- Ethereum surged 17% this week, reclaiming $4,500 and concentrating on the $4,700–$6,000 vary as bullish momentum builds.

- RSI and MACD indicators present sturdy shopping for stress with out overbought alerts, hinting at extra upside potential.

- Institutional gamers like Bitmine added $12B in Ether, fueling optimism for continued progress regardless of rising competitors.

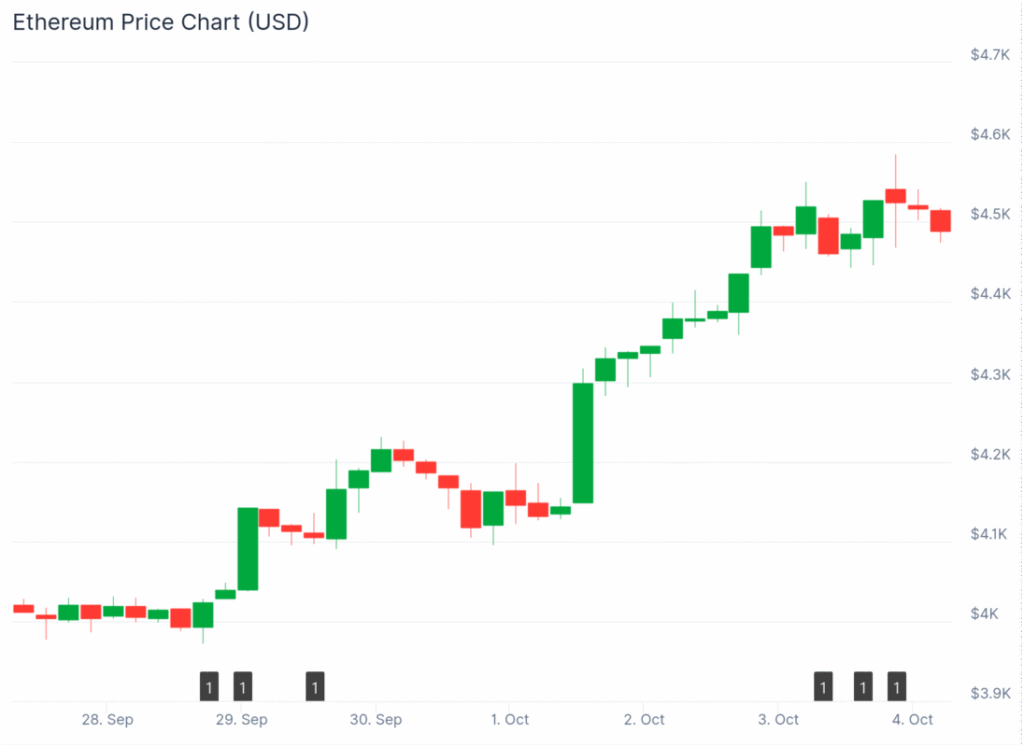

Ethereum is again in movement. The world’s second-largest cryptocurrency simply posted a 17% weekly acquire, pushing costs close to $4,488 as merchants eye a transfer towards the $4,700–$6,000 vary. It’s the primary time ETH has climbed above $4,500 in two weeks, and analysts say the charts are wanting surprisingly bullish.

During the last 24 hours alone, Ethereum rose one other 2%, carrying sturdy buying and selling quantity of $47 billion and open curiosity above $60 billion. Futures premiums are regular round 7%, which sits proper within the impartial zone however hints at confidence constructing beneath. Momentum? Positively rising.

Key Ranges and Analyst Outlook

Market analyst Ted Pillows thinks $4,500 is the following massive wall for ETH. He notes {that a} clear break above that resistance may open the door to $4,700—and even $4,750—earlier than the following pause. On the flip aspect, failure to carry momentum may drag ETH again towards $4,250 in a short-term pullback.

Kamran Asghar, one other well-followed analyst, believes we’re already seeing a confirmed breakout. His chart places the following main goal at $6,035, primarily based on the Fibonacci 1.618 extension. Asghar calls this “a structural shift, not a spike,” suggesting the rally might have deeper legs than merchants suppose.

Technicals Keep Robust

The technicals are portray a stable image. The RSI is sitting at 57, displaying sturdy shopping for demand with out dipping into overbought territory. Translation—there’s nonetheless room to run. In the meantime, the MACD is sitting comfortably in bullish territory, with a constructive histogram that continues to widen.

Market sentiment appears balanced too. Choices delta skew is holding in a impartial vary between +6% and -6%, that means merchants aren’t leaning too closely bullish or bearish. It’s the form of regular setup that usually precedes massive directional strikes.

Institutional Strikes and Community Developments

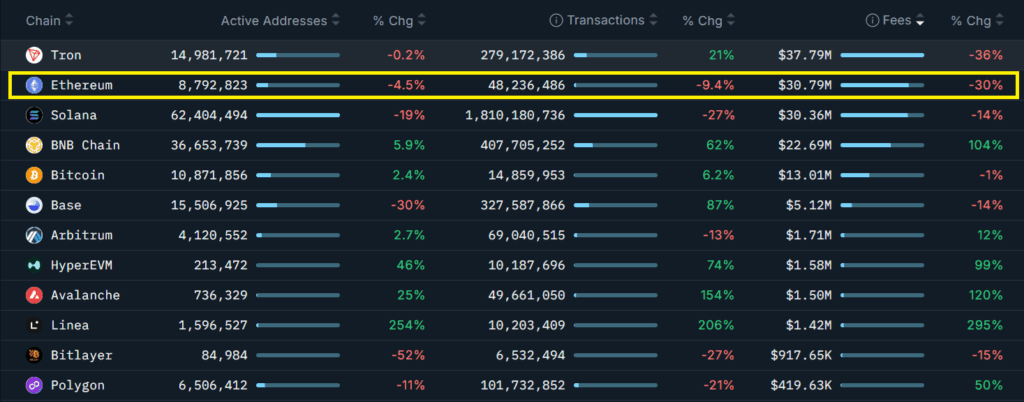

On the basics aspect, Ethereum nonetheless dominates the DeFi panorama, locking up near $100 billion in complete worth. But it surely’s not all sunshine. Community exercise has cooled off a bit—transaction quantity is down 10%, and charges have dropped round 30% month over month. Rivals like BNB Chain, Avalanche, and HyperEVM have seen their utilization and charges surge by 60% or extra, tightening the race throughout sensible contract platforms.

Nonetheless, institutional curiosity in ETH retains climbing. Bitmine Immersion Tech lately added almost $12 billion price of Ether by debt issuance and inventory gross sales. That’s not small change. Analysts are calling it potential “provide shock” territory if extra corporations observe go well with.

In the meantime, Ethereum’s ecosystem continues to shift. Ethena’s artificial stablecoin protocol noticed an 18% bump in complete worth locked, Spark’s lending platform grew 28%, whereas Pendle took a 50% hit in deposits. The broader altcoin panorama can also be heating up, with analysts putting 95% odds on Solana, Litecoin, and XRP spot ETFs getting approval subsequent month.

The Backside Line

Ethereum appears to be like able to maintain pushing greater as technicals align and establishments quietly accumulate. The $4,500 mark stays the important thing battleground. A breakout may set off a push towards $6,000—and with on-chain knowledge displaying no indicators of exhaustion, the bulls may simply have slightly extra gasoline left within the tank.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.