- Solana dropped to $204.17 on shutdown fears however bounced again above $209.50 as bigger gamers purchased the dip.

- Retail longs have been liquidated on the flush, however professional merchants used detrimental funding charges to open new longs.

- Market focus now shifts to SEC’s October 10 resolution on spot Solana ETFs and broader Fed rate-cut expectations.

Solana (SOL) noticed a pointy drop on Tuesday, falling from $208.94 to $204.17 as U.S. inventory markets wobbled on information that the federal government is headed towards a possible shutdown on October 1. Lawmakers as soon as once more did not safe a funding deal, sparking headlines of political impasse.

Curiously, equities shook off the early jitters. The DOW, S&P 500, Nasdaq, and Russell 2000 all managed to shut within the inexperienced, with the DOW clocking one more report excessive. Crypto adopted swimsuit, mirroring shares’ late-day reversal, although most altcoins—together with SOL—are nonetheless shy of Monday’s peaks.

SOL Worth Recaptures Weekly Vary

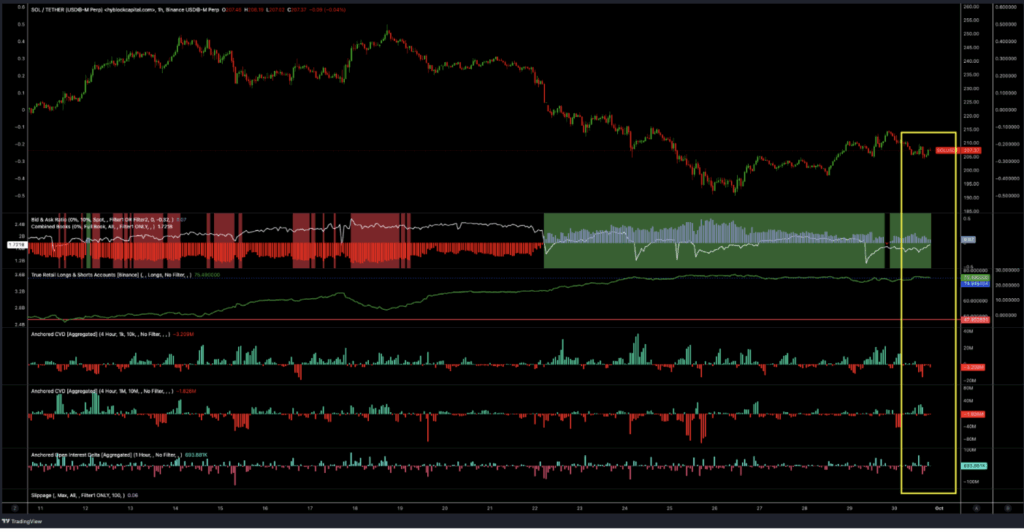

Regardless of the dip, SOL clawed again losses and is buying and selling above $209.50, down simply 1.38% on the day. Knowledge from Hyblock exhibits that retail merchants took the toughest hit, with late leveraged longs flushed out round $205. On the similar time, the larger gamers—wallets within the $1M–$10M cohort—stepped in to purchase the dip, signaling institutional help at decrease ranges.

Charts affirm this sample: the liquidation cascade cleared out smaller longs, whereas professional day merchants and retail opportunists used the detrimental funding charges that adopted to reload recent spot and leveraged lengthy positions.

Broader Market Context

Bitcoin, as regular, led the turnaround. After sinking to an intraday low of $112,656, BTC shortly rebounded to $114,400. The bounce seems to have steadied nerves throughout the board, halting declines in each large- and small-cap cryptos. For SOL merchants, this aid rally helped restore value to its median weekly vary, offering a short-term flooring after the volatility.

Past the noise of U.S. politics, crypto markets stay targeted on extra bullish catalysts. Bitcoin merchants are eyeing the anticipated trio of Federal Reserve price cuts and the potential of a Trump-aligned Fed chair, each of which may inject recent liquidity into threat belongings.

SOL Eyes ETF Deadline

For Solana particularly, consideration is on the October 10 SEC deadline, when regulators are set to rule on a number of spot SOL ETF functions. Many out there consider Bitcoin’s energy will naturally spill over into altcoins, and ETFs may grow to be a serious spark for SOL’s subsequent leg greater. Till then, merchants stay cut up between warning over macro headlines and optimism tied to approaching crypto-specific catalysts.

Disclaimer: BlockNews supplies impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.