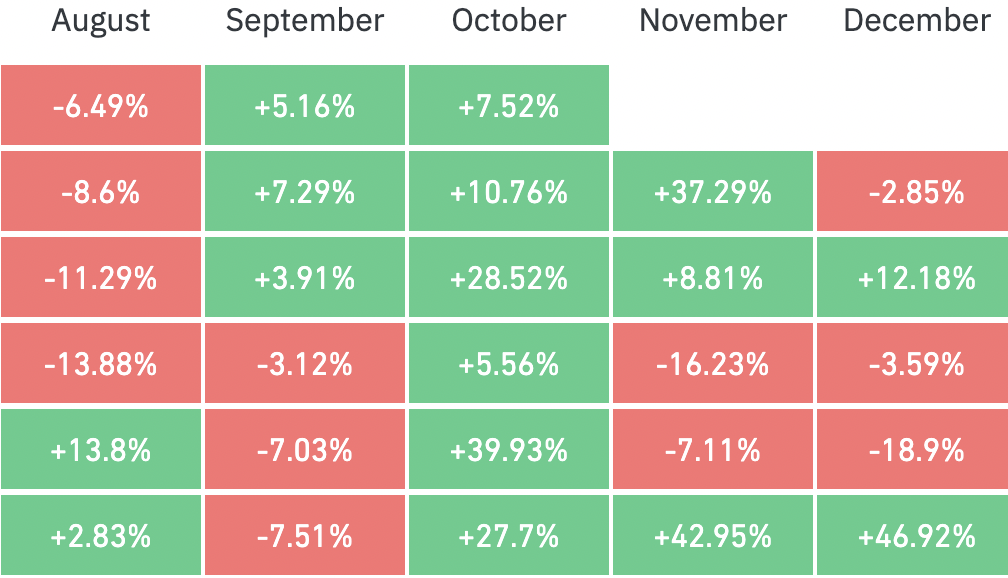

October has been traditionally essentially the most bullish month for Bitcoin, which earned the month the now-overused “Uptober” moniker inside the cryptocurrency neighborhood.

The month does stay as much as its facetious identify, on condition that it has managed to stay within the inexperienced for seven years in a row.

In 2023, Bitcoin surged by 28.5% in October. In 2021, the main cryptocurrency soared by practically 40%.

There have been solely two years when Bitcoin was within the purple in October (2018 and 2014). Each instances, the cryptocurrency was in the course of slightly brutal bear markets that adopted the speculative bubbles of 2013 and 2017.

After a powerful begin, Bitcoin appears to be on observe to increase the streak.

