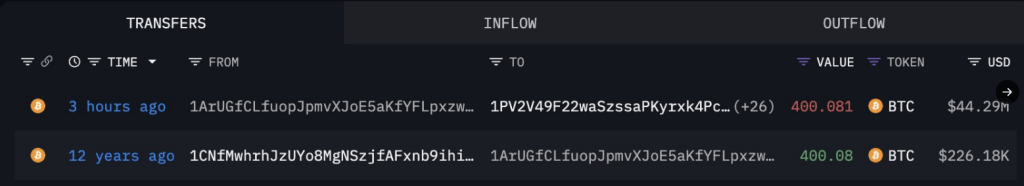

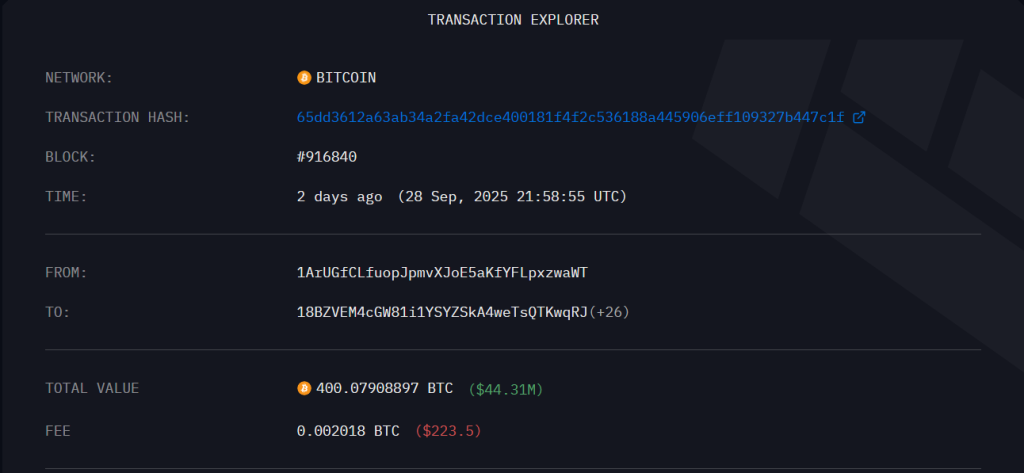

An extended-silent Bitcoin pockets awoke this week and emptied roughly 400 BTC into a number of new addresses. Based on blockchain trackers, the deal with despatched its cash in a number of transactions, largely break up into batches of 15 BTC. The entire worth moved is roughly $44 million, based mostly on present costs.

Associated Studying

Pockets Linked To Early Mining

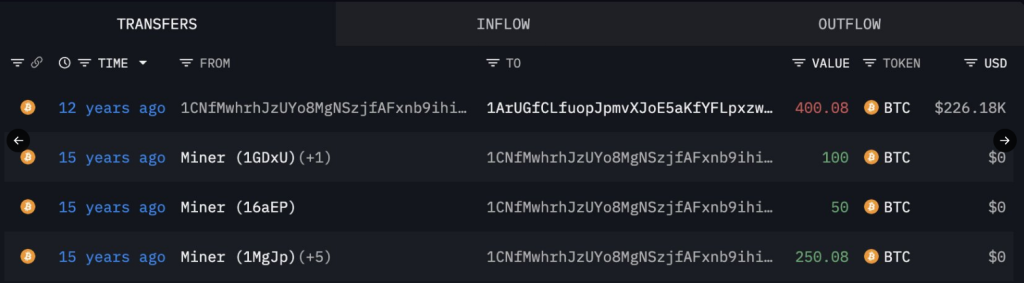

Reviews have disclosed that the cash hint again to mining exercise from practically 15 years in the past. Lookonchain tied the funds to the early days of Bitcoin, and data present the pockets final moved cash in 2013, when Bitcoin traded close to $135 per unit.

That worth then in contrast with in the present day’s degree — round $111,763 per BTC — means the holding rose by about 830 instances in worth because it went quiet.

A dormant pockets awoke after 12 years, shifting 400.08 $BTC($44.29M) to a number of new wallets 3 hours in the past.

The 400.08 $BTC was acquired from miners 15 years in the past.https://t.co/aem7WhbkOu pic.twitter.com/3m4XSBNXFO

— Lookonchain (@lookonchain) September 29, 2025

Arkham Intelligence noticed the distribution sample, noting the repeated 15 BTC transfers that drained the deal with. Even with full visibility of each transaction on the blockchain, the proprietor’s id stays unknown.

The sample — chopping massive sums into smaller, repeated quantities — is a typical approach wallets transfer cash with out dumping every thing on a single trade directly.

Half Of A Wave Of Previous Addresses Turning into Energetic

This activation comes amid a string of strikes from so-called Satoshi-era wallets. Primarily based on experiences, institutional and personal holdings tied to early buyers have been on the transfer recently. In July, Galaxy Digital offered greater than 80,000 BTC linked to an property, a sale that markets valued at near $10 billion.

One other dormant deal with holding 444 BTC grew to become lively in September 2025 and moved roughly $50 million. Not too long ago, one of many huge holders is alleged to have cycled greater than $5 billion of Bitcoin into Ethereum, locking up near $4 billion value of ETH afterward.

Market Alerts Stay Blended

October has historically been a very good month for Bitcoin, with earlier rallies of 40–45% in sure years, however the present indicators point out much less conviction. Holder retention degree has dropped to 80%, and on-chain derivatives flows and whale outflows recommend weaker demand.

Bitcoin was buying and selling close to $114,000 at one level in the present day, with a one-day acquire of two.05% reported, however analysts are watching threat ranges carefully. A continued selloff may push worth towards $107,000; renewed shopping for stress may take it again up towards $119,000.

Associated Studying

What This Means Going Ahead

Actions from Satoshi-era addresses carry symbolic weight, as a result of they arrive from the group that held Bitcoin when it was nonetheless experimental and really low-cost.

Whether or not this 400 BTC switch will spark wider promoting or just mark a reallocation stays to be seen. For now, the market has a transparent document of the transfer, however the motive behind it — property settlement, profit-taking, or inner reshuffling — is unknown.

Featured picture from Pexels, chart from TradingView