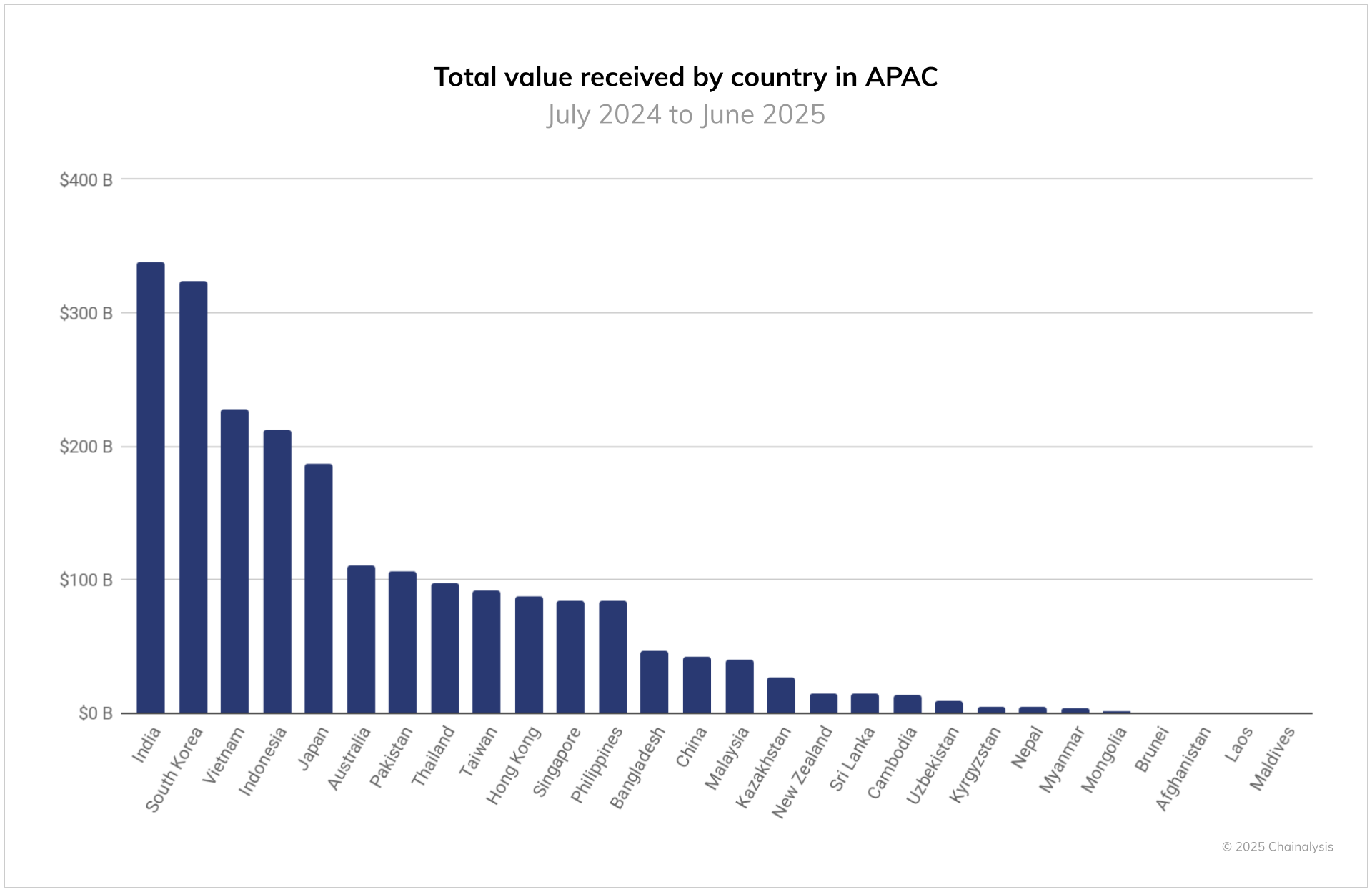

Chainalysis’ 2025 APAC(Asia-Pacific) Crypto Adoption Report reveals speedy progress within the area’s cryptocurrency exercise. Month-to-month on-chain transaction values tripled, rising from about $81 billion in July 2022 to $244 billion in December 2024.

India stays the biggest market by transaction quantity, supported by grassroots adoption, remittances, and fintech integration.