Macro image

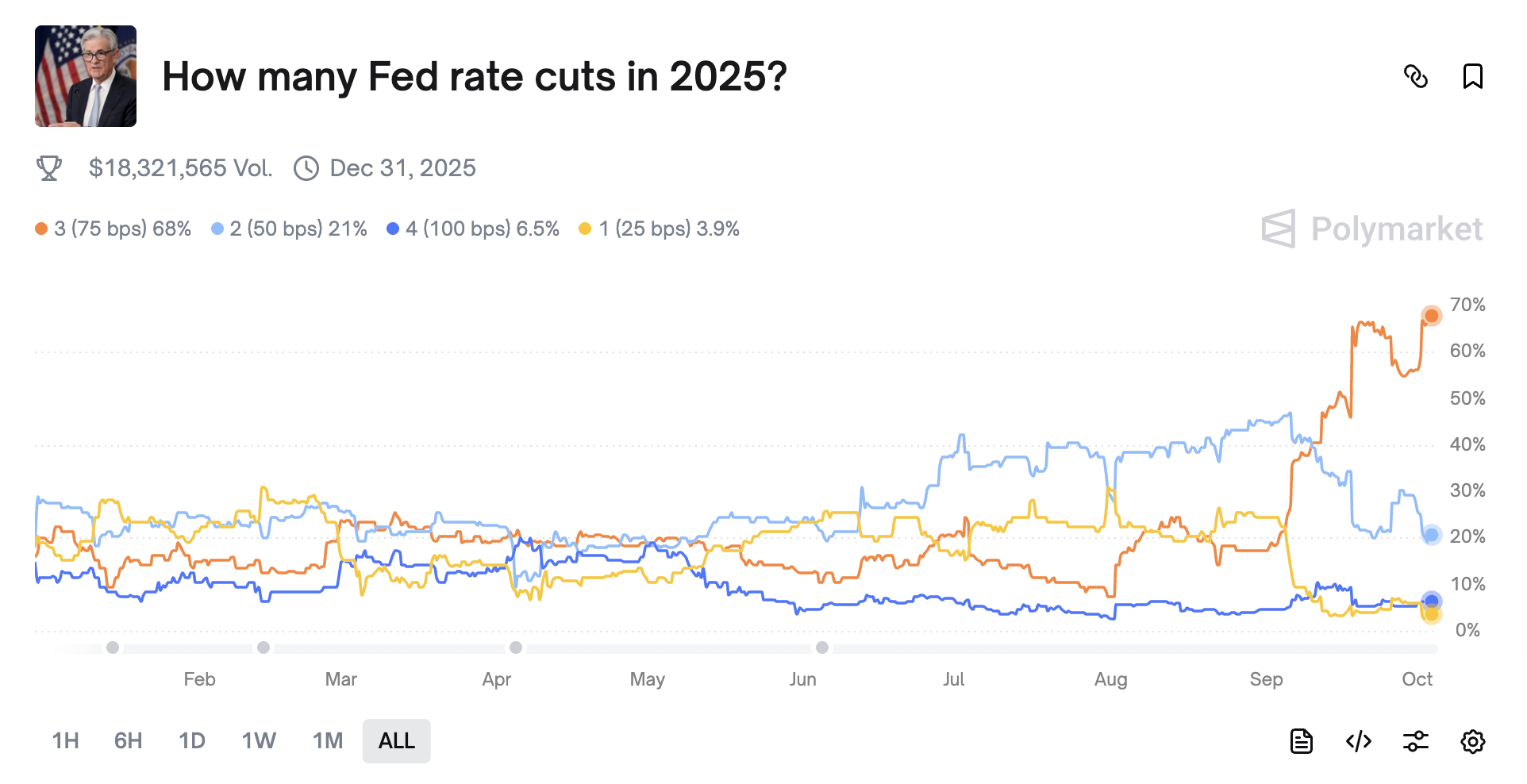

Based on Polymarket bettors, there’s a 94% probability of the Fed slicing rates of interest on the September assembly.

Market contributors are overwhelmingly betting on a complete of three fee cuts in 2025.

Fed fee cuts, which is able to make borrowing cheaper, are anticipated to additional bolster threat belongings.

On the similar time, there’s additionally quite a lot of uncertainty concerning the financial influence of the continued authorities shutdown within the U.S.

The U.S. inventory market skilled a considerable correction in the course of the longest shutdown to this point that came about from Dec. 22, 2018, to Jan. 25, 2019. Again then, Bitcoin was within the late stage of a really grueling bear market. Nonetheless, the influence of this shutdown may very well be dramatically totally different, and the cryptocurrency is at present approaching a brand new file excessive.

Merchants must hold a detailed eye on key information from the Bureau of Labor Statistics concerning employment and unemployment, the Client Value Index (CPI), the Producer Value Index (PPI), in addition to the GDP information.

Bitcoin/gold correlation

Gold has been constantly outperforming Bitcoin this yr regardless of having a considerably larger market capitalization. As reported by U.In the present day, Constancy’s Jurrien Timmer beforehand predicted that gold might move the baton to its digital rival within the second half of the yr, however this has but to occur.

Whereas gold retains smashing new file highs, Bitcoin’s worth motion stays stubbornly underwhelming because the cryptocurrency stays under its file peak.

As famous by analyst Chris Burniske, the Bitcoin-to-gold ratio has slipped again to a traditionally essential assist stage.

This stage may very well be a logical place for a future reversal if it truly manages to meet up with gold this yr.

ETF bonanza

October can also be on observe to be a historic month for the cryptocurrency sector because of the sheer variety of crypto ETFs which can be anticipated to be permitted this month.

Issuers will likely be awaiting the SEC’s selections on a slew of altcoin ETFs designed to trace such cryptocurrencies as Litecoin (LTC), Solana (SOL), Cardano (ADA), and XRP.

Nonetheless, the aforementioned authorities shutdown would possibly delay their approval.