Keep within the loop with our weekly crypto digest as we get you in control on the most well liked tendencies and occasions within the crypto house.

Right here’s what occurred in crypto this week:

NYDIG Government: The mNAV Metric For Crypto Treasuries “Wants To Be Eliminated”

NYDIG’s International Analysis Director, Greg Cipolaro, launched a report indicating that the mNAV metric (market Internet Asset Worth) incessantly utilized by Bitcoin treasury firms could also be deceptive, as mNAV doesn’t take into consideration the operational companies or different belongings that the related firms might personal.

Moreover, this metric usually makes use of “assumed shares excellent,” which incessantly contains convertible bonds that haven’t but met conversion situations, so the info could also be inaccurate.

It’s reported that mNAV is the ratio of market capitalization to internet asset worth. If mNAV is bigger than 1, Bitcoin treasury firms can situation further financing inside a premium vary and use the proceeds to buy BTC, thereby growing the per-share BTC holdings and enhancing the guide worth; if it converges to 1 or falls beneath 1, with the worth of BTC declining and weak secondary market assist, the flywheel mechanism will shift from “enhancement” to “dilution,” creating detrimental suggestions.

China Launches Digital Yuan Worldwide Hub To Spur Cross-Border Use

China has formally launched a world operations heart for its digital yuan in Shanghai, a transfer aimed toward solidifying the e-CNY’s function in world transactions.

The middle, which started operations on September 24, launched three enterprise platforms targeted on cross-border digital funds, blockchain companies, and digital belongings.

Lu Lei, a deputy governor of the Folks’s Financial institution of China (PBOC), acknowledged that the central financial institution is dedicated to offering open and progressive options to reinforce world cross-border funds. He famous {that a} preliminary framework for the digital yuan’s cross-border monetary infrastructure has been constructed.

The launch marks a big step in China’s technique to advertise the worldwide use of its foreign money. By constructing out its personal infrastructure for cross-border finance and digital belongings, Beijing goals to extend the effectivity of worldwide commerce and funding settlement whereas creating new channels for the yuan’s adoption.

Andre Cronje’s Flying Tulip Raises $200 Million At $1 Billion Token Valuation

Andre Cronje’s Flying Tulip, a brand new on-chain buying and selling platform, has secured $200 million in funding at a $1 billion token valuation.

Flying Tulip is constructed on the Sonic blockchain and is pushing boundaries with high-leverage buying and selling and adaptive liquidity fashions. This capital elevate marks a big step towards difficult centralized exchanges with a completely on-chain resolution.

The concentrate on US institutional funds signifies a strategic shift to faucet into substantial capital. With plans for a platform token (FT), the venture goals to redefine yield-backed liquidity in DeFi.

Binance Introduces Crypto-as-a-Service For Monetary Establishments

Binance has introduced Crypto-as-a-Service (CaaS), a white-label platform for licensed banks, brokerages, and exchanges that need to provide cryptocurrency buying and selling however lack the mandatory infrastructure to take action themselves.

As a substitute of constructing advanced methods from scratch, establishments can plug into Binance’s back-end stack, which incorporates buying and selling, liquidity, custody, settlement, and compliance, whereas sustaining full management over their very own model and shopper relationships.

CaaS is packaged with oversight instruments tailor-made for giant monetary gamers. A administration dashboard and API integration give companions visibility into volumes, asset flows, and onboarding exercise, simplifying reporting and operational management. On the safety facet, establishments can create segregated shopper wallets with distinctive deposit addresses, whereas compliance modules cowl KYC and transaction monitoring throughout jurisdictions.

