- Ethereum kicks off This fall with document stablecoin provide and shrinking change balances

- $4.5k is the essential stage to verify the next low earlier than a push towards $5k

- Provide squeeze and liquidity inflows are reinforcing Ethereum’s bullish setup

Ethereum has began This fall with some critical momentum, and the explanations aren’t simply technical hype. On-chain exercise exhibits robust flows, stablecoin provide hitting data, and a tightening provide squeeze that’s boosting demand on the spot market. These elements are reinforcing bids round essential ranges and retaining merchants on edge. Even after a messy September dip, liquidity has returned quick, and Ethereum appears prefer it’s setting the stage for a much bigger breakout.

Key Value Degree for Ethereum Merchants to Watch

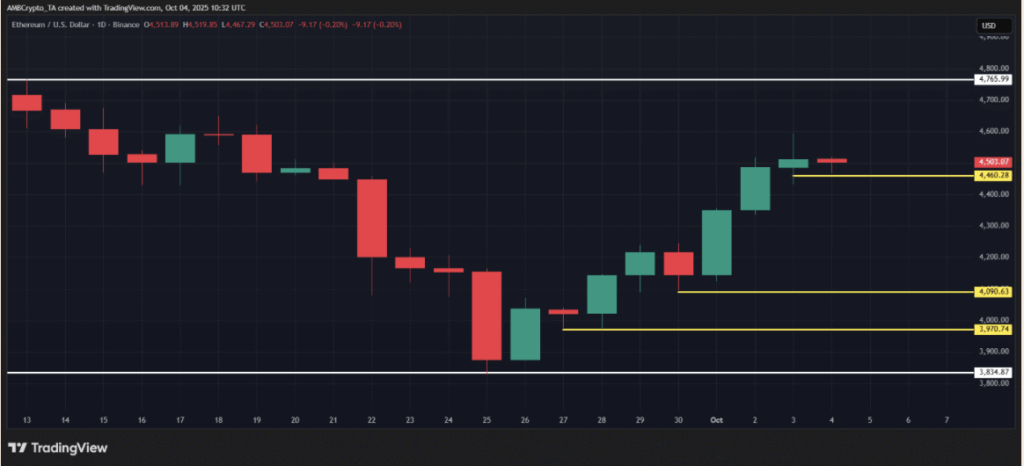

For merchants eyeing the charts, $4.5k is the road within the sand. ETH has already printed two larger lows, each adopted by a push previous resistance, and one other related transfer right here might be sufficient to spark FOMO. A clear maintain above $4.5k units up the following leg larger towards $5k, however the experience gained’t be easy. Final cycle, Bitcoin outpaced ETH by practically double, and with institutional capital flowing closely into BTC ETFs once more, ETH nonetheless faces headwinds from Bitcoin dominance.

Report Stablecoin Provide and Shrinking ETH Reserves

What makes this setup completely different is the power of Ethereum’s on-chain knowledge. Stablecoin provide on ETH has surged to a document $172 billion, up 44% year-to-date, with practically $1 billion added in October alone. That surge pushed Whole Worth Locked again as much as $167 billion, ranges not seen since 2021. Trade reserves inform an analogous story—dropping to an eight-year low of 16 million ETH, with round 183k leaving exchanges in every week. Add to that 36 million ETH already staked, and it’s clear the liquid provide obtainable to promote is shrinking quick.

Ethereum’s Provide Squeeze and This fall Value Outlook

All of this factors to a tightening supply-demand squeeze. Whereas Bitcoin often takes the highlight in This fall, Ethereum’s 9% rally this previous week isn’t a fluke. It’s fueled by recent capital, robust on-chain flows, and holders positioning for the long term. If the $4.5k stage holds as a 3rd larger low, the setup favors a breakout towards $5k sooner relatively than later. The mixture of staked provide, ETF inflows, and document stablecoin liquidity makes Ethereum’s This fall outlook structurally bullish—even when the trail is uneven alongside the way in which.

Disclaimer: BlockNews gives unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.