U.S. shutdown halts 92 crypto ETF filings, and Mission Crypto by SEC Chair Atkins ushers in a brand new period of U.S. digital asset regulation.

The usSecurities and Alternate Fee (SEC) is at a crossroads in its regulation by the introduction of a venture dubbed Mission Crypto by Chair Paul Atkins, which goals at updating and modernizing securities regulation in digital belongings.

This information arrives at a time when the federal government is shut down, basically paralyzing 92 crypto exchange-traded fund (ETF) purposes, halting a lot of the progress in regulation.

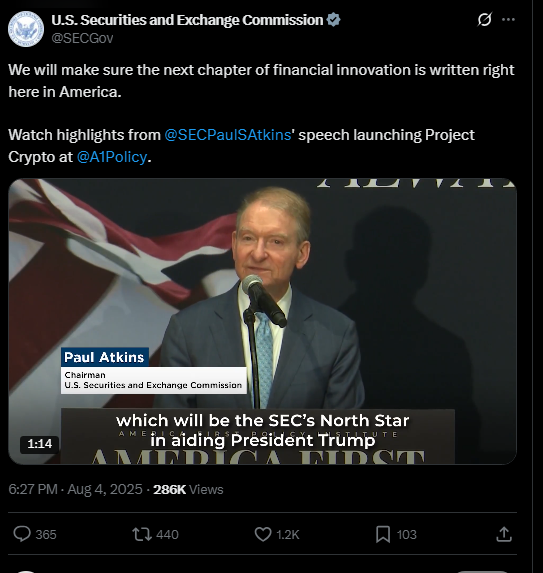

Supply – X

Mission Crypto will assist in explaining how most crypto belongings might be categorised and controlled. Chairman Atkins underlined the truth that not all crypto-tokens are securities, and he instructed the workers to arrange articulate guidelines so as to make clear unresolved regulatory points.

This system promotes crypto capital formation within the U.S. and market innovation primarily based on blockchain.

Because the workers of the SEC undertakes Mission Crypto, their operation is restricted to solely important capabilities, as they now not evaluate proposals for brand spanking new monetary merchandise.

This suspension has postponed the choice on greater than 90 altcoin ETF submissions, similar to spot ETFs on Solana, Cardano, and Litecoin.

The buyers and fund managers are confronted with an unsound time schedule for the reason that common ETF season is paralyzed.

Crypto ETFs are caught in Regulatory Purgatory.

The consequences of the shutdown on the method of making use of ETFs are acute. Approaches to numerous crypto-linked ETFs had been anticipated beforehand, however have been stopped of their tracks.

Such filings had been looking for to create new avenues of investor publicity to cryptocurrencies in a regulatory atmosphere that has been considered as dynamic however cautious.

Because the SEC freezes, the candidates are ready to renew operations because the market anticipations proceed to rise.

Atkins will not be giving up on the U.S. being the one on the forefront of crypto innovation.

In his handle to the America First Coverage Institute, he highlighted intentions to behave on presidential suggestions given by the Presidential Working Group on Digital Asset Markets.

Greater than modernizing laws, Mission Crypto may also rework the U.S. monetary markets consistent with new-generation blockchain applied sciences.

The distinction between the launch of Mission Crypto within the state of affairs of the regulatory freeze factors to the difficult nature of the present state of the U.S. crypto regulation, as a balancing act between ambition to innovate and the threats posed by political and institutional limits.