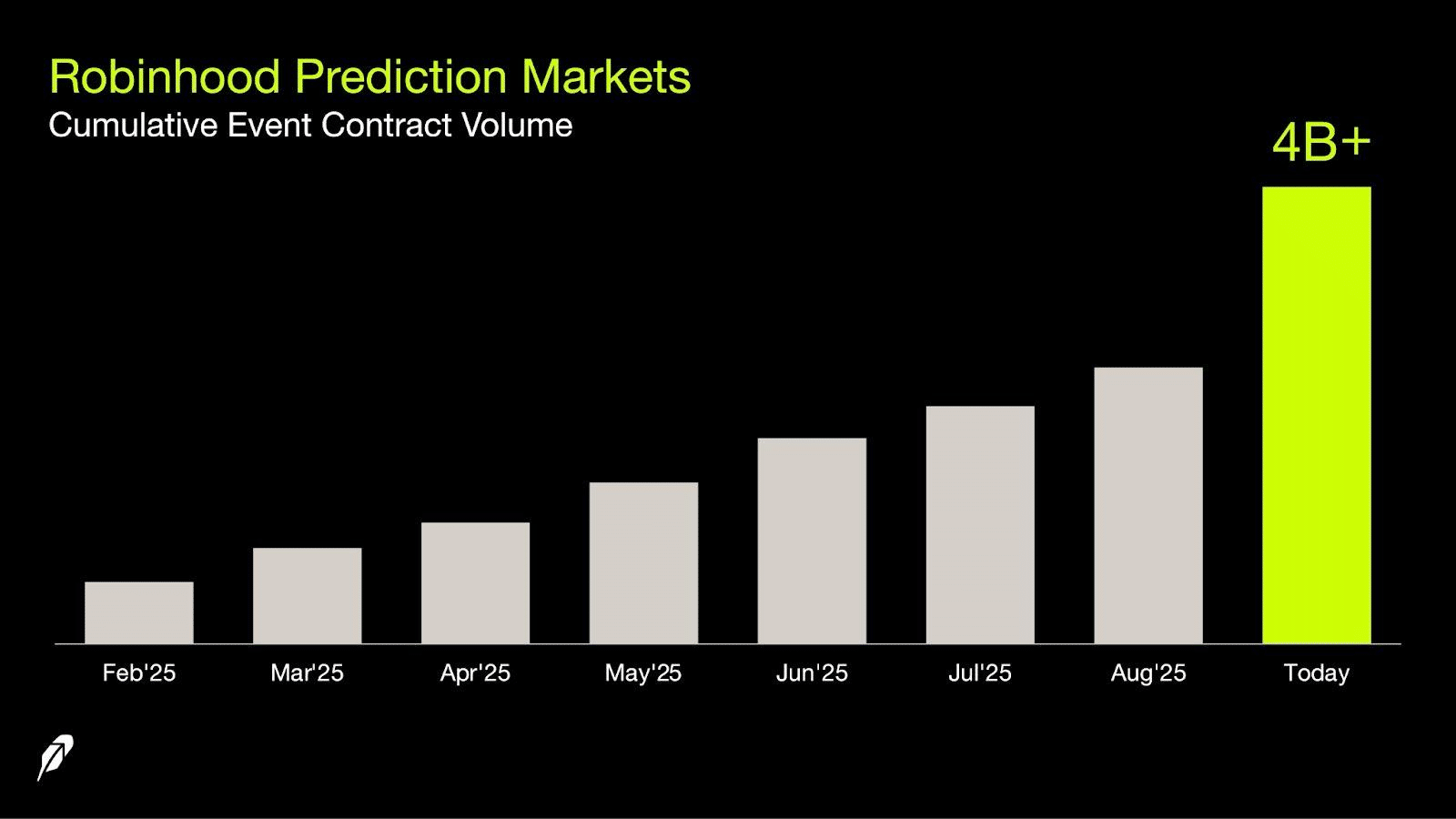

Robinhood Explores Launching Prediction Markets Outdoors The US

Robinhood is reportedly exploring the launch of an offshore prediction market outdoors the US, tapping into new person bases for event-based contracts.

The push goals to duplicate their US success in prediction markets—the place customers wager on occasions like elections or sports activities—past home borders, leveraging their current hub launched earlier this 12 months.

$HOOD additionally surged 9% after CEO Vladimir Tenev revealed on social media that greater than 4 billion occasion contracts have been traded on the platform since its launch.

1inch Rebrands To Mirror Broader Mission Uniting DeFi And International Finance

1inch rebrands as a DeFi-TradFi bridge, unveiling new branding at TOKEN2049 to emphasise infrastructure maturity and cross-chain integration.

The rebrand follows the growth of 1inch’s Software program-as-a-Service (SaaS) mannequin, which has been adopted by main business gamers similar to Binance, Coinbase, Ledger, MetaMask, and Belief Pockets.

