Disclaimer: The opinions expressed by our writers are their very own and don’t characterize the views of U.Immediately. The monetary and market data offered on U.Immediately is meant for informational functions solely. U.Immediately shouldn’t be accountable for any monetary losses incurred whereas buying and selling cryptocurrencies. Conduct your individual analysis by contacting monetary specialists earlier than making any funding selections. We imagine that every one content material is correct as of the date of publication, however sure provides talked about could not be out there.

XRP continues to be on the high of the cryptocurrency market, up 20% in simply sooner or later, reaching $2.44. As of proper now, its market capitalization is $132 billion, making it the fourth-largest cryptocurrency by way of market worth. Together with rising investor optimism, this spike has spurred discussions about whether or not XRP will quickly hit $3.

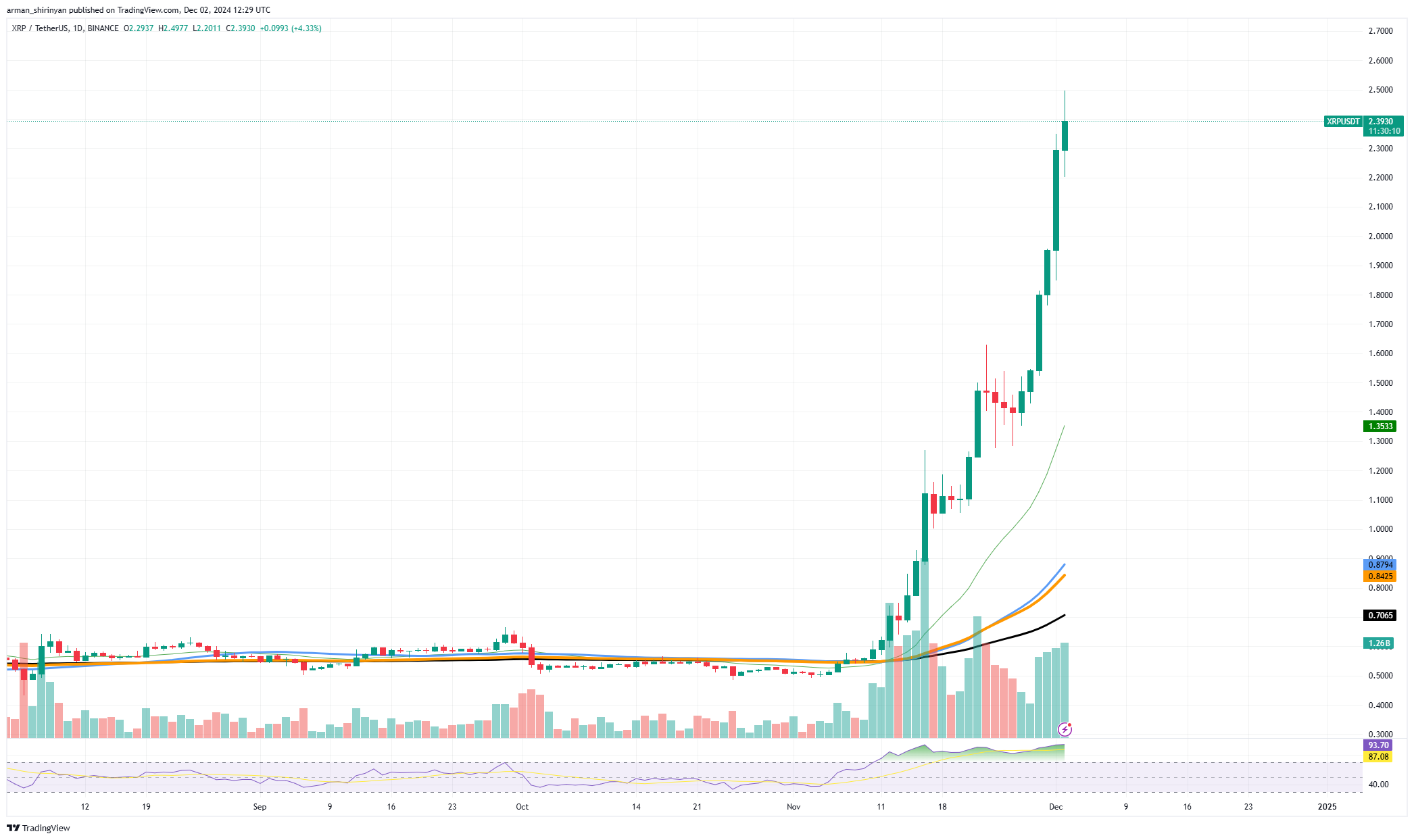

In response to the value chart, XRP has skilled a parabolic rise, decisively surpassing a number of resistance ranges, together with the noteworthy $2 milestone. Sturdy buying and selling quantity backs this upward development, particularly on South Korea’s Upbit alternate, the place it hit $3.69 billion. XRP’s distinct place within the present market cycle was highlighted by the noticeably decrease buying and selling volumes of Ethereum and Bitcoin. Now the query is whether or not XRP can proceed on this path and attain $3.

Given the present momentum, it appears possible. Round $2.75 is the subsequent necessary resistance stage which, if damaged, might open the door to a $3 breakout. With a value above $3, XRP will attain new heights for this rally, presumably reaching $3.50, contingent on market circumstances and sustained curiosity from institutional and retail buyers. However you will need to do not forget that XRP’s RSI is at 87, which signifies that the market is overbought.

This will increase the chance that there will probably be a consolidation or pullback interval prior to a different leg up. The degrees of $1.70 and $2.20 are necessary assist ranges to keep watch over since they function buffers in case of a correction. The ascent of XRP to $3 is now a actuality. With record-breaking buying and selling volumes and robust fundamentals, this formidable aim has a robust foundation.

Shiba Inu positive aspects consideration

With an excellent breakout, Shiba Inu has drawn market consideration and strengthened its place above the crucial $0.00003 stage. This motion demonstrates recent momentum as SHIB has successfully surmounted important resistance ranges, pushed by sturdy shopping for curiosity and rising buying and selling volumes.

