- Most merchants lose earnings resulting from gradual execution, whereas execs use instruments like Archer Bot to place in beneath 60 seconds.

- Verification and on the spot execution are key steps that separate constant winners from late-entry chasers.

- Communities like TradeHero present high quality alpha calls, whereas Archer Bot ensures merchants act quick with built-in threat administration.

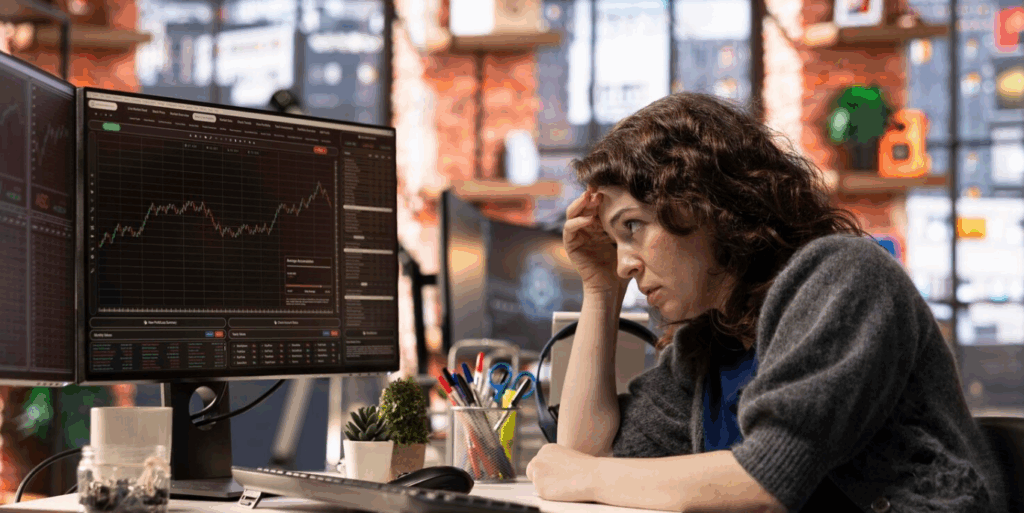

You’re scrolling by your favourite alpha group when somebody drops a contract tackle. “This one’s about to moon,” they are saying. Your coronary heart races—this may very well be the play that modifications every part. However right here’s the place most new merchants fail: they fumble round for 5-Quarter-hour making an attempt to determine the right way to truly purchase the token, solely to observe the chance slip away whereas they’re nonetheless navigating DEX interfaces.

The hole between seeing alpha and benefiting from it isn’t about having higher data—it’s about having higher execution. The quickest merchants go from alpha name to positioned in beneath 60 seconds. Whereas others are nonetheless copying contract addresses and determining slippage settings, they’re already watching their positions pump.

That is precisely why Archer Bot was constructed for alpha hunters who refuse to let execution delays kill their earnings. From alpha discovery to on the spot positioning to reside PNL monitoring—all with out ever leaving Telegram. Flip each alpha name into on the spot motion → HERE

The Alpha-to-Revenue Pipeline

Step 1: Alpha Discovery

One of the best alternatives come from tight-knit communities, alpha teams, and on-chain hunters who spot tasks earlier than they explode. Whether or not it’s a TradeHero neighborhood name, a developer announcement, or good cash pockets exercise, it’s good to be plugged into high quality data sources.

Actual alpha often comes with contract addresses, fundamental challenge data, and context about why the challenge issues. If somebody’s simply posting “this one’s going to moon” with out particulars, skip it.

Step 2: Contract Tackle Verification

All the time confirm contract addresses by a number of sources—the challenge’s official Twitter, their web site, or trusted neighborhood members. Scammers create pretend tokens with related names to trending tasks, hoping to catch merchants who don’t confirm correctly.

A couple of seconds of verification can prevent from shedding every part to a honeypot contract.

Step 3: Immediate Execution

That is the place conventional buying and selling falls aside and good merchants pull forward. Whereas most individuals navigate to Uniswap, join wallets, alter slippage, and pray transactions undergo, Archer Bot customers merely paste the contract tackle into Telegram and execute immediately.