By offering non-custodial infrastructure for decentralized exchanges (DEX) aggregation, cross-chain swaps, and intent-based buying and selling, 1inch now serves over 25 million customers and processes greater than $500 million in each day trades.

Ripple’s David Schwartz Broadcasts Departure From CTO Position By Yr-Finish

Ripple’s Chief Expertise Officer, David Schwartz, has introduced he’ll step down from his function by the top of 2025 after over 13 years with the corporate.

Schwartz, who performed an important function in creating the XRP ledger, will shift his focus to spending extra time together with his household and pursuing private hobbies.

Regardless of his departure from the CTO place, Schwartz confirmed that he would stay concerned with Ripple via its board of administrators.

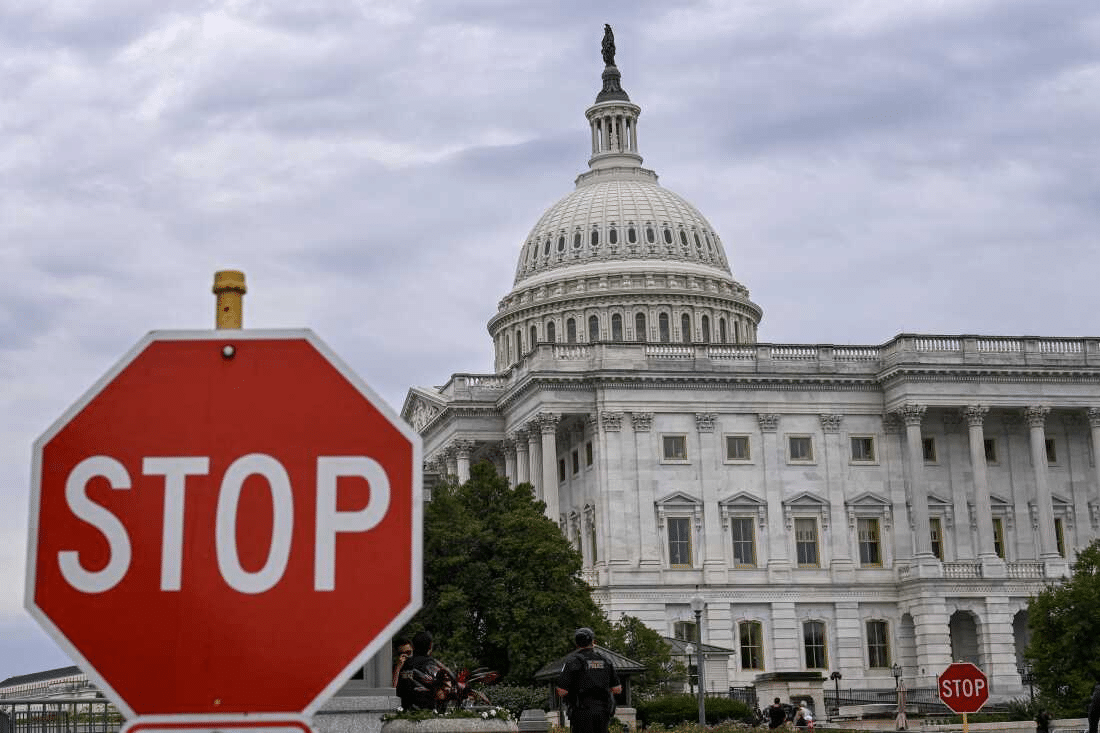

US Inventory Market And Crypto Rises As Buyers Search A International Protected Haven Amid Shutdown

Bitcoin and the US inventory market rose on Wednesday after US lawmakers failed to achieve a authorities funding settlement, leading to a shutdown.

Bitcoin traded round 3% larger on the day, and the Dow Jones Industrial Common jumped 43 factors, or 0.09%, whereas the S&P 500 climbed 0.34%. The tech-heavy Nasdaq elevated 0.42%. The Dow and S&P 500 every closed at report highs on Wednesday.

The US authorities shut down at midnight after a Senate invoice to maintain the federal government funded didn’t garner sufficient votes to go.

Closing Ideas

In order that’s it for this week!

To remain forward of the sport with the freshest crypto information and insights delivered straight to your inbox, contemplate subscribing to UseTheBitcoin’s publication right now.

Have a unbelievable week forward!