Be part of Our Telegram channel to remain updated on breaking information protection

Tether co-founder Reeve Collins says “all foreign money” will grow to be stablecoins by 2030 as conventional finance begins to maneuver on-chain.

“All foreign money might be a stablecoin,” he mentioned throughout an interview on the Token2049 convention in singapore. “So even fiat foreign money might be a stablecoin,” he added. “It’ll simply be referred to as {dollars}, euros, or yen.”

Advantages Of Tokenization Are Too Compelling For TradFi To Ignore

Collins argued that stablecoins will grow to be the transaction methodology of alternative for anybody who needs to ship cash throughout the subsequent 5 years.

In line with the Tether co-founder, the advantages of tokenized belongings have grow to be too compelling for corporations within the conventional finance sector to disregard.

Among the many advantages that tokenized belongings have to supply is a far higher stage of transparency and effectivity in comparison with belongings that haven’t been tokenized on the blockchain, Collins mentioned. These belongings might be moved rapidly with out the necessity for middlemen, which presents extra upside than conventional belongings.

“That’s the reason the tokenization narrative is so massive, as a result of everybody realizes the rise within the utility that you just get from a tokenized asset versus a non-tokenized asset is so vital,” Collins mentioned.

US Crypto Embrace Was A Main Catalyst For The Trade

Collins went on to spotlight that the pro-crypto Donald Trump Administration’s embrace of digital belongings was a serious catalyst for the business.

Since getting into the White Home for a second time period, US President Trump has delivered on quite a lot of his election marketing campaign guarantees to the crypto neighborhood.

He has appointed long-time advocates of crypto into key regulatory positions. The President has additionally created a White Home working group for digital belongings, which handed down a multi-page report back to businesses together with the Securities and Change Fee (SEC) and the Commodity Futures Buying and selling Fee (CFTC) on the best way to higher regulate cryptos.

Trump additionally signed the GENIUS stablecoin Act into regulation, which establishes regulatory tips for stablecoin corporations trying to challenge their tokens within the US.

Previous to the Trump Administration’s crypto embrace, many giant conventional finance corporations have been too afraid to enter the business out of concern of presidency scrutiny, in accordance with Collins.

Whereas there may be nonetheless some grey space surrounding crypto, the Tether co-founder acknowledged that the US authorities’s “shift in stance” has opened the “floodgates.”

“Each giant establishment, each financial institution, everybody needs to create their very own stablecoin, as a result of it’s profitable and it’s only a higher strategy to transact,” Collins mentioned.

He then predicted that there’ll not be a divide between decentralized finance (DeFi) and centralized finance (CeFi).

“There’ll be functions that do issues, transfer cash, give loans, do investments, and it is going to be a mixture of the form of the previous, conventional fashion investments, after which the DeFi varieties of investments,” he mentioned.

Stablecoin Market Cap Soars As Large Banks Rush To Launch Stablecoins

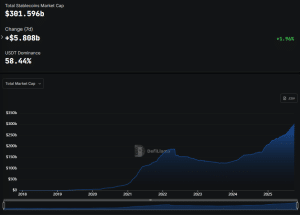

The stablecoin market cap has been in an upward development ever since President Trump signed the GENIUS Act into regulation. Over the previous seven days, the stablecoin market cap has continued rising. Throughout this era, the capitalization for the tokens elevated greater than $5.808 billion to face at $301.596 billion, in accordance with DefiLlama information.

Stablecoin market cap (Supply: DefiLlama)

Tether nonetheless dominates the market. Information from CoinMarketCap places the token’s market cap at greater than $176.33 billion. The subsequent-biggest stablecoin is Circle’s USD Coin (USDC), which has a capitalization of round $74.32 billion.

Because the capitalization for stablecoins continues to rise, giant US banks are actively exploring blockchain and stablecoin know-how. These embrace banks like Financial institution of America, Citigroup, and others.

In line with a July 16 Reuters report, Financial institution of America’s CEO has confirmed that the financial institution is actively engaged on launching a stablecoin. In the meantime, giant US lenders similar to Citigroup are additionally exploring stablecoin issuance to adapt to the extra crypto-friendly surroundings within the US.

Wall Road big JPMorgan, alternatively, already operates an inside blockchain-based token referred to as JPM Coin. It’s used for settlement in institutional contexts, and isn’t accessible to the retail market.

In associated information, the interbank messaging platform SWIFT introduced that it’s collaborating with Ethereum ecosystem developer Consensys and 30 world banks to develop a blockchain-based ledger.

💬 Everybody’s speaking about Swift’s blockchain-based ledger…

On Monday’s Large Concern Debate at Sibos 2025, Thierry Chilosi answered a key query concerning the announcement: why now?

“Right now, monetary establishments are taking a look at new types of worth and methods to scale them. That is… pic.twitter.com/D6r43w2CPJ

— Swift (@swiftcommunity) October 1, 2025

Associated Articles

Greatest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection