Sam Bankman-Fried acknowledges that his most important error was that he had given FTX to the brand new CEO previous to chapter, and he had no remaining alternative to.

The disgraced founding father of FTX, Sam Bankman-Fried, says that his greatest mistake was the one which despatched him the reins of the crypto alternate to the brand new CEO, John J. Ray III, earlier than the corporate introduced its chapter in November 2022.

Bankman-Fried turned conscious of a potential exterior funding that would have rescued FTX only a few minutes after signing over the alternate and mentioned he couldn’t take his resolution again.

It was revealed in a current unique interview with Mom Jones and shed new mild on the dramatic remaining days of the $32 billion alternate that on November 11, 2022, filed Chapter 11 chapter.

Underneath the management of Ray, FTX went bankrupt rapidly, and he employed the legislation agency Sullivan and Cromwell to supply authorized recommendation. The brand new CEO has a status for dealing with company meltdowns similar to Enron.

The autumn of FTX was described as an unprecedented company management failure the place monetary information had been chaotic and administration practices had been poor, which was revealed all through the chapter course of.

The chapter of FTX confirmed that the corporate had misused hundreds of thousands of buyer funds. Buyer funds of the corporate had been misused by the sister firm, Alameda Analysis, and the corporate suffered billions of {dollars} of buying and selling losses, the infamous Alameda hole.

In a while, Bankman-Fried was arrested within the Bahamas and extradited to the U.S., the place he was sentenced to 25 years in jail over his half within the collapse and the fraud.

FTX Collectors Strategy $1.6 Billion Compensation Milestone

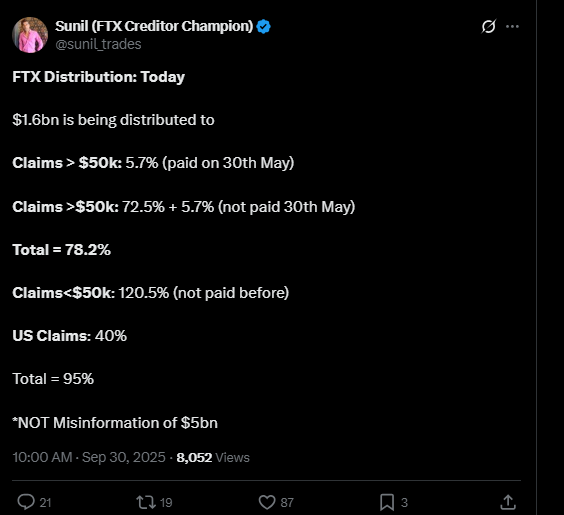

Just lately, the FTX chapter property supplied info that it’s going to launch 1.6 billion {dollars} to collectors within the continued compensation course of.

Supply – X

This would be the third giant tranche after earlier repayments in February and Might 2025.

The repayments shall be modeled to have excessive restoration charges for the smaller claimant of greater than 120 %, bigger claims of greater than 50,000 U.S. claimants could have roughly 60 % restoration charge, and an total complete compensation charge is close to 78.2 %.

Such repayments are a sign of a gradual but progressive bid to pay again collectors following the trade destabilizing meltdown.

Bankman-Fried and his authorized workforce are difficult his conviction, saying the newly appointed CEO mishandled the billion-dollar chapter.

The legislation firm that made some huge cash out of the pricey courtroom circumstances. This scandal is one other twist to the dramatic story of the spectacular collapse of FTX.