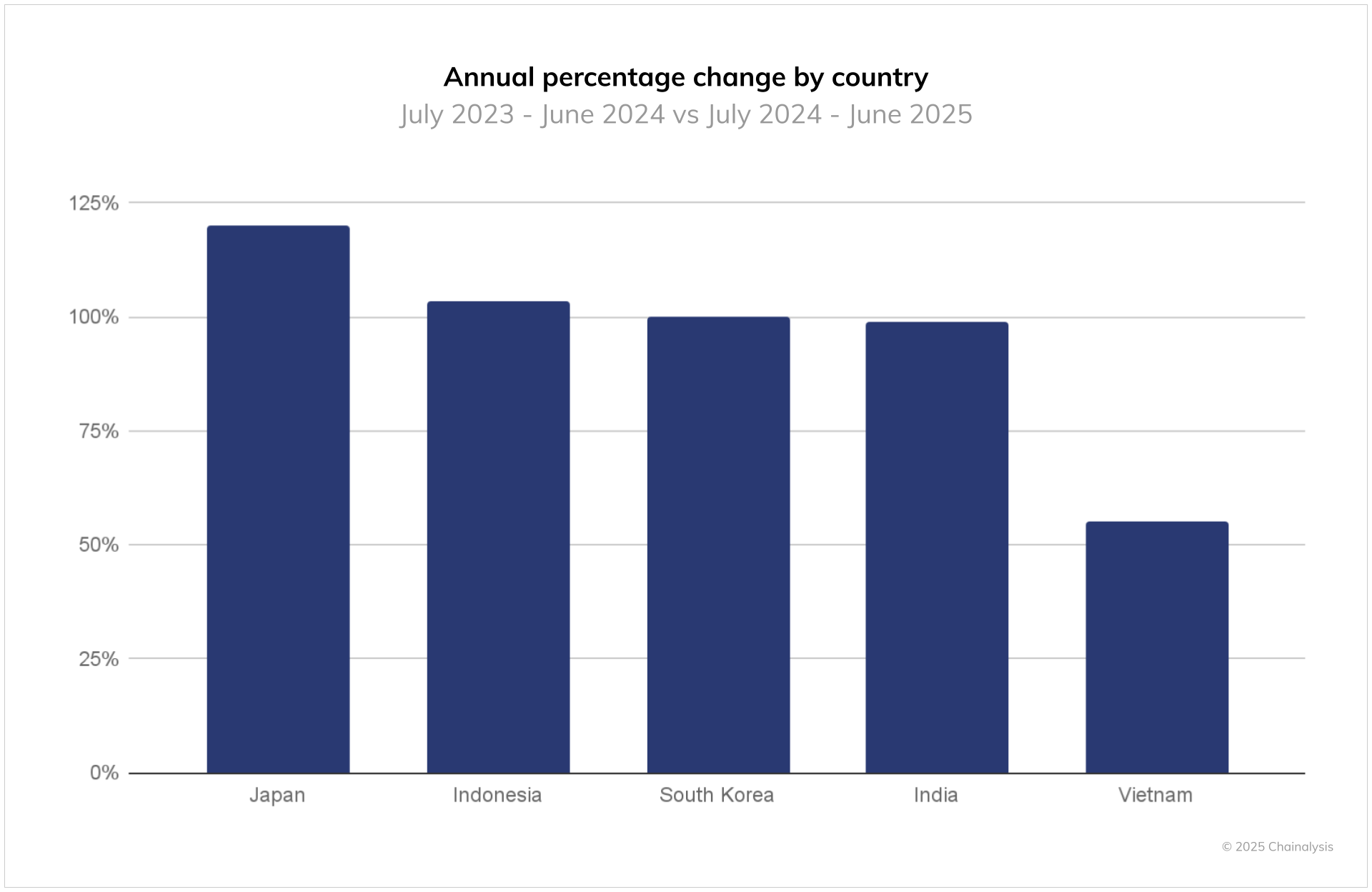

Japan, whereas smaller in absolute quantity, recorded the quickest year-on-year progress at 120% to June 2025, pushed by regulatory reforms, broader investor participation, and elevated utilization of main cryptocurrencies. This progress highlights the varied adoption fashions shaping the APAC crypto panorama.

Sponsored

Sponsored

India Retains Dominance Amid Broad Crypto Adoption

India continues to guide the Asia-Pacific area in cryptocurrency adoption by whole on-chain transaction quantity. As of mid-2025, India accounted for roughly $338 billion in month-to-month on-chain transactions, considerably greater than some other APAC market.

Grassroots adoption drives a lot of this progress. Key components embrace remittances from the Indian diaspora, retail buying and selling, and fintech integration through platforms just like the Unified Funds Interface (UPI). Younger adults are more and more utilizing crypto as each an funding and a supply of revenue. This pattern reveals rising familiarity and acceptance of digital property throughout the inhabitants.