In response to a chart evaluation, the latest rally signifies that SHIB is rising from a interval of consolidation, propelled by a rise in market exercise. A constructive indication is the value’s steady upward momentum, regardless that it briefly touched $0.000031 earlier than retracing barely. The 21 EMA has served as dependable assist, and the energy of this transfer was additional supported by the breakout and a spike in buying and selling quantity.

Staying above $0.00003 shouldn’t be assured although, significantly in gentle of the bigger market dynamics. The general state of the cryptocurrency market continues to be unstable, and SHIB’s RSI is overbought at 70, indicating that there could also be a short correction or consolidation. The quantity of $0.000027 may present immediate assist within the occasion of such a pullback, with $0.0000249 being the subsequent essential stage to keep watch over.

On the plus aspect, extra positive aspects is perhaps potential if SHIB can keep its place above $0.00003. Primarily based on market sentiment and ongoing bullish momentum, a profitable transfer previous $0.000032 might result in $0.000035, and even $0.00004. SHIB would require sustained assist from the bigger market, particularly from Bitcoin and Ethereum, which continuously drive altcoin actions with the intention to proceed on its upward trajectory.

Bitcoin not prepared?

Bitcoin seems to be stalling because it approaches the much-awaited $100,000 milestone. The cryptocurrency appears to be consolidating under $98,000 after a notable rally in latest weeks, which begs the query of whether or not the bullish momentum is waning or merely stalling for a bigger market transfer.

In response to the chart evaluation, Bitcoin is presently buying and selling near $96,000, which is just under the psychological resistance stage of $100,000. A break above this stage, which serves as a major barrier, may begin the following surge of bullish momentum. As market sentiment cools and profit-taking quickens, a pullback is extra possible the longer Bitcoin struggles to recuperate $100,000.

The latest breakout zone and the 21 EMA are in keeping with $90,400, which is vital assist. Bitcoin could transfer towards the $80,400 assist, which is in keeping with the 50 EMA and acts as a strong security internet for the present bullish development if it breaks under this stage, which might point out extra bearish stress.

With a present Relative Energy Index of 71, the market is overbought. Though this isn’t essentially an indication of bearishness, it does indicate that the market could undergo a interval of consolidation or a short correction earlier than making an attempt to rise once more. Sturdy shopping for stress is critical to interrupt via the present resistance ranges to ensure that Bitcoin to regain its upward momentum and transfer towards $100,000. Bulls could possibly reopen the trail towards $100,000 and presumably $105,000 if they’ll push the value above $98,000 with important buying and selling quantity.