Archer Bot robotically handles all technical complexity—optimum slippage, MEV safety, and fuel optimization—whilst you deal with getting positioned quick. Execute alpha calls in seconds, not minutes → HERE

Velocity Benefit in Motion

Conventional Execution (10 minutes)

Copy contract tackle → Open browser → Navigate to Uniswap or Jupiter → Join pockets → Paste tackle → Look ahead to token information → Set slippage → Calculate place → Submit transaction → Look ahead to affirmation

By the point you’re positioned, early merchants are taking earnings.

Archer Bot Execution (30-60 seconds)

Copy contract tackle → Paste into Archer Bot → Verify place measurement → Immediately positioned

This pace distinction is usually the distinction between 10x positive aspects and shopping for tops.

Dwell PNL and Threat Administration

Archer Bot supplies real-time revenue and loss monitoring straight in Telegram. No app switching or guide calculations—you see precisely how a lot your place is value at any second.

Automated Threat Administration

Set automated purchase and promote ranges to take away emotion from buying and selling choices:

- Take Income: 25% at 2x, 50% at 5x robotically

- Automated buys: Lock in buys on high-potential tasks at particular value ranges

- Ladder Promoting: Lock in positive aspects immediately whereas sustaining upside publicity

Skilled merchants swear by systematic threat administration, and Archer Bot makes these methods accessible to anybody. Get professional-grade threat administration instruments → HERE

The Neighborhood Benefit

One of the best alpha comes from being a part of communities the place critical merchants share reliable alternatives. Teams like TradeHero present high quality calls and thorough analysis, giving members entry to alternatives earlier than they hit mainstream channels.

When alpha will get referred to as in high quality communities, you’re not simply getting a contract tackle—you’re getting context, evaluation, and collective knowledge from skilled merchants.

Join with merchants who constantly revenue from alpha within the TradeHero neighborhood the place members share researched alternatives and confirmed methods. Be part of skilled alpha merchants → HERE

Frequent Alpha Buying and selling Errors

Execution Delays: Sluggish execution kills earnings. Most merchants enter throughout distribution phases when early patrons are promoting.

Poor Threat Administration: FOMO results in outsized positions. Deal with every alpha play as hypothesis, not funding.

Info High quality: Following low-quality sources that put up random contracts as a substitute of researched alternatives.

Emotional Buying and selling: Letting greed override exit methods or panic promoting throughout regular volatility.

Constructing Your Alpha System

Info Sources

Develop relationships with high quality alpha communities like TradeHero who study to acknowledge reliable alternatives versus pump schemes.

Execution Infrastructure

Have buying and selling setup optimized earlier than alternatives seem. Funds prepared, Archer Bot configured, and clear guidelines about place sizing.

Steady Studying

Examine profitable and failed trades to establish patterns. What alpha works in your threat tolerance? What timing results in optimum entries?

Your Alpha Buying and selling Blueprint

- Arrange Archer Bot and observe with small positions

- Be part of high quality communities like TradeHero

- Outline place sizing and threat administration guidelines

- Observe the workflow till it turns into automated

- Preserve self-discipline round sizing and stops

- Examine trades to enhance decision-making

- Construct relationships in alpha communities

- Refine execution pace and threat administration

The Backside Line

The hole between seeing alpha and benefiting from it’s going to solely widen as extra merchants acknowledge the significance of execution pace. Alpha buying and selling isn’t about having one of the best data—it’s about having one of the best execution when alternatives seem.

The mixture of high quality communities, on the spot execution instruments, and disciplined threat administration creates a system for constantly turning alpha calls into earnings. Those that adapt early will seize alternatives that others can solely watch slip away.

Prepared to show each alpha name into on the spot motion? Archer Bot eliminates execution delays that value merchants 1000’s in missed alternatives. From contract tackle to positioned in seconds—all by Telegram. Begin capturing alpha earnings at this time → HERE

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.