The Indian market advantages from a mix of demographic components and supportive monetary infrastructure. Remittance flows, which have historically been a key financial element, at the moment are more and more routed by cryptocurrency channels, providing decrease prices and quicker settlement occasions in contrast with standard banking methods.

Moreover, fintech platforms have built-in crypto buying and selling with current fee methods, making transactions seamless for retail customers. Regulatory developments, together with clearer taxation tips and licensing frameworks, have additionally contributed to market confidence.

Regardless of the massive scale of adoption, volatility stays an element, and regulators proceed to watch buying and selling exercise to stop systemic dangers. Total, India’s market illustrates how a big, digitally related inhabitants can drive substantial on-chain quantity even amid evolving regulatory circumstances.

Sponsored

Sponsored

Japan Posts Quickest 12 months-on-12 months Progress

India leads in whole transaction quantity, however Japan noticed the best year-on-year progress in APAC. By June 2025, its transactions had risen 120%. This speedy progress follows regulatory reforms. The modifications make clear the authorized and tax standing of cryptocurrencies, enhance investor safety, and assist institutional participation.

Clearer funding frameworks and revised reporting guidelines have inspired broader adoption. Retail traders and small monetary establishments are significantly affected. The usage of main digital property—Bitcoin, Ethereum, and XRP—has grown. Exchanges now provide smoother on- and off-ramp companies to assist this progress.

Japan’s progress can be influenced by cultural and financial components. In metropolitan areas like Tokyo and Osaka, cryptocurrency adoption has been integrated into mainstream monetary exercise, whereas regional adoption stays extra restricted however steadily increasing. The nation’s established banking system, mixed with excessive smartphone penetration and digital literacy, helps seamless entry to crypto markets.

Moreover, Japanese shoppers have more and more adopted crypto for numerous functions, together with remittances, buying and selling, and fee options. The APAC market remains to be bigger total, however Japan’s speedy progress highlights the affect of regulatory readability and market schooling. Analysts say ongoing authorities oversight and compliance guidelines might form Japan’s crypto market within the years forward.

Sponsored

Sponsored

Distinct Adoption Fashions Throughout APAC

Past India and Japan, different APAC nations present distinct adoption patterns reflecting native financial and cultural contexts.

In South Korea, cryptocurrency buying and selling operates equally to fairness markets, with excessive liquidity, institutional participation, and a rising demand for stablecoins. Regulatory oversight is comparatively stringent, emphasizing transparency, anti-money laundering compliance, and investor safety. This construction permits South Korea to combine crypto buying and selling into its broader monetary ecosystem, supporting each retail and institutional traders.

Vietnam presents a contrasting mannequin, with cryptocurrencies more and more built-in into day by day life. Digital property are used for remittances, gaming, and private financial savings, reflecting a sensible method to adoption. Cellular-based entry is prevalent, and crypto has change into an alternate technique of storing worth amid inflationary pressures.

Pakistan demonstrates a mobile-first adoption mannequin, relying closely on stablecoins for inflation hedging and facilitating funds to freelancers and distant employees. These markets illustrate how financial constraints and technological entry affect adoption methods.

Smaller however extra mature markets similar to Australia, Singapore, and Hong Kong have emphasised regulatory refinement and licensing readability, creating environments conducive to institutional participation and market stability.

Sponsored

Sponsored

Collectively, APAC adoption fashions reveal the area’s adaptability and variety in integrating crypto into financial and monetary frameworks.

Regional Outlook and Implications

The Asia-Pacific area is anticipated to proceed experiencing substantial progress in cryptocurrency adoption, though trajectories will differ by nation. India’s giant transaction quantity makes it a key driver of APAC on-chain exercise. Japan’s speedy progress reveals that regulatory readability can enhance adoption even in mature markets.

Rising international locations, together with Vietnam and Pakistan, might additional undertake on a regular basis use instances like remittances and cell funds.

Regulatory frameworks will stay a central think about shaping adoption charges and market stability. Nations that present clear tips for taxation, licensing, and compliance are more likely to encourage each retail and institutional participation.

The evolution of digital infrastructure, together with fintech integration and cell entry, can even be important in sustaining momentum.

Chainalysis’s analysts observe that cross-border remittances and using stablecoins could more and more affect regional flows, significantly in international locations dealing with foreign money volatility. For traders and policymakers, understanding the distinct nationwide adoption fashions throughout APAC can be important to navigating each alternatives and dangers within the evolving cryptocurrency ecosystem.