Billionaire Ray Dalio identifies the code of Bitcoin as the first weak point in it, which makes it uncertain that it’s going to turn out to be a reserve forex regardless of its elevated recognition.

Lately, Billionaire investor Ray Dalio highlighted the Bitcoin code as the main weak point of the cryptocurrency. Posting his ideas on the social community X, Dalio doubted that Bitcoin would function an entire substitute for conventional cash.

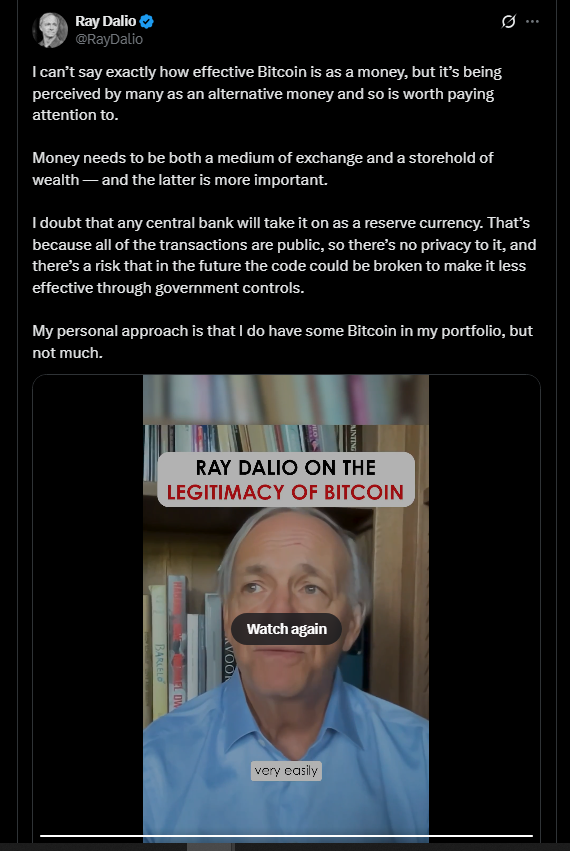

Supply – X

He dropped at focus the twin position of cash as a medium of change and a retailer of wealth. Dalio famous that though Bitcoin is making progress instead supply of cash, its digital code is a vulnerability.

The truth that the ledger within the Bitcoin system is public, he mentioned, renders it much less secretive and subsequently much less fascinating by central banks.

In response to Dalio, central banks will hardly begin utilizing Bitcoin as a reserve forex since all transactions are clear.

This transparency could be abused by governments, and regulatory forces would have the ability to tamper with the code or weaken it.

Dalio acknowledged that there’s a query whether or not the code might be violated or controls might be taken to decrease its effectiveness.

Nonetheless, he revealed that he owned a small little bit of Bitcoin together with gold in his portfolio, the place he admitted that its worth is a substitute asset, however fastidiously.

Why Code Issues in Bitcoin’s Future

Bitcoin is blockchain technology-based, such that it’s a decentralized registry that’s saved by an open-source code. Though this mannequin eliminates the thought of centralized management, it additionally has its personal dangers which might be particular to Bitcoin.

The fear that Dalio has is that this code may function a topic of future weak point, both by hackers or restrictions imposed by the federal government.

Bitcoin doesn’t have a centralized backstop like conventional financial techniques to deal with crises or protocol errors.

Particularly, the code of Bitcoin has been recurrently modified up to now to stop bugs and improve performance.

However rising dangers, similar to quantum computing, forged doubt on the cryptographic safety of Bitcoin in the long run.

Dalio identified that these are precise challenges to mainstreaming Bitcoin as cash because of these technical uncertainties.

Bitcoin’s Privateness Drawback Behind Dalio’s Skepticism

The transparency of Bitcoin can be a two-sided sword, as identified within the critique by Dalio. Though most applaud the open ledger because of its safety and anti-corruption, Dalio insists that this renders Bitcoin inappropriate to massive monetary establishments and governments that want privateness of their transactions.

The recognition of Bitcoin as a substitute for reserve-level sovereign currencies is counterintuitive to the visibility of the funds and flows on the blockchain.

The cautious optimism of Dalio is the present development within the crypto world involving the supporters of the blockchain and the fiscal conventionalists.

His opinion appreciates the availability avenue of Bitcoin and the common transactional benefits, however identifies the publicity of potential vital vulnerabilities that may impede its institutional adoption.