Briefly

- The market cap of prime Bitcoin miners is hovering.

- Final month, the highest public Bitcoin miners tracked by JP Morgan handed the $50 billion mark.

- The surge comes as firms within the house pivot to high-powered computing.

The market cap of Bitcoin miners soared in September as corporations within the house benefited from pivots to high-powered computing that feeds the burgeoning synthetic intelligence sector, in line with a report from JP Morgan.

Analysts on the banking big highlighted the surge in a Wednesday report, noting that the mixed worth of the 14 prime publicly traded miners it tracks handed $50 billion for the primary time ever.

Prime mining shares this week have jumped in worth with the value of the main cryptocurrency, too, with Mara, Riot, and CleanSpark all up considerably over the week—and the previous month. These corporations retreated barely on Wednesday.

“Progress in combination market cap outpaced bitcoin value appreciation for the sixth consecutive month, as operators proceed to diversify their companies away from bitcoin mining in the direction of HPC,” the report learn.

The surge in market cap comes as miners look to high-powered computing to extend earnings. Google final month introduced it was backstopping a deal between AI compute firm Fluidstack and Bitcoin miner Cipher, giving Google the appropriate to purchase a 5.4% stake in Cipher.

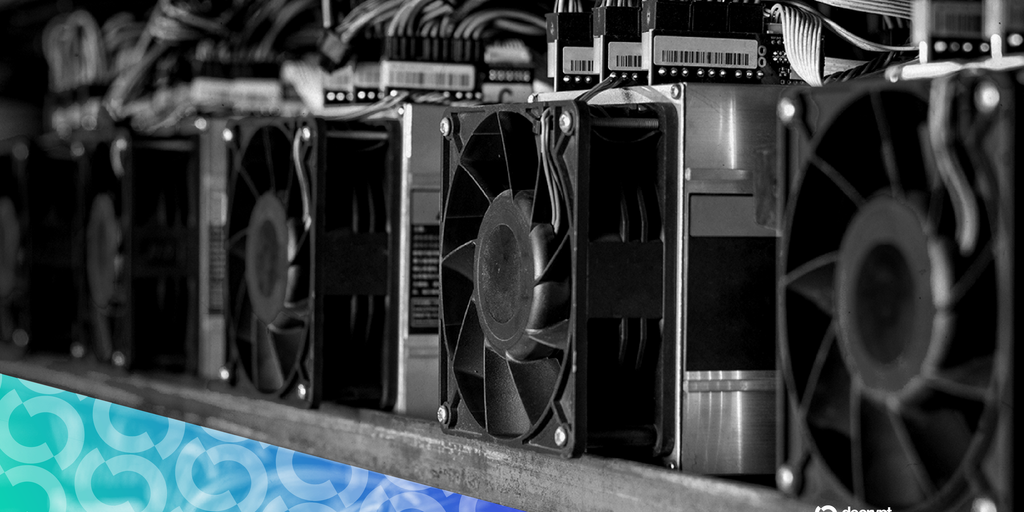

Bitcoin miners—sometimes industrial operations consisting of warehouses filled with computer systems that work to safe the community—are rewarded in newly minted cash for processing blocks on the decentralized fee community.

However when the value of the most important cryptocurrency drops, companies might battle to cowl their prices.

Specialists have instructed Decrypt that whereas each Bitcoin mining and operating a knowledge middle to energy AI companies might seem related, the pivot from crypto to HPC is not all the time simple and requires completely different experience.

HIVE Digital’s inventory is up practically 9% over the previous week, and has surged by 41% over the previous month. Nasdaq-listed MARA has jumped by 8% this week and practically 16% over a 30-day interval.

CleanSpark, in the meantime, has spiked extra over the previous month, with its share value up over 51% over that interval. This week, CLSK has risen by 4%.

Bitcoin was not too long ago buying and selling above $117,615, an almost 3% 24-hour rise. It dropped under $107,000 per coin in the beginning of September, CoinGecko information reveals.

Day by day Debrief E-newsletter

Begin each day with the highest information tales proper now, plus unique options, a podcast, movies and extra.