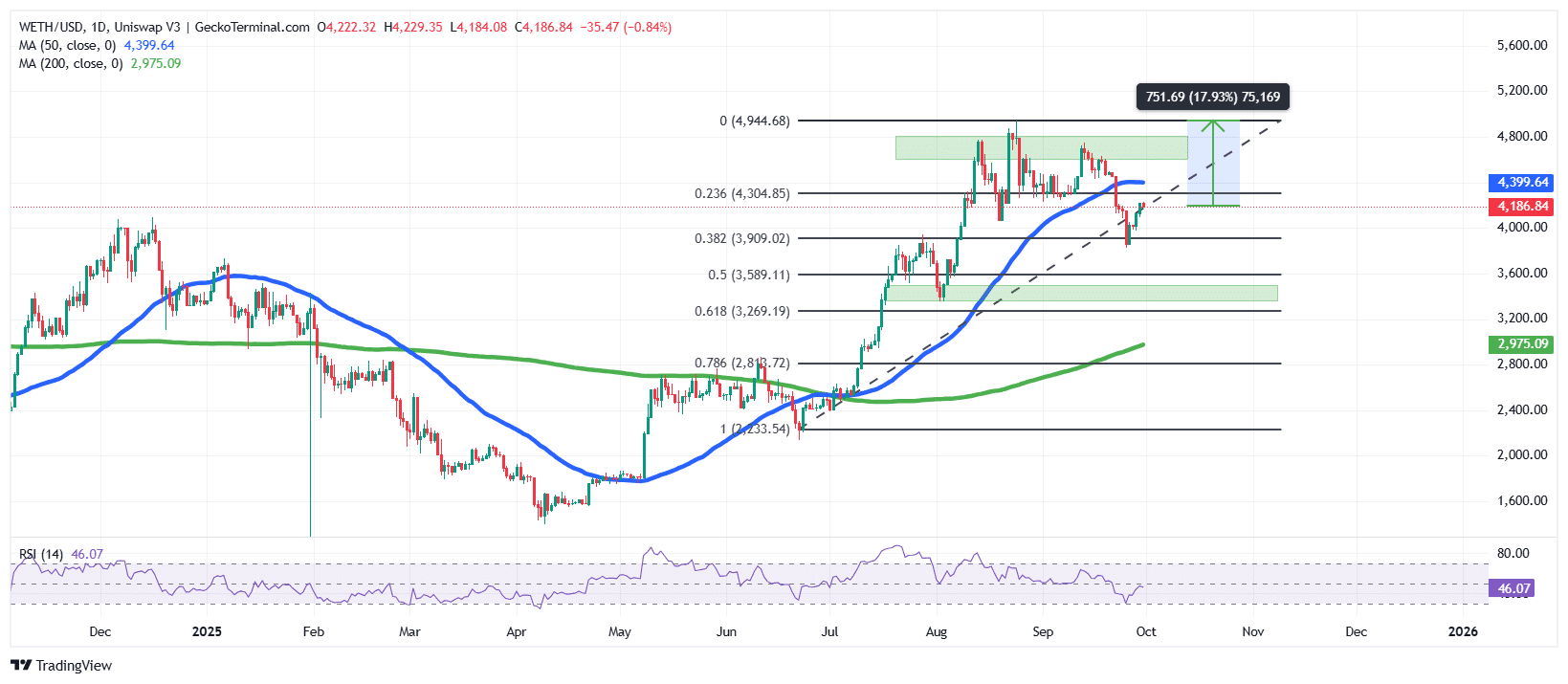

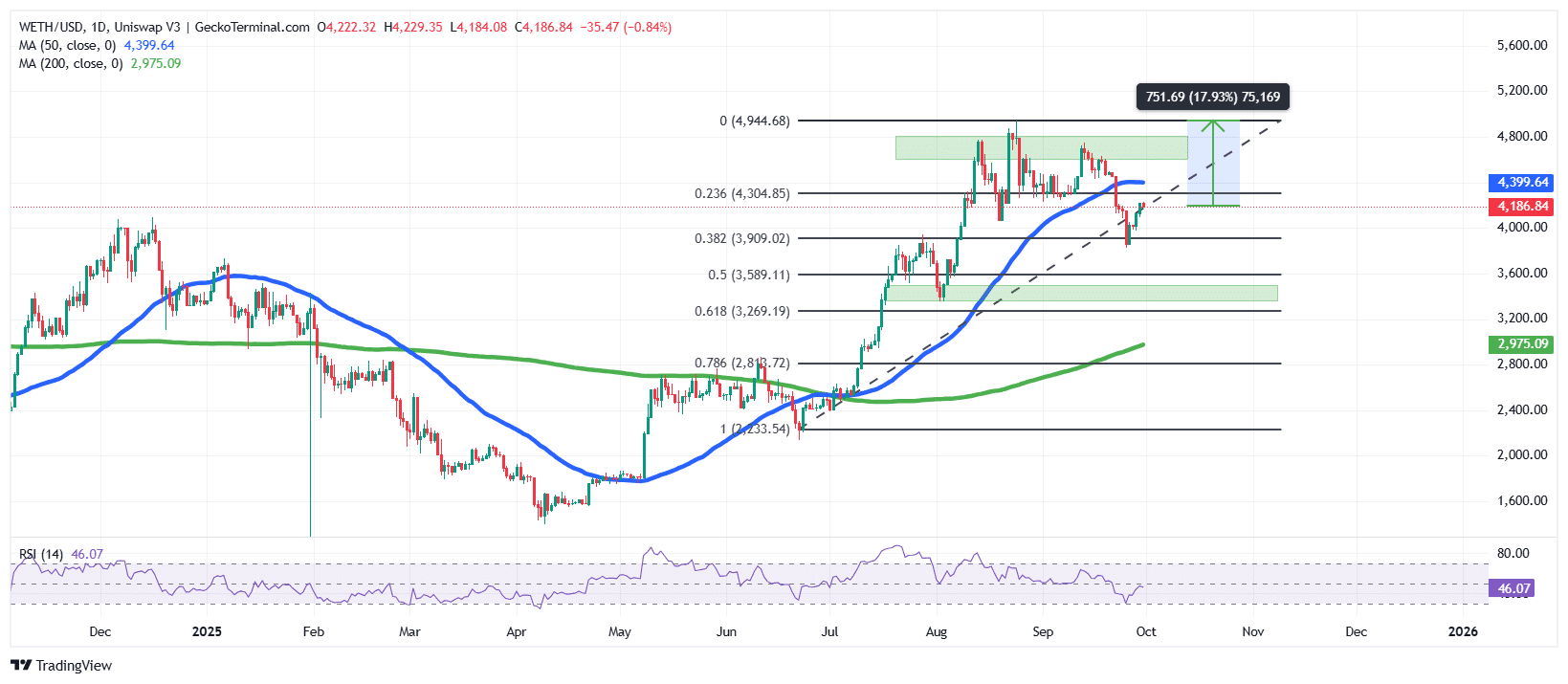

The ETH value is presently buying and selling round $4,186 after bouncing off current lows. The broader development since mid-summer has been bullish, with a powerful rally that took ETH above $4,900 earlier than retracing.

This retracement discovered assist across the 0.382 Fibonacci degree close to $3,909, from the place consumers stepped in.

ETH is in a short-term upward channel (dashed trendline), suggesting that the current dip might have been a corrective transfer inside a broader bullish construction.

Nevertheless, the value of ETH is buying and selling just under the 50-day Easy Shifting Common (SMA) ($4,399), which is performing as quick resistance. A decisive breakout above this degree might verify a renewed bullish momentum.

In the meantime, the Relative Power Index (RSI) is at 46, a impartial studying that leans barely bearish. This means that Ethereum is neither overbought nor oversold, leaving room for momentum to shift both method relying on upcoming value motion.

Based on the Fibonacci Retracement ranges, $4,304 (0.236) is quick resistance, whereas $3,909 (0.382) acts because the closest assist.

A breakdown under $3,909 might expose ETH to deeper pullbacks towards $3,589 (0.5 retracement). On the flip facet, a breakout above $4,304 might set the stage for a push towards the $4,900 zone once more.

If Ethereum can break and maintain above the $4,304–$4,400 zone, momentum might favor the bulls, probably sending the value towards the $4,900 area as soon as once more, a transfer that represents a few 17% upside from present ranges.

Then again, failure to clear the 50-day SMA and a drop under $3,909 might set off additional draw back towards the $3,600–$3,270 assist vary.

Based on analyst Ali Martinez, ETH might nonetheless plunge to $2,400.

Is it loopy to suppose Ethereum $ETH might drop to $2,400? pic.twitter.com/nBpoDYwd4g

— Ali (@ali_charts) September 30, 2025

Associated Information:

Greatest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection