Be a part of Our Telegram channel to remain updated on breaking information protection

BlackRock’s iShares Bitcoin Belief (IBIT) has entered the highest 20 checklist of the most important ETFs (exchange-traded funds) for the primary time, with its property reaching $90.7 billion.

Based on an X publish by Bloomberg ETF analyst Eric Balchunas, IBIT is now ranked beneath the Vanguard Dividend Appreciation ETF (VIG US) with its $98 billion in property, and above the Know-how Choose Sector SPDR Fund (XLK US) with its property standing at $90.6 billion.

That’s after BlackRock’s spot Bitcoin ETF recorded its greatest web each day inflows since Aug. 14.

Analyst Says IBIT Might Enter Prime 10 Round December 2026

Requested when or if IBIT may enter the highest ten checklist, Balchunas stated the milestone ”might not take lengthy.”

“It took in $40b final 12mo and went up 85%,” Balchunas wrote, estimating it may enter the highest 10 round Christmas subsequent 12 months.

Somebody requested me how lengthy until Prime 10. It’s $50b away. If the final 12mo are repeated it might not take lengthy. It took in $40b final 12mo and went up 85%. That stated, these different ETFs rising too so i do not know. If compelled i might set the over/underneath for Xmas 2026.

— Eric Balchunas (@EricBalchunas) October 1, 2025

Spot Bitcoin ETFs Proceed Influx Streak, Pull In Over $1.5 Billion In 3 Days

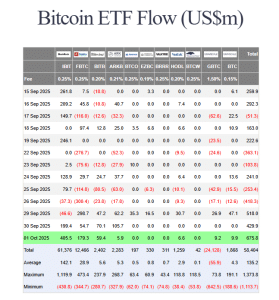

IBIT’s entry into the highest 20 comes amid a multi-day influx streak for US spot Bitcoin ETFs. Within the newest buying and selling session, the merchandise pulled in one other $675.8 million, knowledge from Farside Traders exhibits. This was the ETFs’ highest web each day inflows since Aug. 14.

US spot Bitcoin ETF flows (Supply: Farside Traders)

BlackRock’s IBIT led the cost within the newest buying and selling session, with traders pouring in $405.5 million into the fund. The following-biggest web each day inflows had been posted by Constancy’s FBTC, which noticed $179.3 million inflows on the day.

Different funds that recorded web each day inflows within the newest buying and selling session had been Bitwise’s BITB, ARK Make investments’s ARKB, VanEck’s HODL, in addition to each of Grayscale’s funds.

In the meantime, Invesco’s BTCO, Franklin Templeton’s EZBC, Valkyrie’s BRRR and WisdomTree’s BTCW recorded no new flows on the day.

With yesterday’s inflows, the US spot Bitcoin ETFs prolonged their constructive stream streak to a few days as effectively. Throughout this era, the merchandise have pulled in additional than $1.5 billion

BlackRock’s IBIT stays the spot Bitcoin ETF of selection, and leads when it comes to cumulative web inflows. Traders have poured $61.376 billion into the fund since its launch final 12 months.

In a Sept. 30 X publish, Balchunas commented on the funds’ efficiency so far, noting that the spot Bitcoin ETFs took in $7.8 billion within the third quarter this 12 months.

The Bloomberg analyst added that the funds have additionally pulled in $21.5 billion year-to-date, and $57 billion since inception. Nevertheless, some traders are nonetheless disillusioned with how the merchandise are performing.

Balchunas went on to criticize these traders who he says “stay in infantile fantasy” and are disillusioned that the funds are usually not seeing “$1T of inflows day-after-day.”

The spot bitcoin ETFs took in $7.8b in Q3, now $21.5b YTD and $57b since inception. Strong climb up. But some on listed here are depressing bc they stay in infantile fantasy that expects $1T of inflows day-after-day. However actual progress in actuality is 2 steps fwd, one step again. by way of @JSeyff pic.twitter.com/dAEJJTOYWW

— Eric Balchunas (@EricBalchunas) September 30, 2025

Nasdaq Submits Submitting To Checklist BlackRock’s Bitcoin Premium Earnings ETF

As IBIT continues to carry out, Nasdaq has just lately filed with the US Securities and Trade Fee (SEC) to checklist and commerce the asset administration large’s iShares Bitcoin Premium Earnings ETF.

BlackRock’s new fund features a coated name mechanism that can generate constant yield by way of Bitcoin publicity.

Whereas IBIT tracks the spot value of Bitcoin, the Premium Earnings ETF provides an choices overlay to extract additional earnings. The belief will make investments primarily in BTC, IBIT shares, and money reserves, in keeping with the submitting.

The SEC has already acknowledged that the submitting complied with the overall itemizing standards. As such, the general public remark interval on the proposed rule change has been initiated.

Blachunas described the brand new fund as a “sequel” to IBIT, and stated the product shouldn’t be meant to diversify into different cryptos, however is as a substitute meant to supply extra choices for funding throughout the Bitcoin ecosystem.

The brand new product submitting comes after Bloomberg reported that IBIT just lately surpassed Coinbase’s Deribit platform to grow to be the biggest venue for Bitcoin choices buying and selling. Open curiosity in choices tied to IBIT reached almost $38 billion, whereas choices tied to Deribit solely reached $32 billion.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be a part of Our Telegram channel to remain updated on breaking information protection